(Bloomberg) — Crypto brokerage Genesis warned of the danger of bankruptcy amid contagion from the speedy demise of Sam Bankman-Fried’s FTX empire.

Most Examine from Bloomberg

Tampa Bay Buccaneers quarterback Tom Brady and the Golden Condition Warriors’ Steph Curry are among the the celebs that a Texas regulator is investigating for probable securities-law violations tied to their promotions of FTX.

The tumble of Bankman-Fried’s businesses, which include trading desk Alameda Investigation, is contributing to minimized liquidity in crypto marketplaces.

Worries about Genesis and other ailing crypto outfits, such as BlockFi Inc., are unnerving buyers. A selloff in Bitcoin paused Tuesday but the token remains close to the least expensive stage due to the fact November 2020.

Critical tales and developments:

-

Crypto Business Genesis Explained to Alert of Personal bankruptcy Without the need of New Money

-

Bitcoin’s Slide Pauses in Wait around for Subsequent Domino to Tumble Right after FTX

-

US Prosecutors Opened Probe of FTX Months In advance of Its Collapse

-

Tom Brady, Steph Curry Attract Texas’ Scrutiny More than FTX Plugs

(Time references are New York except if normally mentioned.)

FTX Group Individual bankruptcy Submitting Displays Money Harmony of $1.24 Billion (1:30 p.m. HK)

An FTX Team personal bankruptcy submitting confirmed that the fallen cryptocurrency trade and a variety of affiliates had a combined cash balance of $1.24 billion.

The latest tally as of Nov. 20 “identifies considerably larger income balances than the debtors ended up in a posture to substantiate as of Wednesday, Nov. 16,” according to the filing.

Bahamas Agrees to Allow Delaware Choose Manage Aspect of FTX Meltdown (8 a.m. HK)

Bahamas courtroom officials dropped their opposition to moving 1 piece of FTX’s restructuring scenario to a US court in Delaware, according to a courtroom submitting.

Liquidators appointed in the Bahamas for 1 FTX affiliate agreed to transfer a situation they filed in New York to Delaware, wherever far more than 100 models are beneath the oversight of a federal choose, FTX attorneys stated in papers submitted in US Bankruptcy Court docket in Wilmington, Delaware.

FalconX Suggests it Will Resume Use of Silvergate Payment Network (7:40 a.m. HK)

Institutional cryptocurrency platform FalconX stated it will resume making it possible for prospects to use Silvergate Funds Corp.’s payments method to transfer money soon after suspending it final 7 days.

Uncertainty around cryptocurrency industry situations in the wake of FTX’s collapse and an outage that influenced Silvergate’s “wire payment network” prompted the suspension, FalconX stated Monday in a memo to purchasers. Considering the fact that then, issues have abated, San Francisco-centered FalconX stated.

Tom Brady, Steph Curry Draw Texas’ Scrutiny More than FTX Plugs (7:15 a.m. HK)

A Texas regulator is scrutinizing payments been given by celebrities to endorse FTX US, together with what disclosures were being made and how available they have been to retail investors

Tampa Bay Buccaneers quarterback Tom Brady and the Golden Condition Warriors’ Steph Curry are among the higher-profile people being investigated.

Bitcoin Retains Close to Lowest Considering the fact that November 2020 (7:10 a.m. HK)

Crypto markets go on to be beneath pressure on concern about the spreading fallout from the FTX crisis. Bitcoin wavered Tuesday, buying and selling down below $16,000 at all over the lowest amount since November 2020. A gauge of the top rated 100 digital assets has declined a lot more than 70% over the past 12 months.

Crypto Business Genesis Claimed to Warn of Individual bankruptcy (6 a.m. HK)

Digital-asset brokerage Genesis is battling to increase clean money for its lending unit, and it is warning possible traders that it may well have to have to file for individual bankruptcy if its endeavours fall short, according to people today with understanding of the subject.

Genesis, which has faced a liquidity crunch in the wake of crypto trade FTX’s bankruptcy submitting this thirty day period, has invested the past several times trying to find at minimum $1 billion in contemporary funds, the persons claimed. That incorporated talks in excess of a potential investment decision from crypto exchange Binance, they claimed, but funding so much has failed to materialize.

US Prosecutors Opened Probe of FTX Months Before Its Collapse (4:14 p.m.)

Long right before Sam Bankman-Fried’s FTX cryptocurrency empire collapsed this month, it previously was on the radar of federal prosecutors in Manhattan.

The US Attorney’s Office for the Southern District of New York, led by Damian Williams, put in various months performing on a sweeping evaluation of crypto forex platforms with US and offshore arms and experienced started off poking into FTX’s huge exchange functions, in accordance to people common with the investigation.

Fidelity Ought to Reconsider Bitcoin Exposure in 401(k)s: Senators (3:43 p.m.)

Democratic senators Dick Durbin, Elizabeth Warren and Tina Smith are urging Fidelity Investments to reconsider making it possible for 401(k) approach sponsors to offer you exposure to Bitcoin.

“The the latest implosion of FTX, a cryptocurrency trade, has created it abundantly very clear the electronic asset business has critical troubles,” the senators claimed in a letter to Fidelity CEO Abigail Johnson.

Tiger Global’s Now-Worthless FTX Wager Experienced Bain’s Because of Diligence (3:03 p.m.)

Bain & Co. was amongst consulting companies that assisted carry out thanks diligence for Tiger World-wide Management’s expense in now-defunct crypto exchange FTX, in accordance to folks common with the make a difference.

