Mobileye World-wide Inc. priced its original general public giving higher than its focused vary late Tuesday to raise almost $1 billion, most of which will go to Intel Corp.

Mobileye priced its initial general public featuring at $21 late Tuesday, the business introduced in a information launch, after previously stating a focused selection of $18 to $20 shares are anticipated to begin buying and selling on the Nasdaq under the ticker symbol “MBLY” on Wednesday. Intel

INTC,

will offer at the very least 41 million shares of Mobileye, which would elevate $861 million, and also agreed to a $100 million concurrent sale of stock to General Atlantic, which would make the whole elevated at the very least $961 million.

Intel paid $15.3 billion to receive Mobileye in 2017, and was reportedly aiming for a valuation as substantial as $50 billion when initially setting up this IPO, but in its place will settle for a primary valuation of about $16.7 billion. Following a report calendar year with extra than 1,000 choices in 2021, the IPO current market has mostly dried up in 2022.

Go through: Mobileye IPO: 5 things to know about the Intel autonomous-driving spinoff

Underwriting banking institutions — Intel stated two dozen underwriters, led by Goldman Sachs Group Inc.

GS,

and Morgan Stanley

MS,

— have entry to an extra 6.15 million shares for overallotments, which could thrust the full elevated increased than $1 billion and make Mobileye the second-premier featuring of the calendar year. Only two offerings so considerably this year have lifted at the very least $1 billion — non-public-fairness business TPG Inc.

TPG,

elevated accurately $1 billion in January, and American Worldwide Team Inc.

AIG,

spinoff Corebridge Money Inc.

CRBG,

elevated at least $1.68 billion in September.

Intel will get the bulk of the proceeds of the supplying — soon after promising to make absolutely sure that Mobileye has $1 billion in funds and equivalents, the chip maker will consider the rest of the proceeds for its own coffers. Wells Fargo analysts calculated that Mobileye will will need about $225 million to strike that amount, leaving at the very least $736 million for Intel ahead of expenses and other fees.

Intel will also sustain regulate of the company following spinning it off, trying to keep course B shares that will convey 10 votes for every share while advertising class A shares that express one vote for every share. Intel will retain a lot more than 99% of the voting energy and approximately 94% of the financial possession of the corporation, and the Mobileye board is envisioned to include things like 4 customers with ties to Intel, together with Main Govt Pat Gelsinger serving as chairman of the board.

Read also: Intel documents for Mobileye IPO, creating a share composition that will retain the chipmaker in control

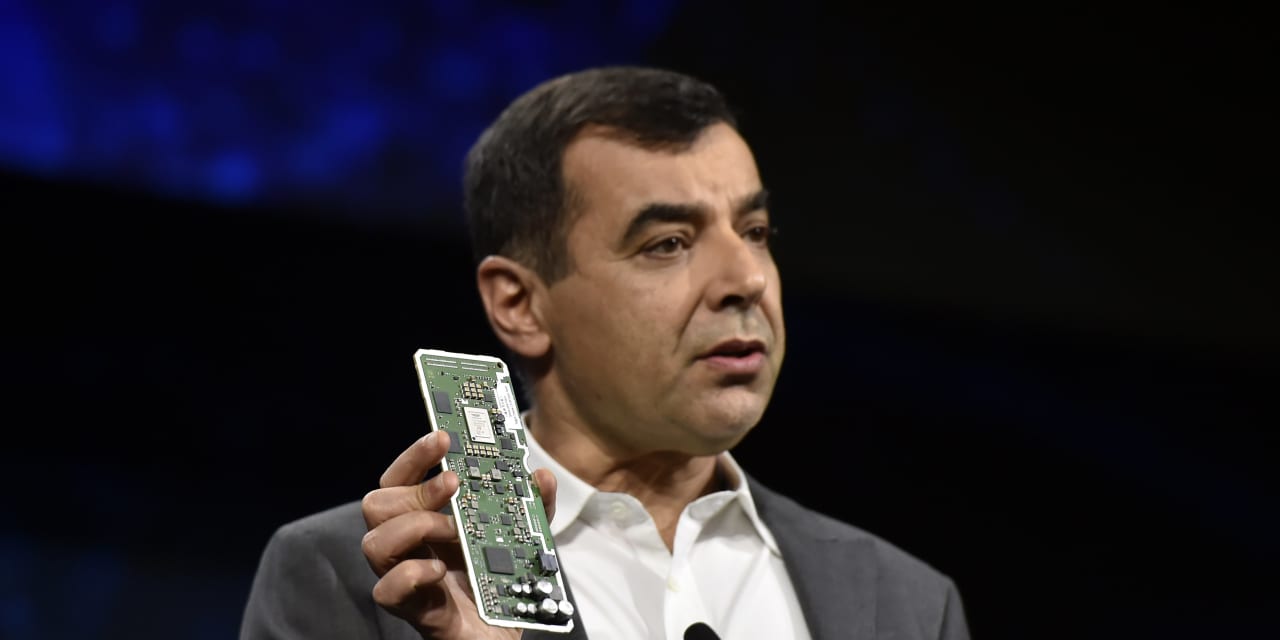

Mobileye will keep on to be led by founder Amnon Shashua, who served as main govt prior to Intel obtained the corporation and stayed at the helm although it was part of the Silicon Valley chip maker. Shashua established Mobileye in 1999 and turned it into a pioneer in the area of automated-driving technology and one particular of Israel’s most notable tech providers.

Mobileye filed for the original public giving at the finish of September, when executives were being nonetheless reportedly hoping for a $30 billion valuation.