The Fed’s ongoing inflation fight—which saw mortgage rates spike from 3% to 6% in 2022—has set off the second most significant household price tag correction of the article-WWII era.

On 1 hand, the 2.4% fall in U.S. dwelling selling prices witnessed amongst June and October is little relative to the housing crash’s 26% nationwide home cost decline from the prime in 2007 to the bottom in 2012. On the other hand, the ongoing property price tag correction might have a large amount of gas left in the tank.

Look no even more than a Goldman Sachs paper place out very last week with the title “Receiving worse just before obtaining improved.” Scientists at the financial commitment bank argued in the paper that the countrywide residence rate correction will continue on by way of 2023.

“We are reducing our 2023 forecast for calendar year-around-yr depreciation in the Situation-Shiller Household Selling price Index to -6.1% from -4.1% beforehand. This would signify an combination peak-to-trough decline of about 10% in U.S. property costs as a result of the end of this 12 months from June 2022,” produce Goldman Sachs researchers.

Via October, the lagged Case-Shiller Countrywide Dwelling Selling price Index has registered a -2.4% countrywide residence cost decrease. However, scientists at the investment decision lender estimate after we get the November and December readings, we’ll see nationwide dwelling charges are by now down -4%. That implies we might now be 50 percent-way to Goldman Sachs’ believed 10% peak-to-trough drop.

Nationally, a 10% peak-to-trough decline in U.S. household prices—which climbed 41% among March 2020 and June 2022—shouldn’t do also considerably economical injury, suggests Goldman Sachs. However, the company states some regional marketplaces would not be so fortunate.

