The poison of suspicion is horrible in the cryptocurrency marketplace.

A month just after the overnight implosion of the crypto empire of Sam Bankman-Fried, 30, it is one more lord of the crypto sphere who is now the issue of the wildest rumors about the solvency of his crypto kingdom.

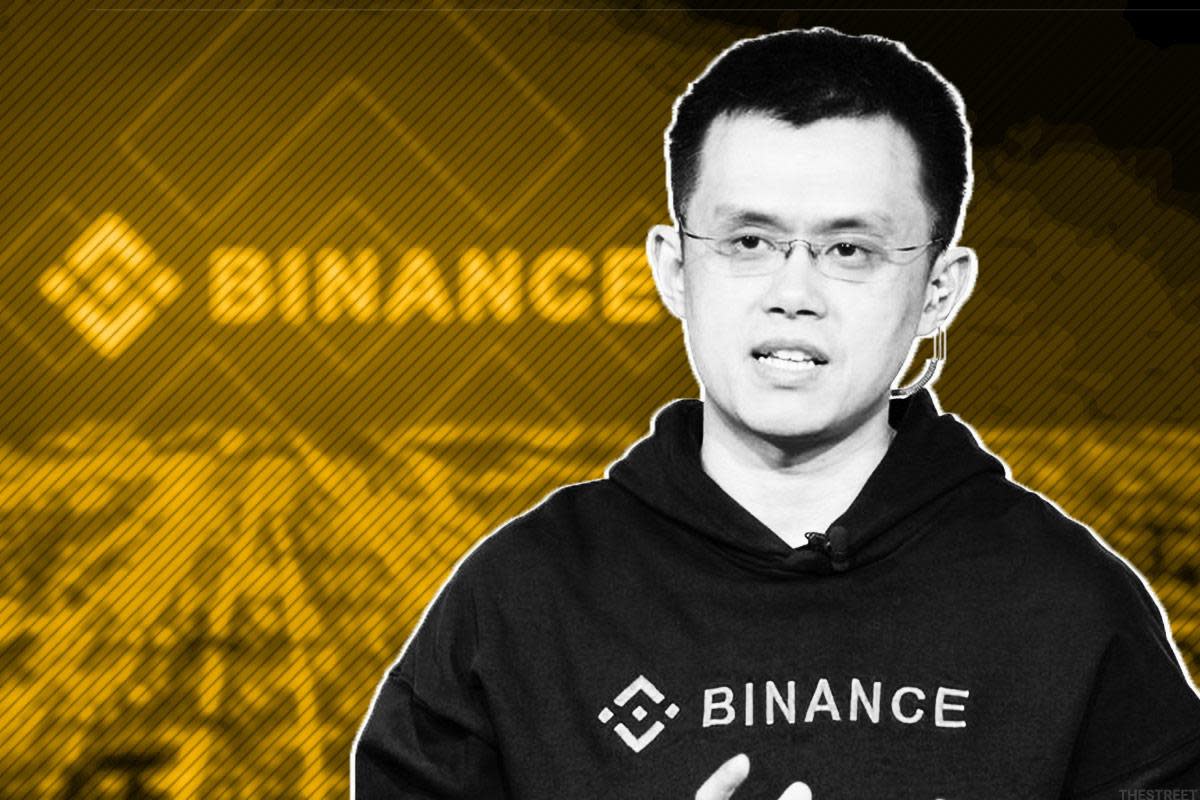

This is Changpeng Zhao, the founder and CEO of Binance, the world’s major cryptocurrency exchange by investing volume. Ironically, it was a tweet from Zhao that sparked the beginning of the finish for FTX and its sister business Alameda Research, the two jewels of the Bankman-Fried empire.

On November 6, Zhao introduced in a submit, on Twitter, that his business had created the decision to offer $530 million worth of FTT cash, a cryptocurrency issued by FTX. Binance had received its coins when the agency bought its stake in FTX in 2021.

In his announcement, he included that the determination to liquidate FTT cash was because of to current revelations which appeared to be about Alameda’s balance sheet.