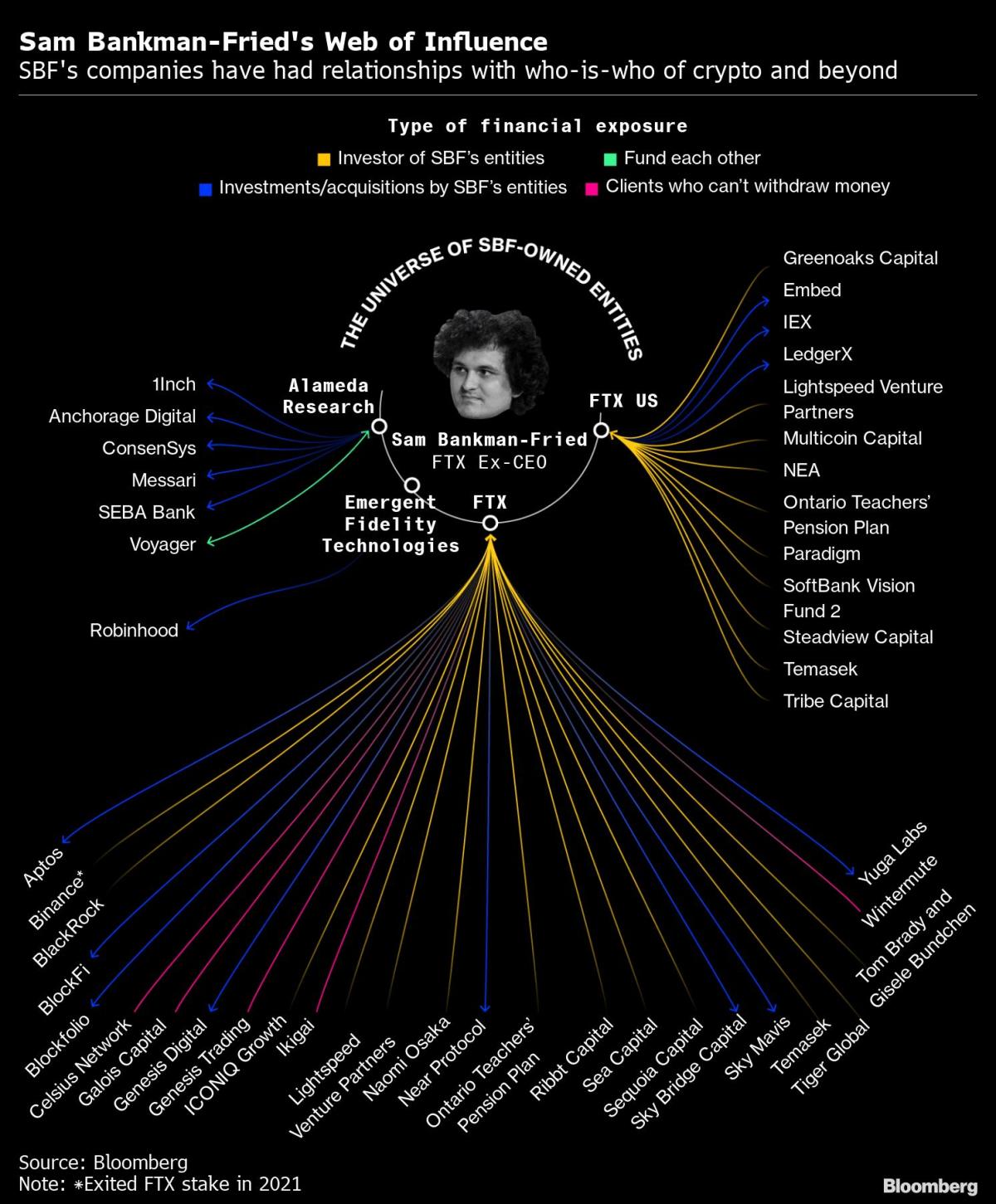

Tiger Worldwide, which pays Bain much more than $100 million a year to investigation personal businesses, has now written down its $38 million FTX stake to zero, the men and women explained. Sam Bankman-Fried’s oversight of a large world wide web of FTX-linked entities was a single of the hazards highlighted in the course of the owing-diligence process, but the income supervisor continue to thought it was a seem expense at the time, a person of the people today explained.

Cathie Wooden Goes on Coinbase Obtaining Spree as Wall Avenue Sours (12:21 p.m.)

Wall Street’s waning conviction in Coinbase Worldwide Inc. has accomplished little to prevent Cathie Wood. In its place, she’s been scooping up shares of the having difficulties cryptocurrency exchange in the wake of the collapse of FTX.

Wood’s Ark Expense Management money have bought extra than 1.3 million shares of Coinbase because the get started of November, well worth about $56 million centered on Monday’s trading price, according to info compiled by Bloomberg. The browsing spree, which started just as FTX’s demise began, has boosted Ark’s full holdings by approximately 19% to about 8.4 million shares. That equates to all around 4.7% of Coinbase’s full excellent shares.

‘Alameda Gap’ Observed Assisting Dry Up Liquidity Across Crypto Industry (11:26 a.m.)

The wipeout of Sam Bankman-Fried’s crypto empire, including its crown jewel FTX trade and sister investing desk Alameda Analysis, is supporting to reduce liquidity throughout the crypto marketplace.

The decline has been dubbed the “Alameda Gap” by blockchain-information company Kaiko, named for the investing team at the center of the storm which is closing its textbooks. Plunges in liquidity normally occur for the duration of periods of volatility as trading stores pull bids and asks from their buy publications to greater control challenges, Kaiko mentioned in a Nov. 17 e-newsletter.

Most Browse from Bloomberg Businessweek

©2022 Bloomberg L.P.