(Bloomberg) — The battering of bonds this yr from inflation and increased prices has designed very long-phrase municipal securities so cheap that buyers who commonly shun them might be consumers.

Most Study from Bloomberg

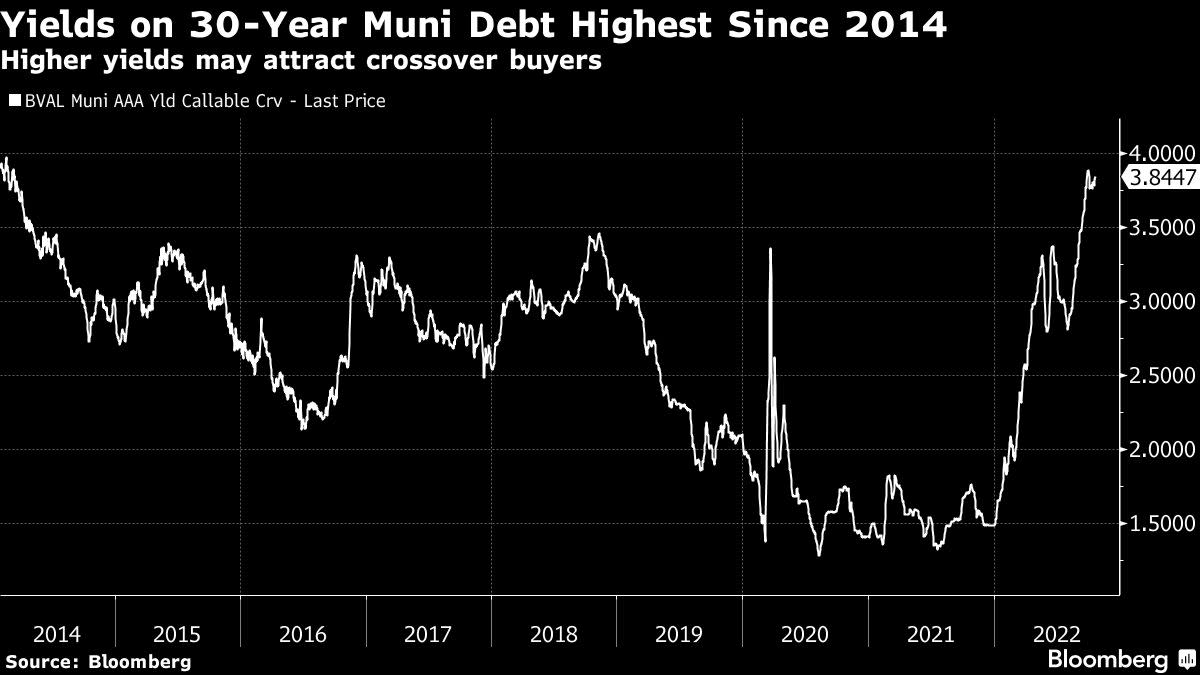

The yield on tax-exempt municipal personal debt maturing in 30 yrs attained 3.8% on Thursday, around its optimum considering the fact that March 2014, in accordance to facts compiled by Bloomberg.

That’s nearly 92% of the amount on 30-calendar year US Treasuries, better than the normal ratio for tax-exempt to taxable financial debt, that means the municipal bonds are comparatively low cost. And the creditworthiness of state and city securities has benefited from robust tax receipts and federal pandemic relief, earning them extra persuasive to a wider selection of buyers, said Paul Malloy, head of municipal financial investment at Vanguard Group Inc.

“Together it actually does make municipals appear to be a person of the most attractive elements of the mounted-money market place now, especially at the prolonged stop,” Malloy explained.

Yields on each new and old muni bonds have risen as the Federal Reserve raised desire rates to sluggish the fastest inflation in many years. Costs in the secondary sector dropped, building a loss of 11.5% so far this yr for the broader municipal-bond market, in accordance to Bloomberg Barclays Indexes.

Tax-exempt securities maturing in 22 decades or longer are the worst-undertaking section of the muni curve, getting rid of 18.9% as a result of Oct. 19, according to the indexes.

But Vanguard’s Malloy anticipates a bounce back, with demand from customers from so-named crossover consumers who emphasis on company and US Treasury securities assisting to elevate muni bond price ranges, which transfer inversely from yields.

“One of the most important characteristics of the muni industry is it will snap back again and it will snap back again difficult when it does,” Malloy mentioned.

Some municipal marketplace contributors also see aid coming from the Fed down the road, when the central lender inevitably slows its rate-increase regime. Investors in for a longer time-dated securities must prolong their portfolio length, but in a disciplined manner, in accordance to a Financial institution of The us Corp. municipal study report dated Oct. 14.

“We see that the strongest returns tend to come on lengthy maturity indexes involving the second-to-previous and past rate hike,” in accordance to the Financial institution of The us report.

Most Go through from Bloomberg Businessweek

©2022 Bloomberg L.P.