(Bloomberg) — Intel Corp. shares jumped following the embattled chipmaker promised a recovery in the next 50 percent, top buyers to appear previous a disappointing financial gain-margin forecast in the latest quarter.

Most Read through from Bloomberg

The firm predicted that gross margins — a carefully viewed evaluate — would get started to widen once again in the again fifty percent of 2023. Intel is returning to comprehensive manufacturing capability, and an stock glut afflicting the personal compute current market is nearing an close, executives reported on a convention call Thursday. The upbeat remarks served ship the shares up additional than 6% in late buying and selling immediately after an earlier decline.

“You ordinarily have a more robust next half in our industry, and we anticipate that to be the circumstance,” Main Executive Officer Pat Gelsinger explained on the call. “We’re viewing some eco-friendly shoots in the market. But we assume it is a tricky market place for all.”

The enterprise also painted a more optimistic look at of the broader Laptop marketplace, declaring it expects shipments to arrive at 270 million units this yr in advance of raising to about 300 million models each year in the long run. That would place the overall back higher than the amount in 2022, when shipments commenced sliding.

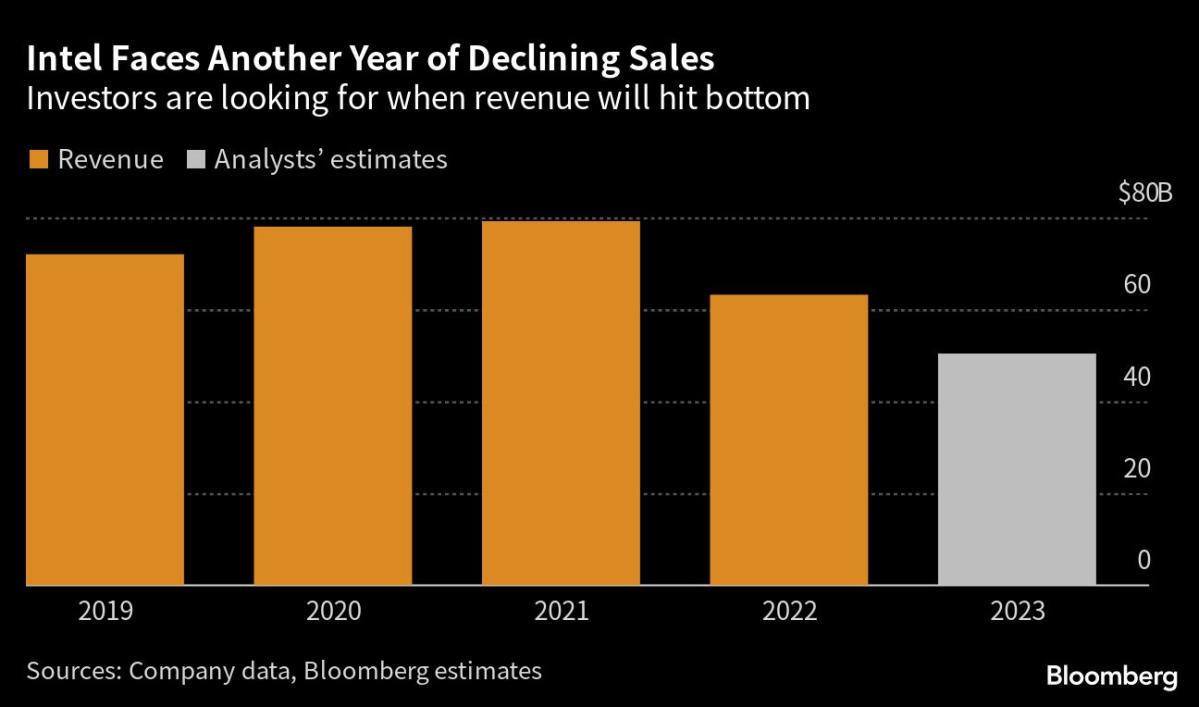

Gelsinger is confronting a substantial pileup of stock, weak need and the reduction of marketplace share — all of which contributed to a historic slump. At the similar time, he’s hoping to velocity up the introduction of new production technological know-how, a expensive attempt to regain Intel’s business management. But that work — if profitable — will not bear fruit right up until 2025.

Investors have been skeptical that the chipmaker can catch up with rivals, and the stock plunged virtually 50% past year. On Thursday, Gelsinger argued that the corporation has begun to switch a corner.

“In the factors that they can control, they’ve lived via the worst of that ache,” explained Cody Acree, an analyst for Benchmark Co.

Read Additional: Intel’s ‘Worst Is Over’ Circumstance Faces Earnings Examination

In the near term, Intel’s money outlook nevertheless appears to be dim. It expects a decline of 4 cents a share in the 2nd quarter, excluding some objects, the enterprise mentioned. That compares with the 2-cent typical estimate of analysts.

That initially sent shares down much more than 2% in late trading, just before a later rally. They had closed at $29.86, leaving them up 13% this calendar year.

The revenue outlook was a bit brighter, with the corporation predicting income of $11.5 billion to $12.5 billion. The midpoint of that assortment exceeds the normal analyst estimate of $11.7 billion.

Intel predicted that gross margin — the part of profits remaining following deducting the expense of production — would be 37.5% in the next quarter. That compares with an estimate of 41%.

The firm has been working its factories at much less than their full ability, that means it has to consider “underloading” rates that crimp margins. When that headwind will recede as the corporation is in a position to improve output afterwards this yr, margins won’t rebound to exactly where they as soon as ended up until finally people plants are upgraded, according to Main Fiscal Officer Dave Zinsner.

The factories will need new manufacturing systems that will be pricey to put in position. At the time that transpires — and Intel is aggressive with rivals once more — the business hopes to restore profitability to historic amounts.

When its factories have been property to the industry’s most cutting-edge output and its merchandise ended up dominant in the server and Computer system marketplaces, the firm routinely posted a margin of far more than 60%.

In the first quarter, Intel described a decline of 4 cents a share, excluding some things, far better than the 16-cent decline analysts had predicted. Income came in at $11.7 billion. That beat analysts’ projection of $11.1 billion, but income has arrive down sharply in modern several years. Intel had quarterly earnings of extra than $20 billion as just lately as 2021.

Customer computing, Intel’s Laptop chip business, produced $5.8 billion in income. That compares with an estimate of $4.95 billion. Information-center sales have been $3.7 billion, compared to an regular projection of $3.51 billion.

1st-quarter Computer shipments slumped 29% to 56.9 million models, using them back again beneath the degrees of early 2019, in accordance to IDC. That places the market on system to come in a lot more than 100 million units shy of its 2021 full.

Intel’s toughness in the server processor marketplace as soon as cushioned it from the ebb and movement of the Computer organization. Server chips, the central parts of devices that run the web and corporate networks, are substantially far more high priced and worthwhile than individuals that go into laptops. But in that area, Intel has missing current market share to rival Superior Micro Gadgets Inc. and in-household initiatives by important shoppers these kinds of as Amazon.com Inc.’s AWS.

A slowdown in need in the server and networking company hasn’t strike base nevertheless, Intel executives stated Thursday.

Overall, Intel gave adequate optimistic information to raise investors’ spirits. But analysts like Benchmark’s Acree will be waiting for the corporation to comply with by.

“There are continue to a good deal of queries,” he reported.

(Updates with much more on Personal computer figures in fourth paragraph.)

Most Go through from Bloomberg Businessweek

©2023 Bloomberg L.P.