(Bloomberg) — Goldman Sachs Group Inc. sees interesting alternatives rising in US shares even as the S&P 500 benchmark continues to be expensive versus its background and accounting for desire prices.

Most Go through from Bloomberg

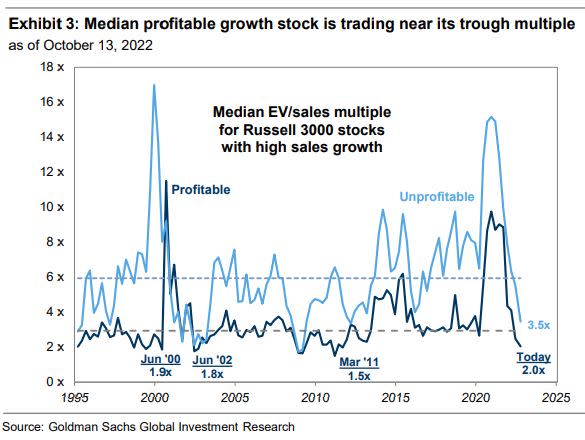

The risk-reward for the S&P 500 Index stays unattractive but “the diploma of valuation dispersion inside the fairness industry is wide,” strategists including David J. Kostin wrote in a notice dated Oct. 14. They see options in stocks joined to quicker money movement generation, worth, lucrative development, cyclicals and smaller caps.

Goldman’s notice highlighting some bargains arrived on a working day when the S&P 500 benchmark shut underneath its base-situation yr-conclusion concentrate on of 3,600. The gauge remains costly relative to background and present-day fascination charges, Kostin and team wrote.

Whilst the S&P 500 Index has dropped 25% this year amid problems that the Federal Reserve’s policy tightening will force the US economy into a recession, it is continue to 12% earlier mentioned Goldman’s hard-landing scenario focus on of 3,150.

Browse: Goldman Picks High quality, Liquid Bets as Diversification Participate in Fails

Amongst providers generating dollars flow speedier than other people, Goldman likes retail retailer operator Macy’s Inc. and carmaker Normal Motors Co. Rewarding growth shares that it considers to be bargains include things like biotechnology organization Exelixis Inc. and Facebook-parent Meta Platforms Inc.

Cyclical shares that it sees as low-priced even in the party of a economic downturn incorporate builders PulteGroup Inc. and Toll Brothers Inc., as for each Goldman’s examination.

Most Go through from Bloomberg Businessweek

©2022 Bloomberg L.P.