-

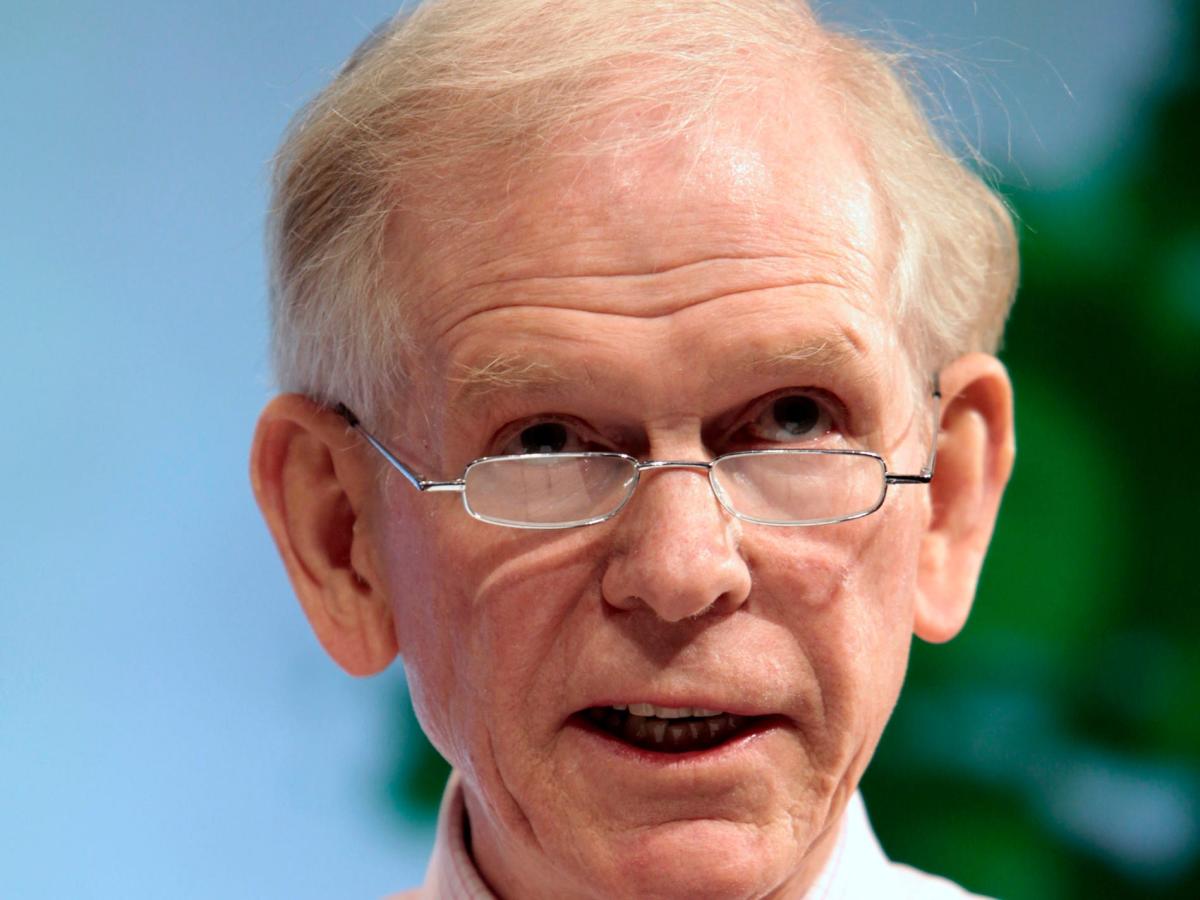

Jeremy Grantham expects US household charges to slide in excess of the upcoming number of yrs.

-

The GMO cofounder sees the S&P 500 plunging as lower as 2,000 details, a 52% fall.

-

The elite investor warns the modern banking turmoil may perhaps strain other pieces of the economical system.

Prepare for a extended drop in US residence rates, a probable 52% plunge in the S&P 500, and a lot more banking issues, Jeremy Grantham has warned.

American homes are quite costly relative to family incomes, and surging mortgage costs have eroded people’s homebuying electrical power, the marketplace historian and GMO cofounder instructed CityWire in a modern interview.

As individuals step by step notice their attributes are well worth significantly much less than they thought, they are possible to come to feel poorer and cut back again on foreign trips, graduate schooling, and other large-ticket things, Grantham predicted. The decline in spending could mood economic expansion, he noted.

“It doesn’t materialize overnight, but housing casts a really prolonged shadow and economically is much more hazardous than the inventory industry,” Grantham mentioned. “The lousy news is it moves really slowly but surely. The peak previous time was 2006 and it failed to trough until finally 2012 — it took six many years.”

“I will not hope a crash but I count on dwelling prices to drift again into additional affordability,” he additional.

The veteran investor sounded the alarm on a “superbubble” spanning shares, bonds, and real estate in January 2022. He partly blamed the asset-price growth on near-zero curiosity costs, which inspired shelling out over conserving and manufactured it really affordable to borrow.

Nonetheless, in a bid to suppress historic inflation, the Federal Reserve has hiked costs to about 5% above the earlier 13 months or so. The US central bank’s steps have elevated the charge of mortgages, auto financial loans, credit rating cards and other forms of personal debt.

In addition to a housing downturn, Grantham predicted a sharp decrease in stocks. The S&P 500 is possible to plunge involving 27% and 52% from its existing degree of 4,130 factors, he told CityWire.

“The most effective we could hope for is that this marketplace would base at about 3,000,” he mentioned. “The worst we need to dread is additional like 2,000.”

Understanding that might sound excessive, Grantham famous the benchmark index touched 666 points in 2009, which means if it bottoms at 2,000 points this time close to, it will still have tripled over the past 14 several years.

Grantham also nodded to the collapse of Silicon Valley Financial institution and Signature Lender in March, which sent shockwaves as a result of the economical method and has stoked fears of a credit score crunch. He recommended set-money buyers to be thorough, as even more banking turmoil could threaten the appealing yields on bonds.

“We do seem to be functioning the risk of a rolling economic worry,” he said.

Examine the first short article on Organization Insider