The abrupt collapse of FTX carries on to reverberate via the cryptocurrency field.

When it is nevertheless really early to determine the full repercussions of Sam Bankman-Fried’s crypto empire filing for personal bankruptcy, it is predicted that there are heading to be many victims in the crypto sphere, according to industry sources.

The reasoning is that FTX, the cryptocurrency exchange, which was still valued at $32 billion in February, was a central participant in the crypto chessboard. So was its sister company Alameda Study, a hedge fund and buying and selling system, also founded by Bankman-Fried.

In the summertime of 2022, the two firms experienced emerged as market saviors, right after the collapse of sister cryptocurrencies Luna and UST induced a credit crunch which rocked several corporations exposed to their Terra ecosystem. Hedge fund A few Arrows Capital (3AC) was forced into liquidation, though crypto lenders Celsius Community and Voyager Electronic submitted for individual bankruptcy. Bankman-Fried bailed out lots of businesses, including lender BlockFi, brokerage RobinHood and other folks.

‘Another $1 Billion’

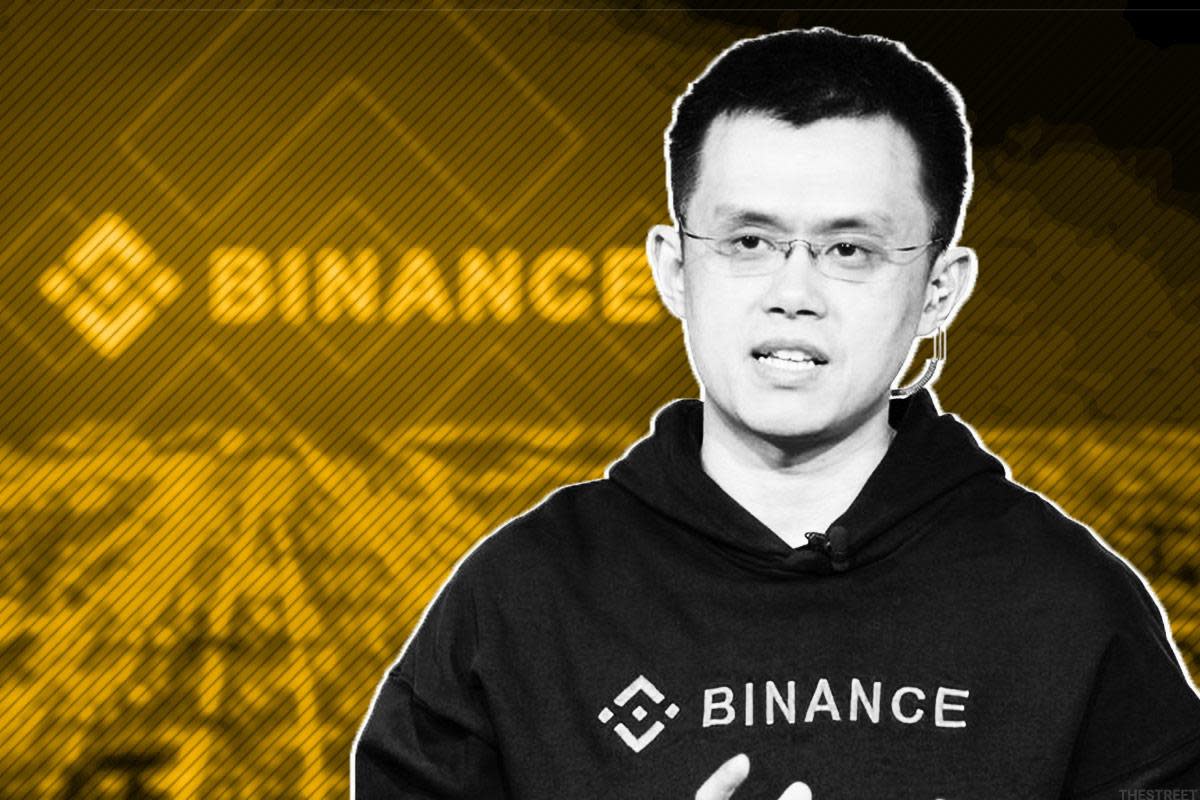

Now that FTX is down, there is no doubt that a lot of companies will be impacted. Loan company BlockFi and brokerage Genesis have previously suspended hard cash withdrawals by their clients. To stay away from a systemic disaster, Changpeng Zhao, the founder and CEO of Binance, the world’s greatest cryptocurrency exchange, has announced a fund to assist corporations dealing with money complications.

Aspects on how this fund will get the job done have not but been offered. But Zhao, who now seems to be the large winner from the fall of Bankman-Fried, has just uncovered that Binance is allocating $2 billion to this fund.

“Yesterday, #Binance allotted Yet another $1 billion to the industry get well initiative. All in BUSD,” Zhao posted on Twitter on November 25.

This announcement arrives a day soon after a to start with piece of news, given by Zhao in the course of an interview with Bloomberg News. In that interview, he announced that Binance experienced now allotted $1 billion to the rescue fund.

“If that is not ample we can allocate far more,” Zhao advised the information outlet.

“To lessen further more cascading damaging results of FTX, Binance is forming an market recovery fund, to support initiatives who are normally sturdy, but in a liquidity crisis,” Zhao very first stated on November 14. “More aspects to arrive soon. In the meantime, you should make contact with Binance Labs if you imagine you qualify.”

Binance Labs is the economic arm of Binance.

Zhao has also determined to open this fund to other players and buyers who would like to aid the crypto field. Aptos Labs and Bounce Crypto will contribute to the fund.

The Tumble of FTX

History will try to remember that it was the decision of Zhao and Binance to promote $530 million worthy of of FTT, the cryptocurrency issued by FTX, which was the starting of the stop for the Bankman-Fried empire. In fact, just after the announcement of this selection on Twitter on November 6, there adopted a operate on the system of panicked FTX prospects. Five times afterwards, the firm was bankrupt, immediately after Binance had provided up on attaining it two days before.

As a crypto trade, FTX executed orders for their shoppers, getting their hard cash and obtaining cryptocurrencies on their behalf. FTX acted as a custodian, keeping the clients’ crypto currencies.

FTX then applied its clients’ crypto property, by means of its sister company’s Alameda Research trading arm, to generate income by means of borrowing or marketplace creating. The income FTX borrowed was applied to bail out other crypto establishments in the summer season of 2022.

At the similar time, FTX was utilizing the cryptocurrency it was issuing, FTT, as collateral on its balance sheet. This represented a considerable exposure, due to the concentration possibility and the volatility of FTT.

Once this exposure arrived to mild, clients, fearing an FTX collapse, rushed to liquidate their crypto positions and get their cash back again. On November 6, Clients withdrew a document $5 billion in a operate on the trade. This led to the insolvency of FTX, as it did not have the crypto assets, now on loan or marketed, to honor its clients’ provide orders.

:max_bytes(150000):strip_icc():focal(605x417:607x419)/Alabama-Woman-Forced-to-Attend-Jury-Duty-011725-tout-b-2583e44b563f4d4fbeec46beb0a5ee35.jpg)