FTX v. Binance

In a November 2 article, Coindesk claimed that most of the balance sheet of Alameda Investigation, Bankman-Fried’s investing system, was comprised of the FTT token, the cryptocurrency issued by FTX. Obviously, if the token collapsed, Alameda would be left with practically nothing. This revelation surprised investors who considered the business had other property.

The article prompted a operate on the bank and, 5 times afterwards, FTX and Alameda filed for Chapter 11 bankruptcy.

Binance and Zhao “set FTX out of small business,” Shark Tank star Kevin O’Leary, who was a FTX’s ambassador, explained to U.S. Senators on December 14.

But for the earlier few times, Binance has been at the center of speculation itself, that the platform would not have sufficient reserves to endure a run on the lender.

It is as a result no shock that a lot of Binance customers have rushed to try out to withdraw their funds, deposited on the system in the form of cryptocurrencies.

“Binance has experienced the maximum each day withdrawals considering that June, with around $2B* in net outflows given that December 12,” details investigation group Nansen, stated on December 13.

Reserves

But Nansen included that the platform has ample liquidity to stand up to a major exodus of assets. The agency has $62.6 billion in reserves, which need to be enough to fulfill consumer withdrawal calls for, Nansen approximated.

The trouble is that it is really rough to definitely evaluate the financial well being of Binance, for the reason that the total accounting of the firm’s property and liabilities is not out there.

This opacity and a controversial selection by Binance, only fuels FUD, a slang in the crypto sphere that refers to Panic Uncertainty and Question. The platform paused withdrawals connected to cryptocurrency USDC on December 13, in buy to facilitate a “token swap” of USDC stablecoins for its own BUSD stablecoins.

The enterprise explained it as a measure to loosen up liquidity in anticipation of more withdrawals but for several crypto enthusiasts on social media this was bad, as FTX did the identical factor just just before filing for bankruptcy.

“Points seem to be to have stabilized,” Zhao tweeted on December 14. “Yesterday was not the best withdrawals we processed, not even major 5. We processed more throughout LUNA or FTX crashes. Now deposits are coming back in. 🤷♂️💪”

The CEO reiterated that no total of withdrawals can result in difficulties for Binance, in the course of an interview with CNBC on December 15. He extra that the firm holds assets a single-on-a single and declared that Binance in no way utilizes customers’ funds.

“Binance isn’t going to owe any individual any revenue,” Zhao stated when requested about the firm’s liabilities.

This does not avert rumors from continuing to circulate on social networks, a person of the primary facts channels for gamers in the crypto sphere.

As a end result, BNB, the cryptocurrency issued by the Binance ecosystem, has been impacted by the FUD: BNB rates are down just about 14% in the last seven days, according to knowledge firm CoinGecko. By comparison, Bitcoin (BTC) rates are down 1.2% in the similar time period.

TheStreet sent a series of inquiries to Binance that were not answered.

Opaque

What has also fueled and carries on to fuel suspicion around Binance is that the agency is not controlled, compared with its rivals Coinbase (COIN) – Get Cost-free Report and Kraken for instance. All this suggests that Binance is not obligated to reveal its accounts and can do what it wishes. Customers and buyers need to imagine what the system tells them. They have no way to confirm.

The corporation also does not say exactly where its headquarters are based. Established in China, Binance remaining the place in 2017 in advance of the nation banned cryptocurrency trading.

An audit on the state of the firm’s reserves took location in excess of the weekend of December 11, to demonstrate that just about every customer greenback is confirmed. But in truth of the matter, what this so-named activity of transparency has revealed is that the assets had been not thoroughly collateralized and Binance was incredibly selective about its disclosures.

The so-termed proof-of-reserves, which was destined to re-establish consumer have faith in in the system, was mocked on social media, forcing Binance to enjoy protection.

The other stressing difficulty is an investigation by the Department of Justice (DoJ) that could lead to dollars laundering prices in opposition to Binance and some of its top rated executives, which includes Zhao, Reuters not long ago reported.

The investigation commenced in 2018 and is focused on Binance’s compliance with U.S. anti-cash-laundering regulations and sanctions. At the finish of 2020, the DoJ asked Binance to post inside documents relating to how the agency ensured that people of its system do not launder revenue.