The US markets are showing some conflicting signs, making forecasting difficult. The main headwind, inflation, is down – but the labor market is strong, with unemployment falling and wages rising. The Federal Reserve raised interest rates at the fastest rate since the 1980s, bringing them from near-zero to more than 5% in the last 12 months, risking recession to try and keep a cap on prices.

But will the Fed’s efforts come to naught? Interest rate increases tend to affect the markets with a lag of 12 to 18 months, and we’re seeing inflation coming down now – the last data, for April, showed a 4.9% annualized rate of increase, far down from last year’s 9.1% peak. But that 4.9% is still more than double the Fed’s target rate.

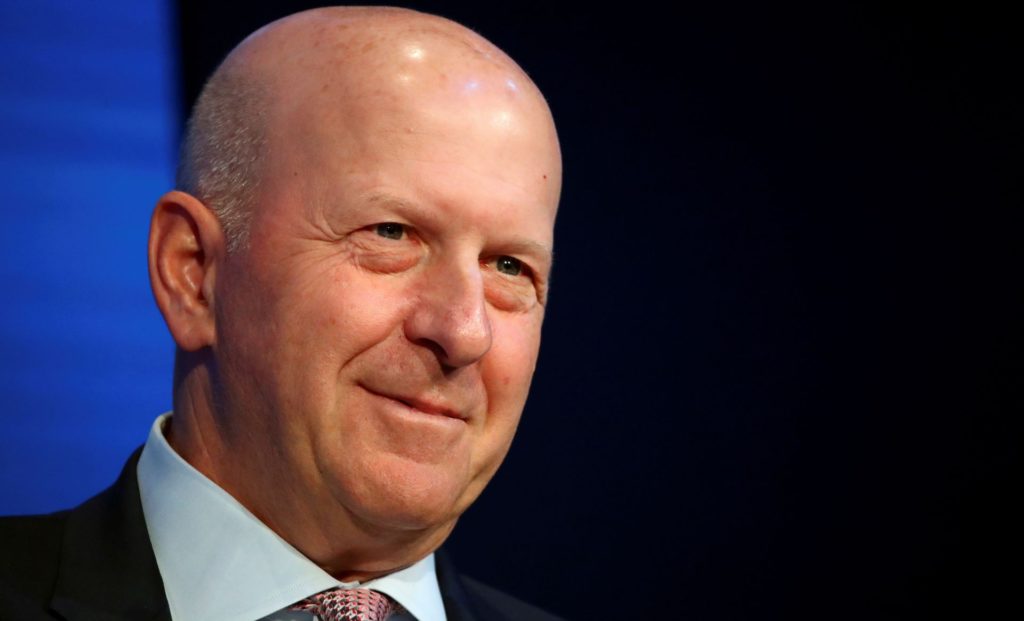

This is the background to recent comments from Goldman Sachs chief David Solomon who believes inflation still poses a significant challenge to the economy.

“I sense that it’s going to be stickier, it’s come off its peak, but it’s going to be stickier and more resilient which is why we’re expecting that while the Fed may pause and will be data dependent, you might need to see higher rates to ultimately control it some more,” Solomon opined.

In such a stickier inflationary environment, investors are naturally going to move toward defensive stocks – the ones that can show resistance to a downturn. Using the TipRanks platform, we’ve pulled up details on two names that Goldman Sachs analysts are recommending as defensive equities. Here are the details.

Flywire Corporation (FLYW)

First up on our list is Flywire, an online payment processing service. The company took an interesting route into the crowded online payment niche, starting out as a specialist in the education sector. Since then, it has broadened its services to include payment processing across a global network, catering to the healthcare, travel, and B2B industries in addition to education. Flywire is equipped to handle customers’ verification and security compliance needs, operating in more than 140 currencies.

Flywire can boast of a truly worldwide reach, with over 3,300 business customers in 240 countries and territories. The company offers service and support in dozens of languages around the clock, making the payment process seamless from any perspective. In addition to major names like Mastercard, Visa, and AMEX, Flywire also partners with PayPal and Venmo.

