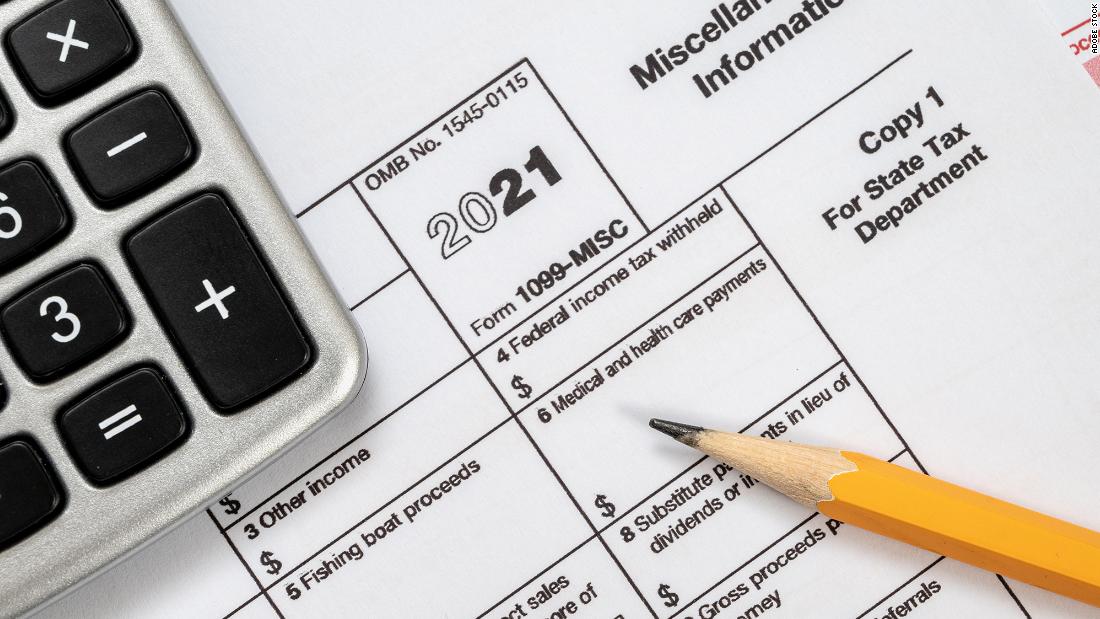

(Trends Wide Spanish) — The 2023 tax season (in which 2022 taxes are filed) began on Monday, January 23, and taxpayers have until Tuesday, April 18 to file their tax return.

If you live abroad, the regular date is April 15, but you have an automatic two-month extension (June 15).

If you were a victim of storms in California, Alabama or Georgia, you can apply for tax relief to extend the date to May 15.

But who should file 2022 taxes?

According to the Internal Revenue Service (IRS), if you are a US citizen or resident alien, you must file a tax return based on your gross income, marital status, age, and whether or not you are a dependent.

The first thing to define is your marital status, as this can make a big difference in the amount of taxes you will have to pay and can also determine if you are eligible for certain deductions and credits. The IRS offers these filing status options: single, head of household, married filing jointly, married filing separately, or widowed.

If for the purposes of your return more than one marital status fits your situation, “choose the one that gives you the lowest tax,” says the IRS.

The next thing is to determine what your gross annual income is, which is all the income you received in 2022 in the form of money, goods, property and services that are not exempt from tax, as defined by the IRS. If you are married or live with your partner in a community property state—there are nine states including Arizona, California, Nevada, and Texas—half of any community income defined by law can be considered yours.

This 2022 tax filing requirements table applies to most taxpayers:

If you have doubts about whether or not you should file your 2022 tax return, you can do this IRS questionnaire. However, it is only available in English.

How much I have to pay?

The United States tax system pays different percentages of taxes depending on the amount of taxable income —defined by the IRS as “any income that is subject to federal income tax, whether derived from work or not”— and there are seven in total for fiscal year 2021: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

In short: the more you earn, the more you have to pay.

This table reflects how much tax percentage you will have to pay based on your filing status and your taxable income in 2022:

Standard and itemized deductions

Under federal tax law it is possible to deduct some personal expenses from your taxable income, which can reduce the amount of tax you pay or increase the amount of your refund.

According to the IRS, there are two ways to claim deductions, either by itemizing them on your federal tax return or by using a standard deduction. Typically a taxpayer itemizes deductions if the total of the deductions is greater than the standard deduction for your filing status.

For its part, the standard deduction is a specific amount that you can deduct to reduce the amount of your income that is subject to tax. This amount is adjusted each year for inflation and varies based on the taxpayer’s marital status, age, and whether or not they are blind.

The IRS established that:

“The standard deduction for married taxpayers filing jointly increases to $27,700 for tax year 2023, up $1,800 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction increases to $13,850 in 2023, $900 more, and for the head of household filing status, the standard deduction will be $20,800 for tax year 2023, $1,400 more than the amount for tax year 2022.” .

In summary, the standard deduction for tax year 2023 based on filing status is:

- Singles and Married Filing Separately: US$ 13.850

- Married filing jointly: US$ 27.700

- Family boss: US$ 20.800

You are not eligible to use the standard deduction if you are:

- A married person filing a Married Filing Separate return, whose spouse itemizes deductions

- A person filing a return for a period of less than 12 months due to a change in your annual method of accounting.

- A person who was a nonresident alien or an alien dually classified as an alien during the year. Exceptions apply.

The IRS offers an online quiz to determine the amount of your standard deduction. However, it is only available in English.

Receive your refund faster

Most tax filers are normally due a refund.

Treasury officials note that the IRS will likely give you your refund within 21 days of receipt, which is the typical turnaround time, but only if you complete your return accurately and completely, file electronically, and elect to for receiving your refund via direct deposit.

To receive your refund as direct deposit you will need to provide your account number and routing number (known as routing number) to your tax preparer or enter this information into the tax preparation software of your choice. Afterward, you can check the status of your refund on the IRS website.

Trends Wide’s Jeanne Sahadi contributed to this report.