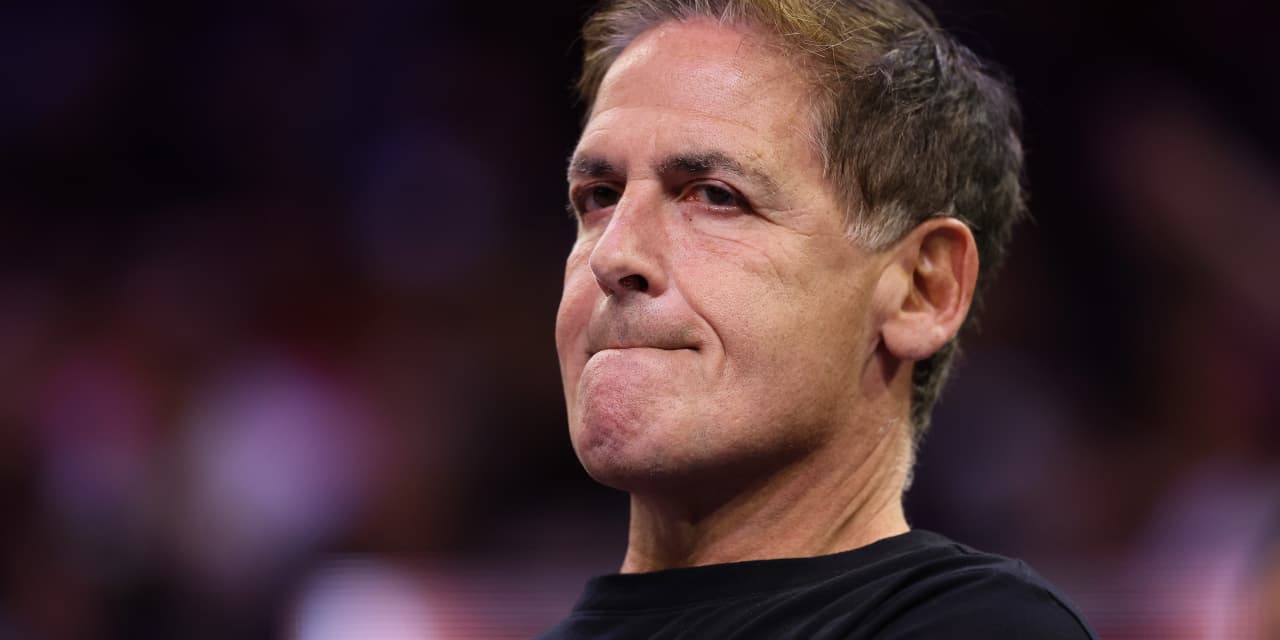

Billionaire Dallas Maverick’s owner Mark Cuban lately made available his viewpoint on the implosion of crypto platform FTX late this week.

“‘That’s any person running a company that is just dumb-as-fucking greedy.’”

Cuban, speaking on Friday at a conference in Washington, D.C. hosted by Sporting activities Business Journal, shared the see that avarice was at the root of the downfall of one-time crypto darling Sam Bankman-Fried, whose company FTX Group just filed for chapter 11 individual bankruptcy.

“So what does Sam Bankman [Fried] do, he’s just–‘gimme much more, gimme a lot more, gimme much more.’ So I’m gonna borrow money, personal loan it to an affiliated enterprise and hope and fake to myself that the FTT tokens that are in there on my equilibrium sheet are gonna to sustain their worth.”

Check out out: Mark Cuban suggests acquiring metaverse serious estate is ‘the dumbest shit ever

FTX’s collapse marks a amazing turnabout for a enterprise, which was once valued at $26 billion, and whose founder, Bankman-Fried was seen by quite a few in the crypto business as a venerable actor in the Wild West of digital exchanges.

On Thursday, the 30-yr-old entrepreneur tweeted: “I f—ked up, and ought to have carried out superior,” referencing the collapse of his exchange.

Embattled FTX, small billions of pounds, sought personal bankruptcy defense just after the exchange expert the crypto equivalent of a bank run. FTX, an affiliated hedge fund Alameda Exploration, and dozens of other similar companies also filed a personal bankruptcy petition in Delaware on Friday morning. Boasting a practically $16 billion fortune a short while ago, Sam Bankman Fried’s internet well worth experienced all but evaporated in the wake of the FTX implosion, according to the Bloomberg Billionaires Index.

The price of FTX’s native token FTT went down about 88.8% in excess of the earlier 7 times to all over $2.74, according to CoinMarketCap knowledge.

The U.S. Justice Office and the Securities and Trade Fee are searching into the crypto exchange to figure out whether or not any felony exercise or securities offenses have been committed.

Regulators and are examining regardless of whether FTX utilised purchaser deposits to fund bets at Alameda Investigation, a no-no in standard markets, according to experiences.

Cuban, who is one particular of the stars of the investing show “Shark Tank” and owns the NBA’s Dallas Mavericks, is a large investor in crypto and blockchain-related platforms. According to a CNBC report, he has reported that 80% of his investments that aren’t on Shark Tank are crypto-centric.

See: Tom Brady, Steph Curry and Kevin O’Leary set to drop significant from FTX individual bankruptcy submitting

For his element, Cuban is component of a class-motion lawsuit accused of misleading buyers into signing up for accounts with crypto system Voyager Electronic, which filed for individual bankruptcy in July. The match alleges that Cuban touted his guidance for Voyager and referred to it “as near to risk-free as you are gonna get in the crypto universe.”

Cuban described Voyager in his Friday interview. Representatives for the billionaire trader did not right away respond to a ask for for comment.

The Mavericks operator took to Twitter on Saturday to say that the crypto implosions “have been banking blowups. Lending to the mistaken entity, misvaluations of collateral, arrogant arbs, adopted by depositor runs.”

Cuban’s web truly worth is $4.6 billion, in accordance to Forbes.