Home flippers who pounced on current drops in residence selling prices now experience some key hurdles — and potentially key losses.

It is a tale several could have foreseen: Just after dwelling-flipping attained record heights as 2022 kicked off, the bubble would seem to have burst. The a single-in-10 household flipping/regular gross sales ratio has dropped as the in general genuine estate industry hits the brakes.

Home income fell off a cliff amongst August and September 2022, and dipped an astounding 25% from September 2021, according to the Countrywide Association of Realtors. It’s now triggering quite a few assets traders to dump their stock, and rapid.

“Anybody that’s flipping appropriate now requirements to be searching closely at pricing of property: Rate it to promote. Right now is not the time to get greedy,” Noah Brocious, president of Cash Fund I, a really hard-dollars loan company that does business enterprise in Phoenix, Colorado and Texas, instructed Bloomberg News.

It is correct that in other places — in the stock industry, for example — lower costs and selloffs reveal golden prospects to purchase. But for these eagerly eyeing the housing current market, it is time to imagine all over again.

Really don’t miss

Slumping demand

Dwelling flippers should confront specifics: The skyrocketing demand we noticed previously this 12 months may not return for years, if ever. Very first, housing inventory reached a 10-12 months reduced back again in January 2022, according to Trading Economics, with just 860,000 one household and apartment units for sale in the United States.

About 115,000 single-household residences and condos have been “flipped” in the U.S. throughout the second quarter of 2022, in accordance to actual estate info curator ATTOM. This made up about 8.2% of all household revenue in the quarter, or up to 1 in 12 transactions. It indicated that any economic cooldown had not yet manifested in the broader market place.

“The complete variety of properties flipped was the second-best overall we have recorded in the earlier 22 many years, and the median profits price of a flipped residence — $328,000 — was the greatest ever,” claimed Rick Sharga, govt vice president of current market intelligence for ATTOM.

“The huge question is regardless of whether the fix-and-flip market place will commence to lose steam as in general house income have declined drastically in excess of the past number of months, and the expense of financing has virtually doubled over the past 12 months.”

Study a lot more: ‘The figures just don’t work’: Though increasing home finance loan fees have some homebuyers offering up, many others believe they’ve observed a workaround

Sales figures peaked in July at 1.31 million properties. Though that arrived down just somewhat in August to 1.28 million properties, a common increase has continued even as demand from customers carries on to fall.

Mounting premiums

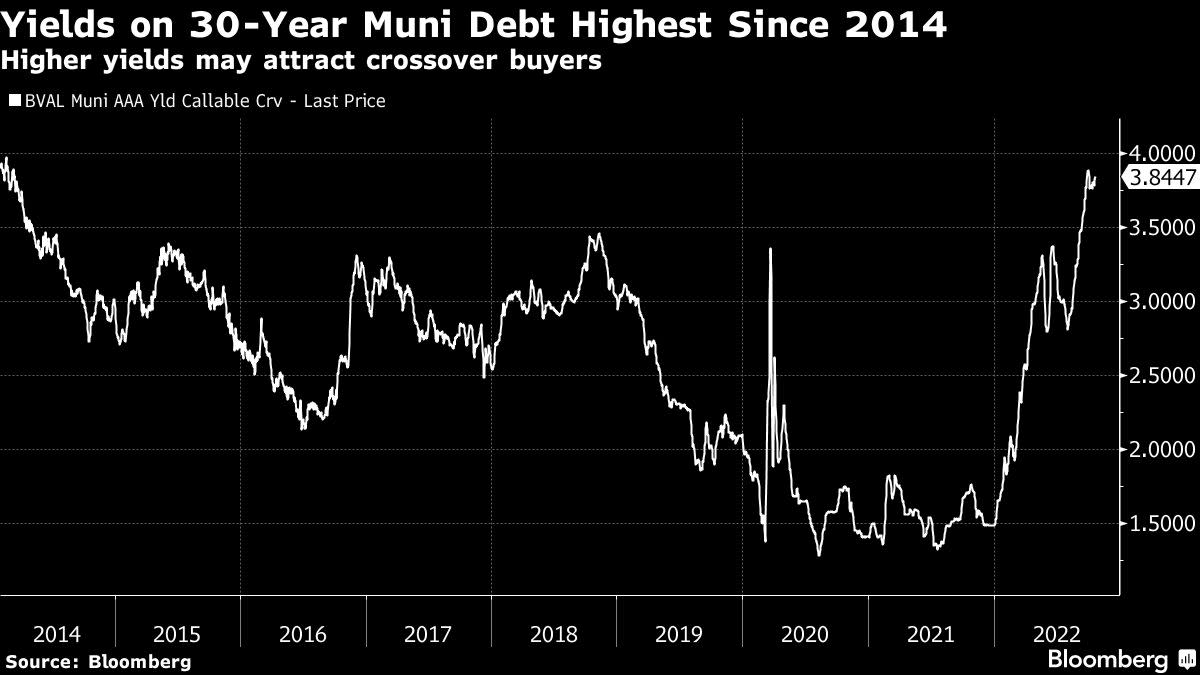

Now for the second issue going through household flippers, the just one that’s generating anyone groan: increased interest rates. That indicates costlier mortgages, which have socked flippers with large increases in their financial loans.

As home traders typically commit in various houses at after, it is no wonder that numerous now want to get them off their hands. But with future potential buyers also turned off by superior premiums, it’s turning into a Hail Mary enjoy.

The United States interest rate rose .5% at the start out of 2022, and now sits among 3% and 3.25%. Nonetheless it is likely to climb higher before the yr is out as the Fed has hinted at a slew of hikes to appear, which could idea the nation into a recession.

With that in brain, a lot of residence buyers will want to wait around just before they get greedy more than property selling prices. Now, a fantastic offer on a property is counterbalanced by a mortgage with a far greater curiosity fee in contrast to this time past 12 months.

There is some hope on the horizon, nevertheless, in accordance to the ATTOM report. After six straight periods of losses, earnings margins rose in the course of the most up-to-date quarter. The gross financial gain on a common transaction hit $73,700, up 10% year-in excess of-year and 10% quarter-about-quarter.

What’s future, then? Americans must have more details on forward-hunting trends when the upcoming housing reports arrive out at the stop of October.

In the meantime, bear this in mind: As residence flipping tends to mirror the relaxation of the marketplace, residence buyers really should brace for further drops — belly drops provided.

What to read through next

-

Really should I hold out for the housing market place to plummet prior to getting a dwelling? 3 motives why this housing downturn is almost nothing like 2008

-

‘It was hard, frightening times’: Child-boomer economic authorities who lived by the Wonderful Inflation recount ways to journey out a recession

-

This is how much the regular American 60-calendar year-old holds in retirement price savings — how does your nest egg examine?

This post gives information only and need to not be construed as suggestions. It is offered without warranty of any form.