(Bloomberg) — Previous Treasury Secretary Lawrence Summers warned that the Federal Reserve will probably need to elevate interest rates much more than markets are at present expecting, thanks to stubbornly large inflationary pressures.

Most Examine from Bloomberg

“We have a very long way to go to get inflation down” to the Fed’s concentrate on, Summers informed Bloomberg Television’s “Wall Street Week” with David Westin. As for Fed policymakers, “I suspect they’re heading to need to have much more improves in desire rates than the current market is now judging or than they’re now saying.”

Fascination-rate futures advise traders be expecting the Fed to raise fees to about 5% by May possibly 2023, in comparison with the present-day target assortment of 3.75% to 4%. Economists expect a 50-basis point raise at the Dec. 13-14 plan conference, when Fed officials are also scheduled to release new projections for the vital rate.

“Six is undoubtedly a situation we can write,” Summers claimed with regard to the peak proportion price for the Fed’s benchmark. “And that tells me that five is not a great greatest-guess.”

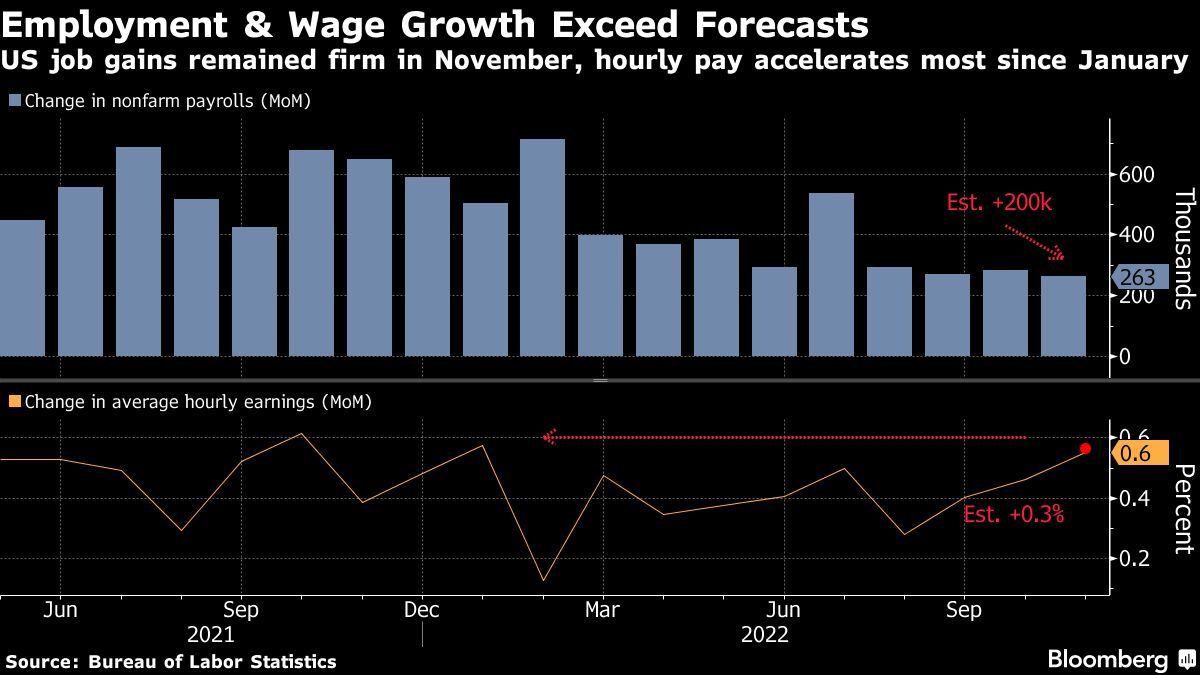

Summers was talking hrs just after the hottest US every month positions report confirmed an unforeseen bounce in common hourly earnings gains. He mentioned these figures showcased continuing potent rate pressures in the economic system.

“For my cash, the finest single evaluate of main underlying inflation is to glance at wages,” mentioned Summers, a Harvard University professor and compensated contributor to Bloomberg Television. “My perception is that inflation is likely to be a very little extra sustained than what persons are searching for.”

Read through A lot more: Job Sector Is Much too Limited for Fed Consolation as Labor Pool Shrinks

Regular hourly earnings rose .6% in November in a wide-based achieve that was the greatest due to the fact January, and were up 5.1% from a calendar year before. Wages for creation and nonsupervisory workers climbed .7% from the prior thirty day period, the most in almost a yr.

Although a amount of US indicators have instructed restricted influence so far from the Fed’s tightening marketing campaign, Summers cautioned that adjust tends to arise all of a sudden.

“There are all these mechanisms that kick in,” he mentioned. “At a specified level, individuals run out of their cost savings and then you have a Wile E. Coyote sort of minute,” he mentioned in reference to the cartoon character that falls off a cliff.

In the housing market place, there tends to be a sudden rush of sellers placing their properties on the market place when selling prices start to drop, he said. And “at a sure place, you see credit rating drying up,” forcing reimbursement troubles, he additional.

“Once you get into a detrimental scenario, there’s an avalanche aspect — and I think we have a actual chance that that is heading to transpire at some point” for the US economic climate, Summers reported. “I never know when it is likely to arrive,” he stated of a downturn. “But when it kicks in, I suspect it’ll be relatively forceful.”

Inflation Concentrate on

The previous Treasury main also warned that “this is likely to be a somewhat substantial-desire-rate economic downturn, not like the lower-fascination-amount recessions we have viewed in the earlier.”

Summers reiterated that he didn’t imagine the Fed should to transform its inflation goal to, say, 3%, from the recent 2% — in portion since of probable reliability issues right after obtaining permitted inflation to surge so high the earlier two years.

Most Examine from Bloomberg Businessweek

©2022 Bloomberg L.P.