As a defensive stock, Flywire benefits from the global shift toward digital transactions and the paperless office. Businesses of all scales, from the smallest Mom & Pop shops to industry giants like Mastercard, can realize efficiencies by switching from paper transactions to digital processing. Being an electronic payment specialist, Flywire is positioned advantageously at the right time and in the right place. The company’s stock has risen approximately 21% this year, significantly outperforming the S&P 500’s year-to-date gain of 8%. With clear indications of continued expansion in the digital payment sector, Flywire is strongly positioned to sustain its growth alongside its customer base.

The headline result from the company’s 1Q23 financial release tells the story: Flywire’s top line revenue grew 46% year-over-year, to reach $94.4 million – and it beat the forecast by almost $11.48 million. Like many tech firms, Flywire does run a net loss, but its Q1 EPS loss of 3 cents compared favorably to the 10-cent per share loss from the year-ago quarter – and it was 4 cents per share better than had been expected. Flywire’s adjusted EBITDA figure expanded dramatically y/y, from $1.9 million to $7 million. The highlights of Flywire’s first quarter included 170 new client signings, making 1Q23 the company’s largest ever sales quarter.

For Goldman Sachs, the key points here include Flywire’s strong defensive base, and its ability to generate growth in today’s economy. Analyst Will Nance writes, “Looking ahead, we believe FLYW’s strong NRR track record, coupled with its commitment to consistent operating leverage, should position the company well to continue outperformance in the near term. In particular, we see the company’s defensive business mix in education and healthcare as well positioned to absorb the potential for macro weakness for the remainder of this year.”

“Putting it together,” the analyst summed up, “with shares trading at 47x our 2024 EBITDA estimates, we believe valuation is attractive in the context of FLYW’s ~30-40% growth rates, its impressive rate margin expansion, and the sustainability of its strong NRRs as its record cohorts from recent years continue to ramp.”

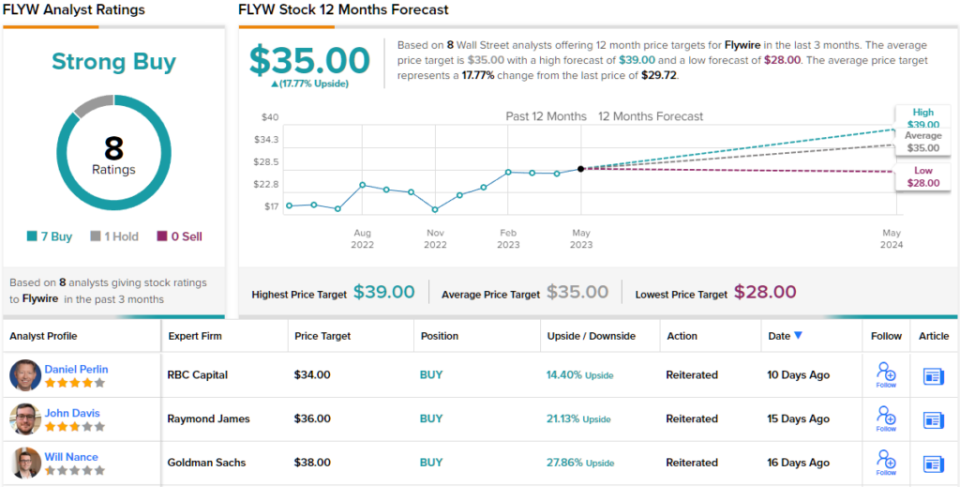

Taking this forward, Nance gives FLYW shares a Buy rating with a $38 price target that implies ~28% upside potential over the coming year. (To watch Nance’s track record, click here)

The Goldman take is hardly an outlier. Out of the 8 recent analyst reviews, there is a clear 7 to 1 breakdown in favor of Buy recommendations over Holds, indicating a Strong Buy consensus rating. Currently priced at $29.72, the stock holds an average price target of $35, pointing to an estimated 12-month upside of around 18%. (See FLYW stock forecast)

