In all probability the finest argument for investing some additional of our 401(k)s in the stock marketplace right now is all the people telling us not to. As a standard rule, it is been a superior time to be bullish when so lots of other folks are bearish.

And maybe the next very best argument is the time of 12 months. The “Halloween Effect” is a serious detail. No person is aware of why, but inventory markets have developed most of their gains for the duration of the wintertime months, from Oct. 31 to April 30.

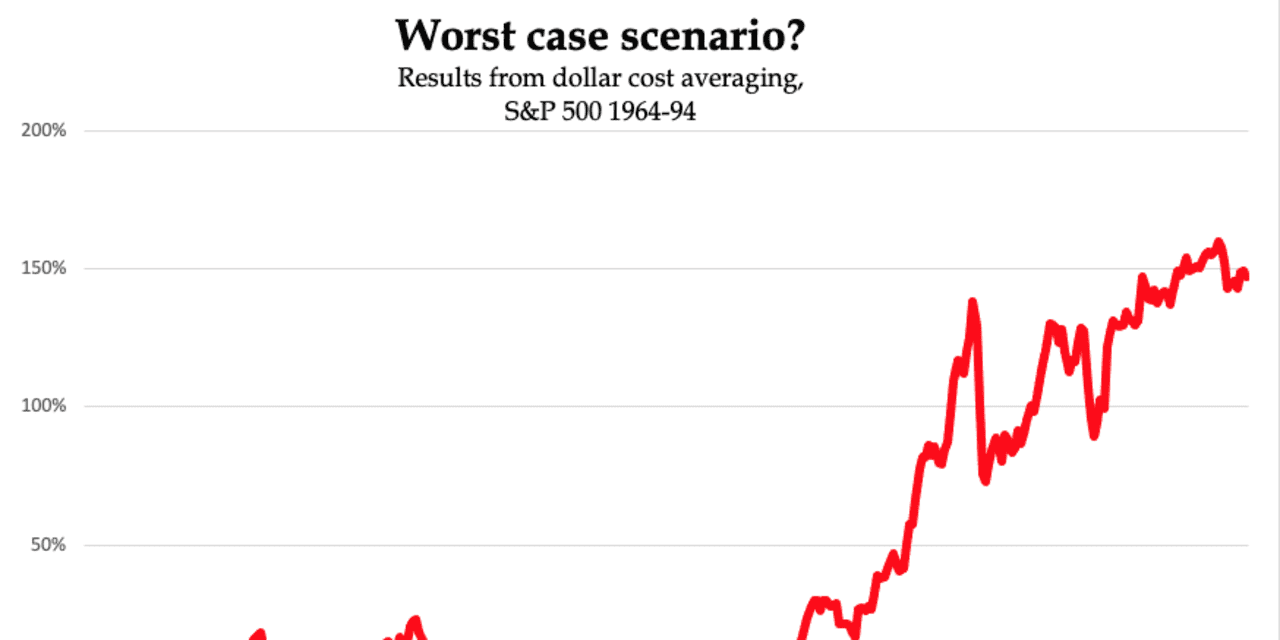

But let us play devil’s advocate and check with: Realistically, how bad could this bear sector be? And I’m not conversing about how negative it could be for shorter-time period traders or a person wanting for a speedy financial gain. I’m contemplating about what it may well signify for retirement investors like you (and me) — people who are investing many years ahead?

Read through: The limit for 401(k) contributions will leap approximately 10% in 2023, but it’s not normally a fantastic concept to max out your retirement investments

To get an notion I cracked the heritage books—or, more properly, the record facts compiled and managed by Robert Shiller, professor of finance at Yale College (and a Nobel Prize winner). He has effectiveness numbers on U.S. stocks going all the way back to the Grant administration.

And I ran some assessment centered on the way a lot more and more of us make investments: Namely, by “dollar-cost averaging,” or throwing a modest (and equivalent) amount of money into the marketplace each single thirty day period, come rain or shine.

Contrary to preferred belief, the worst time for a standard trader to get into the current market was not just prior to the notorious crash of 1929.

Of course, the stock sector collapsed then by virtually 90% more than the future 4 many years (in phases), or about 75% in authentic, inflation-adjusted conditions when you include things like dividends. But oh boy did it bounce again fast. From the 1932 lows it doubled your dollars in a calendar year and it quadrupled your revenue about 5 decades.

Study: What to do with your funds if you are retired or retiring soon

An individual who threw all of their cash into the market place at the worst attainable moment, at the conclude of August 1929, was essentially back again in financial gain by 1936. And anyone who greenback-price averaged their way by way of the Crash of 1929 and the Terrific Melancholy, even assuming they begun at totally the worst time feasible, was in earnings by the spring of 1933 and was up by about 50% by 1939.

But the actually, definitely undesirable time for normal buyers who dollar price tag averaged was the 1960s and 1970s. Alternatively of a speedy crash and bounce back again, traders in the course of individuals many years experienced a rolling disaster as shares fell powering roaring inflation for the very best part of 20 yrs.

Employing Professor Shiller’s facts, I ran a straightforward evaluation of what would have occurred to a dollar-cost common who started in 1964 and stored going for decades.

You can see the end result above.

It isn’t quite. That displays the cumulative “real” return on investment decision, indicating the return after adjusting for inflation, for a person who saved putting the similar amount into the S&P 500 every single month. (Oh, and we’re ignoring fees and taxes.)

Yikes!

Could this occur all over again? Confident. Anything at all could materialize. Is it probably? Most likely not.

This is the worst case situation on document. I am participating in devil’s advocate.

Actually the median genuine return on the S&P 500

SPX,

around 30 many years is just less than 7%.

There are two caveats to bear in intellect.

To start with, this is in “real” terms. What the chart reveals is that, apart from a temporary plunge 1970 and a rocky period of time in the mid-1970s, a inventory portfolio roughly saved up with runaway inflation even as a result of these definitely abysmal many years. You did not get ahead of the 8 ball but you didn’t drop at the rear of it. Modest comfort and ease, unquestionably, but worthy of a point out.

Second, the long, lean a long time ended up then extravagantly compensated by the growth immediately after 1982. A person who started off investing for their retirement in 1964 and didn’t retire until finally the mid-1980s designed a whole get on their investment of about 50% in genuine, getting-power terms. A person who invested over 30 years extra than doubled their dollars.

The great news about bear markets, even extended bear markets, is that if we keep on investing throughout them we decide up stocks on the low cost.

That cash invested in the S&P 500 for the duration of the mid-1970s? Above the next 20 several years it defeat inflation by a staggering 700%.

“Even if buyers are caught in the worst probable time in historical past, by continuing to invest, they are continually averaging down — they are rising their return in the long operate,” says Joachim Klement, financial commitment strategist at Liberum. “They say compounding fascination is the eighth marvel of the environment. I would say dollar-value averaging is the ninth.”