(Bloomberg) — Globally oil need is racing toward an all-time substantial and some of the smartest minds in the field are forecasting $100-a-barrel crude in a issue of months, but US producers are participating in the small activity and seeking to convert around as a great deal funds as possible to investors.

Most Study from Bloomberg

Shareholders in US oil providers reaped a $128 billion windfall in 2022 thanks to a blend of worldwide supply disruptions these as Russia’s war in Ukraine and intensifying Wall Street pressure to prioritize returns in excess of acquiring untapped crude reserves. Oil executives who in a long time previous had been rewarded for investing in gigantic, extended-expression electricity assignments are now beneath the gun to funnel income to investors who are increasingly confident that the sunset of the fossil-gas era is nigh.

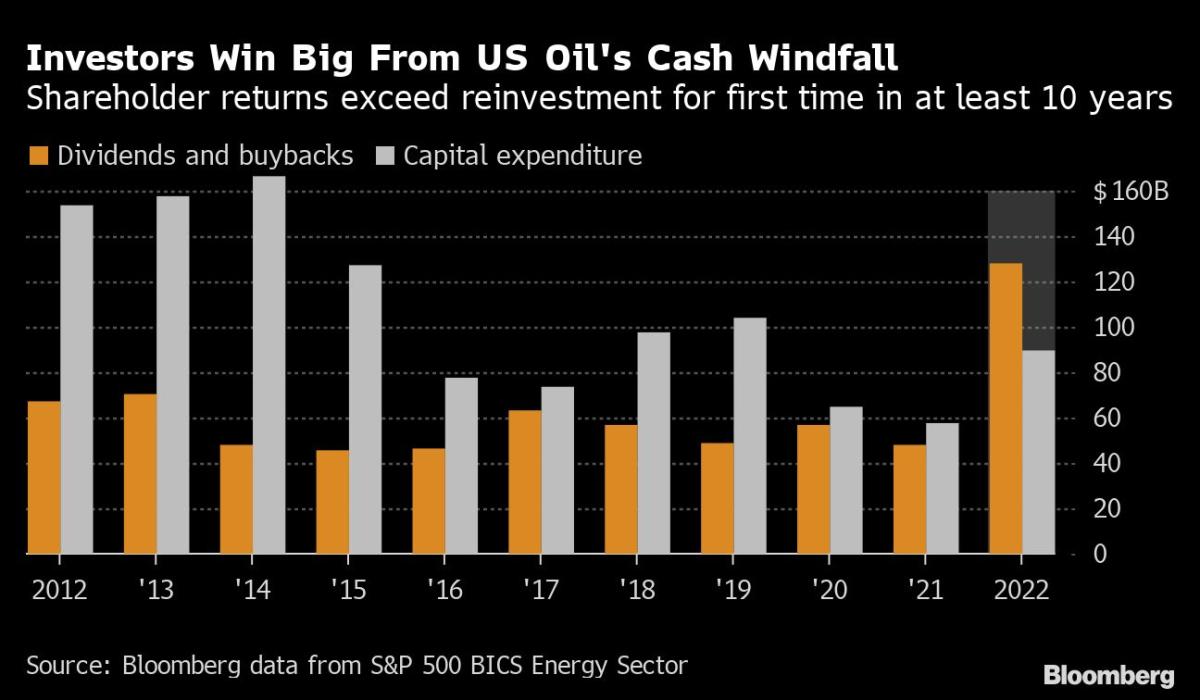

For the to start with time in at the very least a decade, US drillers last calendar year used much more on share buybacks and dividends than on cash projects, according to Bloomberg calculations. The $128 billion in put together payouts throughout 26 corporations also is the most considering that at least 2012, and they occurred in a year when US President Joe Biden unsuccessfully appealed to the field to elevate manufacturing and minimize surging gasoline price ranges. For Massive Oil, rejecting the immediate requests of the US federal government might never have been additional lucrative.

At the heart of the divergence is expanding issue amongst buyers that demand from customers for fossil fuels will peak as shortly as 2030, obviating the need to have for mutlibillion-dollar megaprojects that take many years to generate full returns. In other text, oil refineries and natural-fuel fired power plants — together with the wells that feed them — threat starting to be so-termed stranded assets if and when they are displaced by electric powered cars and trucks and battery farms.