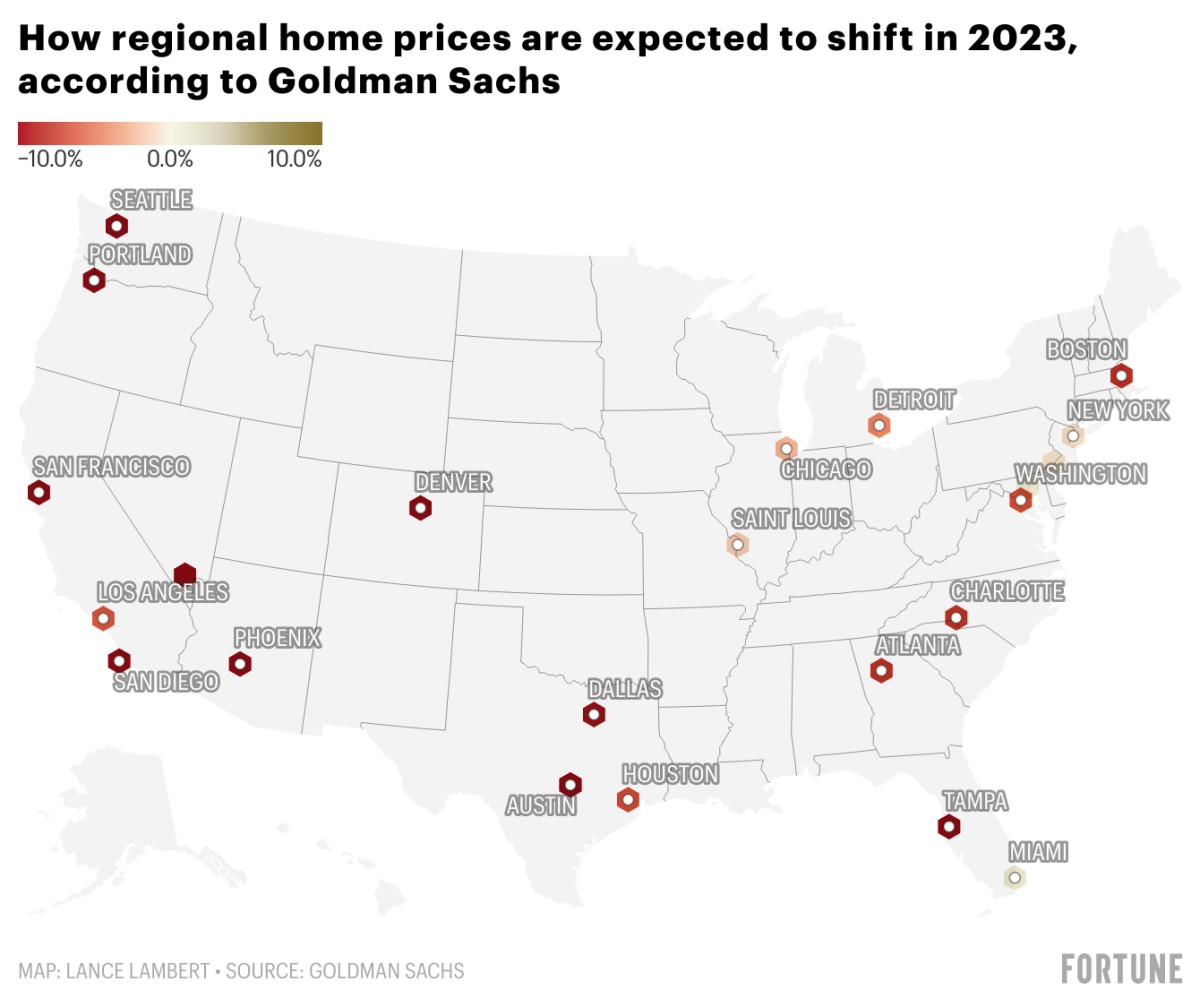

“This [national] decline should really be modest plenty of as to keep away from broad home finance loan credit score pressure, with a sharp boost in foreclosures nationwide seeming not likely. That reported, overheated housing marketplaces in the Southwest and Pacific coastline, this kind of as San Jose MSA, Austin MSA, Phoenix MSA, and San Diego MSA will probable grapple with peak-to-trough declines of above 25%, presenting localized possibility of better delinquencies for home loans originated in 2022 or late 2021,” writes Goldman Sachs.

Watch this interactive chart on Fortune.com

In 2023, Goldman Sachs expects double-digit home cost declines in big marketplaces like Austin (-15.6), San Francisco (-13.7%), San Diego (-13.4%), Phoenix (-12.9%), Denver (-11.4%), Seattle (-11.2%), Tampa (-11.2%), and Las Vegas (-11.1%). All those markets are also the incredibly sites that the property price correction strike the toughest in the second fifty percent of 2022. Indeed, through November, Austin is down 10.4% from its 2022 peak home price.

Why does Goldman Sachs be expecting the correction to provide the greatest blow to marketplaces like San Diego and Austin? The expense financial institution says people markets are “overheated,” which implies that residence price expansion there received too detached from fundamentals throughout the Pandemic Housing Boom. Staying detached from fundamentals packs a specifically tricky punch when property finance loan costs spike like they did in 2022.

Heading ahead, Goldman Sachs thinks many Northeastern, Southeastern, and Midwestern marketplaces could see milder corrections (if any correction at all). In 2023, the investment lender expects house prices to scarcely fall in areas like Chicago (-1.8%) and New York (-.3%), even though its forecast has property selling prices mounting in Baltimore (+.5%) and Miami (+.8%) in 2023.

Look at this interactive chart on Fortune.com

“Our 2023 revised forecast largely reflects our view that fascination fees will stay at elevated degrees for a longer time than at present priced in, with 10-yr Treasury yields peaking in 2023 Q3. As a end result, we are increasing our forecast for the 30-calendar year set house loan fee to 6.5% for yr-close 2023 (representing a 30 bp enhance from our prior expectation),” create Goldman Sachs researchers. “This route would lead to affordability to worsen incrementally, after a slight advancement around the earlier two months.”

Though the financial commitment financial institution expects U.S. residence prices to tumble 6.1% in 2023, it won’t count on a extended downturn like the prior bust: In 2024, Goldman Sachs expects U.S. dwelling rates to rise 1% even as markets like Austin and Phoenix keep on to slide.

“Assuming the economic climate remains on the route to a comfortable landing, steering clear of a recession, and the 30-12 months preset mortgage loan amount falls back again to 6.15% by year-stop 2024, house price tag advancement will very likely change from depreciation to beneath-craze appreciation in 2024,” writes Goldman Sachs.

No matter whether it is Goldman Sachs’ forecast or Moody’s outlook, the greatest wildcard for any household value forecast design stays mortgage premiums. (You can find the most current household selling price forecast from 27 of the nation’s top serious estate investigation firms right here.)

At the peak in November, the average 30-calendar year fastened home loan level as calculated by Property finance loan Fee Day by day sat at 7.37%. However, pursuing optimistic news on the inflation entrance the previous handful of months, economic ailments have loosened and the normal 30-year fastened mortgage fee has fallen to 6.09%. If mortgage loan premiums were being to carry on falling, corporations like Goldman Sachs might have to begin upgrading their household cost outlooks.

Wanting for far more housing knowledge? Stick to me on Twitter at @NewsLambert.

This story was originally featured on Fortune.com

Extra from Fortune:

Air India slammed for ‘systemic failure’ just after unruly male passenger traveling organization class urinated on a lady traveling from New York

Meghan Markle’s authentic sin that the British public cannot forgive–and Us residents can not comprehend

‘It just does not operate.’ The world’s finest cafe is shutting down as its owner calls the modern wonderful dining design ‘unsustainable’

Bob Iger just place his foot down and told Disney staff to come back into the office environment

:max_bytes(150000):strip_icc():focal(997x476:999x478)/ethan-slater-ex-wife-lilly-jay-main-121924-90b8f972f2c44d0f8d177ca74905feb8.jpg)