(Bloomberg) — A rebound for Cathie Wood’s trade-traded funds may perhaps count in part on an similarly battered large-cap technology stock that is a extended-time favourite of hers — Nvidia Corp.

Most Read through from Bloomberg

ETFs managed by the development inventory proponent’s ARK Investment decision Administration LLC have been loading up on Nvidia shares, acquiring extra than 400,000 in September, in accordance to the firm’s day by day investing disclosures. ARK money held additional than 675,000 shares as of June 30, in accordance to knowledge compiled by Bloomberg.

Nvidia shares have plunged 55% this yr, the largest drop among tech stocks with sector values of $100 billion or far more. Sales development has slowed at a time when valuations for fast expanding organizations have arrive beneath intense stress amid soaring fascination costs.

Which is remaining the inventory more cost-effective than it was past calendar year when its industry price was climbing toward $1 trillion. However at 32 periods projected earnings, it is nonetheless priced over its ordinary over the previous 10 years.

Wood has long been a supporter of Nvidia, whose graphics processors are used in own personal computers and for intricate computing jobs expected for artificial intelligence. Shares of the Santa Clara, California-dependent enterprise have been part of her portfolios because ARK began in 2014, together with electric powered-car or truck maker Tesla Inc.

Nonetheless, ARK’s conviction has wavered at moments. The organization sold almost 300,000 Nvidia shares on Aug. 23, the working day ahead of the chipmaker claimed earnings in which its quarterly revenue forecast fell about $1 billion shorter of the regular Wall Street estimate. ARK reps didn’t respond to inquiries trying to get comment.

“Nvidia is a high-quality company and though it was high-priced earlier this yr, the correction has created it look quite appealing at these levels,” stated Greg Taylor, main expense officer at Function Investments Inc.

Wood’s affinity for Nvidia was a massive boon as the shares soared from about $4 at the get started of 2014 to far more than $330 late in 2021, when Nvidia’s marketplace value peaked at more than $800 billion. This 12 months, even so, the inventory has been a significant drag. Nvidia has fallen 60% from a Nov. 29 report, shedding about $500 billion in market worth alongside the way.

Of course, Wooden has been criticized as her portfolios have taken a beating with economic circumstances weighing disproportionately on the substantial-expansion, higher-valuation shares she tends to favor. Her $8 billion flagship ARK Innovation ETF has fallen 55% this yr.

As for Nvidia, Wall Street has been slashing earnings estimates. Projections for 2023 gains underneath commonly approved accounting ideas have fallen much more than 50% more than the previous 3 months, according to info compiled by Bloomberg.