Walmart, Inc. (WMT)

Now we’ll shift our focus from a cutting-edge fintech to one of the most traditional retailers of all: Walmart. Having grown from its humble Arkansas roots, Walmart has become the world’s largest retail giant by revenue, generating over $611 billion in the 2023 fiscal year (covering the 12 months ending on January 31 of this calendar year). The company owns both the Walmart and Sam’s Club retail chains, operating a wide range of supercenters, discount department stores, and grocery stores across the US and internationally. In total, Walmart has more than 10,500 stores in 24 countries and operates under 46 different names.

Walmart recently released financial results for the first quarter of its fiscal year 2024, and showed that it is maintaining its growth trajectory. The company reported total quarterly revenues of $152.3 billion, up 7.6% year-over-year and coming in $4.39 billion above the estimates. The company’s non-GAAP EPS figure of $1.47 was 15 cents better than had been expected.

Highlighted among the results were the US comp sales, which were up 7.4% y/y; eCommerce, which expanded an impressive 27%; and the global advertising business, which saw a 30% y/y increase.

Also during fiscal Q1, Walmart returned $2.2 billion in capital to its shareholders. A large part of this came from the company’s dividend, which was last declared at 57 cents per common share for a payout on May 30. While the annualized rate of $2.28 per share gives a modest yield of just 1.54%, investors should note the dividend’s reliability: Walmart has been making dividend payments since 2003, has not missed a quarter, and has been raising the payment every year.

In addition to its classically defensive dividend payments, Walmart stock has shown an ability to grow even against strong headwinds.

None of this has escaped the attention of Goldman analyst Kate McShane, who says of Walmart: “We believe WMT is a stock that investors still want to own given its defensive qualities in the near term along with the improving profitability profile over the long term.”

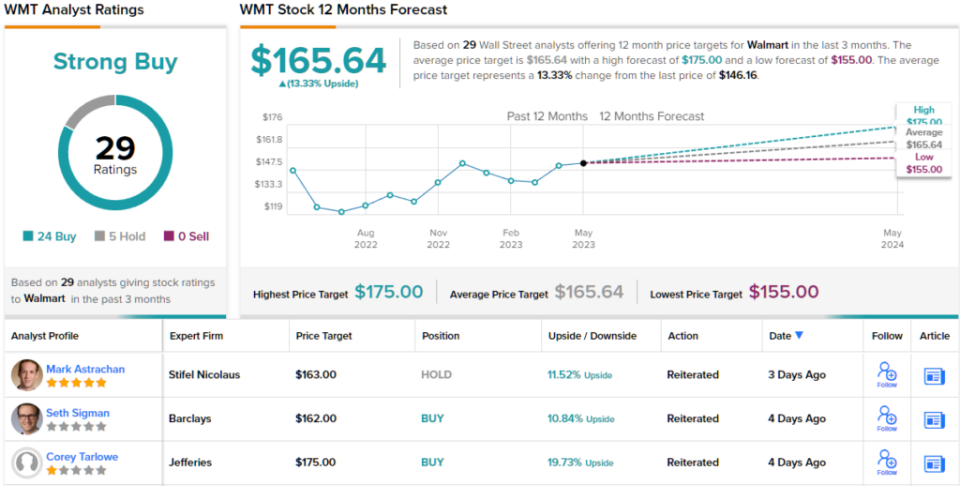

To this end, the 5-star analyst rates WMT shares a Buy, and her price target, set at $176, suggests the stock will grow 20% in the year ahead. (To watch McShane’s track record, click here)

Wall Street’s biggest names never lack for analyst interest, and Walmart is no exception. The shares have picked up 29 recent analyst reviews, including 24 Buys and just 5 Holds, for a Strong Buy consensus rating. Walmart shares are currently trading at $146.16 and have an average price target of $165.64, implying a 13% gain on the one-year horizon. (See WMT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.