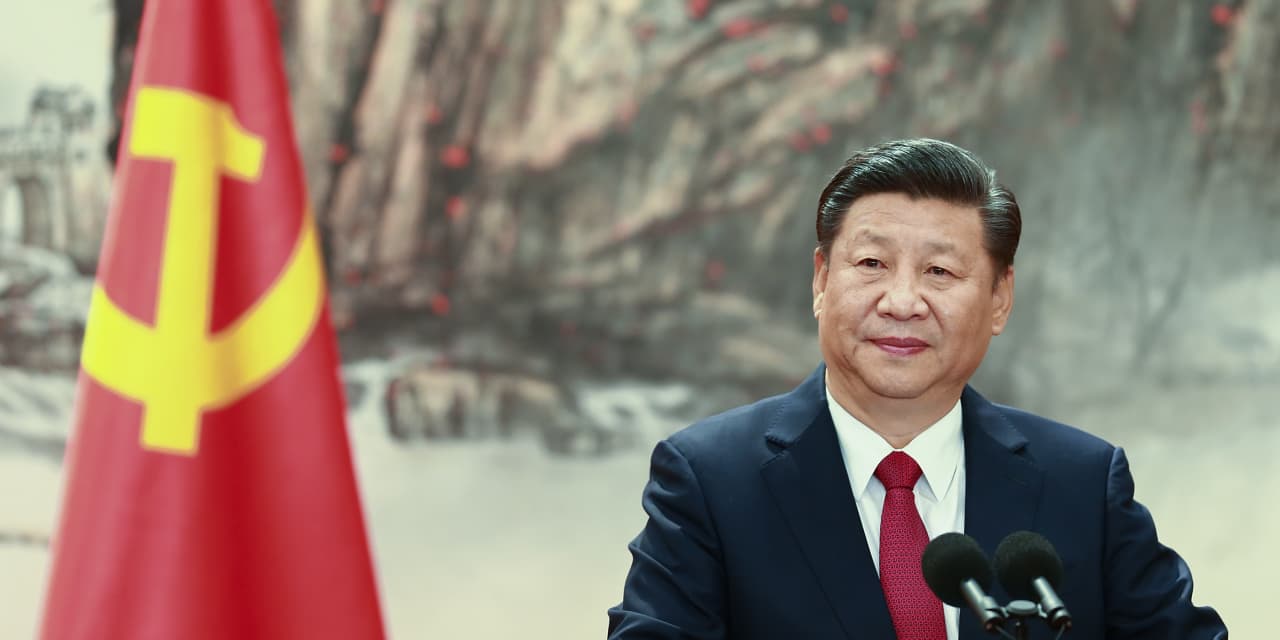

The U.S.-outlined shares of China-primarily based providers took wide beating Monday, as China President Xi Jinping’s moves to consolidate electric power fueled fears that recent insurance policies that have led to a slowing financial system will proceed.

Chinese chief Xi was named above the weekend to a 3rd, five-12 months term as typical secretary, disregarding the personalized of stepping down following two phrases, as the Involved Press reported. Xi also dropped No. 2 chief Leading Li Keqiang, a proponent of industry-model reform and personal enterprise, from a 7-member Standing Committee in favor of more powerful Xi allies.

That spooked buyers previously reeling from a slowing economy, amid fears above the existing zero-COVID coverage that has led to lockdowns, and uncertainty over whether or not the crackdown on technological innovation corporations will go on.

The iShares China Massive-Cap trade-traded fund

FXI,

sank 10.1% in early morning buying and selling to the cheapest value witnessed because November 2008.

That follows a 6.4% plunge in Hong Kong’s Hold Seng

HSI,

to a 13-calendar year reduced, even though the Shanghai Composite

SHCOMP,

get rid of 2.%. The Invesco Golden Dragon China ETF

PGJ,

which holds only U.S.-listed shares of corporations headquartered in China, was pummeled for a 15.3% reduction towards a 10-12 months small.

Also, although information showed that the Chinese economic climate grew additional than predicted in the 3rd quarter, the pace of growth yr to date remained nicely down below the annual progress focus on. “The [growth] gap is thanks to China’s extremely hard COVID-zero mission, which has been confirmed and cemented with Xi’s third time period in business,” claimed Ipek Ozkardeskaya, senior analyst at Swissquote Lender.

Between the additional-active China-based organizations investing in the U.S., shares of electric powered auto maker Nio Inc.

NIO,

plunged 18.1% toward the major just one-working day selloff given that it tumbled 20.2% on Sept. 24, 2019. The inventory was also headed for the initially near under the $10 mark because July 2020.

Among the other EV makers, shares of XPeng Inc.

XPEV,

dropped 15.% towards a report reduced and Li Car Inc.

LI,

lose 15.3% toward a two-yr minimal.

Ecommerce giant Alibaba Team Keeping Ltd.’s stock

BABA,

dove 15.3%, and was investing at the least expensive costs since February 2016.

Somewhere else, shares of Tencent Audio Amusement Group slid 14.2%, JD.com

JD,

slumped 17.1%, Pinduoduo Inc.

PDD,

cratered 23.3%, iQiyi Inc.

IQ,

lost 16.2%, Bilibili Inc.

BILI,

plunged 16.4% and Baidu Inc.

BIDU,

gave up 16.7%.