Tech Chart of the Working day

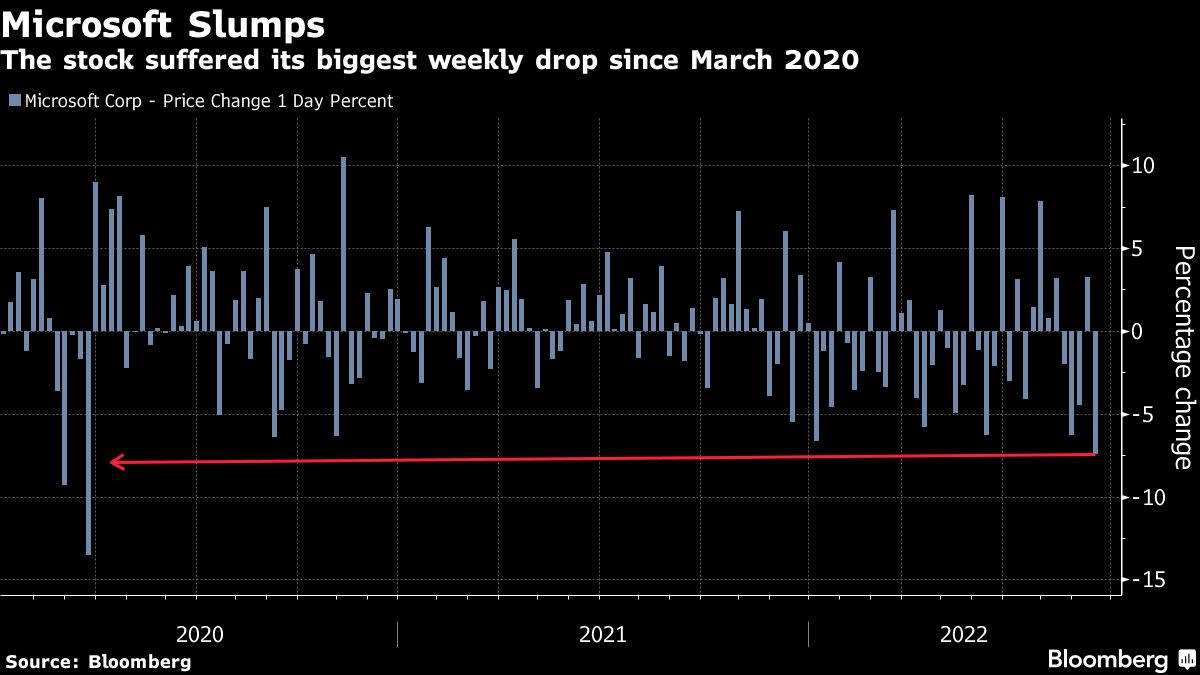

The Nasdaq 100 Index fell 5.8% final 7 days, as a looking at on inflation fueled its biggest weekly proportion fall since January, and the providing was primarily extreme in Microsoft Corp. The software program big dropped 7.5%, its major slump due to the fact March 2020. The inventory, which is down 27% this 12 months, shut at its least expensive amount considering that June.

Top Tech Tales

-

China’s heated rivalry with the US around tech supremacy is introducing refreshing discomfort factors to the world’s next-biggest stock market place, as the Biden administration steps up initiatives to decrease economic reliance on the Asian nation.

-

The UK’s Economic Conduct Authority posted a warning to customers about Sam Bankman-Fried’s crypto trade FTX, saying it is not authorized by the regulator to present money expert services or solutions in the country.

-

The App Association brands by itself as the major voice for thousands of app developers all over the world. In truth, the extensive bulk of its funding arrives from Apple Inc.

-

Oyo Hotels, the as soon as superior-traveling Indian startup, is reviving programs for a stock-current market debut just after expense cuts and a restoration in vacation assisted it lessen losses.

-

Sea Ltd. is preparing to hearth 3% of Shopee workers in Indonesia, element of a broader wave of regional career cuts intended to control ballooning losses and acquire again investors. The Singapore-based firm will commence notifying impacted personnel Monday at its income-burning e-commerce arm, in accordance to a memo observed by Bloomberg News.

-

A slide in the Dangle Seng Tech Index took the gauge in the vicinity of oversold territory for the initially time since a March rout, indicating serious bearishness that some complex traders see as a indication of rebound momentum.

-

A hacker published reliable, pre-launch footage from progress of Grand Theft Car VI, the most expected video clip activity from Consider-Two Interactive Application Inc.

-

Li Zexiang grew up in rural China in the course of the Cultural Revolution, when capitalists were being the enemy. Now the 61-yr-aged educational has quietly emerged as 1 of the country’s most effective angel buyers, backing more than 60 startups such as drone giant DJI.

-

MicroStrategy Inc. co-founder Michael Saylor, just one of the biggest advocates of Bitcoin, stated the program update of the Ethereum blockchain serves to raise the outlook for the world’s largest cryptocurrency.

-

If you get the job done in US film and Television set, the poor news is arriving practically day by day. A multiyear growth in film and Television production, driven by media corporations racing to signal up subscribers for their new streaming expert services, has arrive to a agonizing halt, supplying way to firings, introspection and handwringing.

Most Go through from Bloomberg Businessweek

©2022 Bloomberg L.P.