“The financial investment neighborhood is skeptical of what property and strength price ranges will be,” John Arnold, the billionaire philanthropist and former commodities trader, claimed during a Bloomberg Information job interview in Houston. “They would instead have the cash by way of buybacks and dividends to spend in other locations. The providers have to respond to what the investment decision neighborhood is telling them to do normally they’re not going to be in charge incredibly long.”

The upsurge in oil buybacks is assisting generate a broader US corporate spending spree that observed share-repurchase announcements a lot more than triple throughout the first month of 2023 to $132 billion, the optimum ever to start off a yr. Chevron Corp. by yourself accounted for much more than 50 % that whole with a $75 billion, open up-finished pledge. The White Residence lashed out and explained that revenue would be much better used on expanding power materials. A 1% US tax on buybacks can take impact later this yr.

Global expense in new oil and fuel supplies currently is expected to tumble short of the bare minimum desired to keep up with need by $140 billion this calendar year, according to Evercore ISI. In the meantime, crude supplies are witnessed expanding at such an anemic speed that the margin among use and output will slender to just 350,000 barrels a working day up coming 12 months from 630,000 in 2023, in accordance to the US Electrical power Details Administration.

“The organizations have to reply to what the financial investment group is telling them to do usually they are not likely to be in charge really prolonged.” — Billionaire John Arnold

Administration groups from the most important US oil corporations recommitted to the trader-returns mantra as they unveiled fourth-quarter benefits in modern week and the 36% slump in domestic oil costs given that mid-summer time has only strengthened individuals convictions. Executives throughout the board now insist that funding dividends and buybacks requires priority around pumping more crude to quell purchaser discontent in excess of higher pump selling prices. This might pose a trouble in a make a difference of months as Chinese desire accelerates and worldwide gasoline usage hits an all-time superior.

“Five years ago, you would have witnessed pretty significant calendar year-on-12 months oil-provide progress, but you are not looking at that now,” Arnold said. “It’s one of the bull stories for oil — that the offer advancement that had occur out of the US has now stopped.”

The US is important to international crude offer not just simply because it is the world’s biggest oil producer. Its shale means can be tapped substantially more rapidly than classic reservoirs, this means that the sector is uniquely positioned to respond to selling price spikes. But with buybacks and dividends swallowing up a lot more and additional income move, shale is no for a longer time the international oil system’s ace in the hole.

In the waning weeks of 2022, shale experts reinvested just 35% of their hard cash movement in drilling and other endeavors aimed at boosting materials, down from extra than 100% in the 2011-2017 time period, according to info compiled by Bloomberg. A similar trend is obvious among the majors, with Exxon Mobil Corp. and Chevron aggressively ramping buybacks though restraining money spending to a lot less than pre-Covid ranges.

Buyers are driving this habits, as evidenced by clear messages sent to domestic producers in the previous two months. EOG Methods Inc., ConocoPhillips and Devon Electrical power Corp. dropped immediately after announcing increased-than-envisioned 2023 budgets though Diamondback Energy Inc., Permian Assets Corp. and Civitas Sources Inc. all rose as they saved spending in look at.

On prime of shareholder needs for cash, oil explorers also are grappling with increased costs, reduced effectively productiveness and shrinking portfolios of top rated-notch drilling areas. Chevron and Pioneer Organic Assets Co. are two significant-profile producers reorganizing drilling designs following weaker-than-anticipated very well final results. Labor fees also are rising, according to Janette Marx, CEO of Airswift, 1 of the world’s most important oil recruiters.

US oil output is expected to increase just 5% this year to 12.5 million barrels a day, in accordance to the Strength Information Administration. Upcoming calendar year, the enlargement is anticipated to gradual to just 1.3%, the company claims. Even though the US is adding a lot more offer than most of the rest of the world, it’s a marked distinction to the heady days of shale in the prior ten years when the US was incorporating additional than 1 million barrels of each day output each individual calendar year, competing with OPEC and influencing world wide rates.

Desire, instead than offer-side actors like the American shale sector or OPEC, will be the major driver of price ranges this 12 months, Dan Yergin, Pulitzer Price-winning oil historian and vice chairman of S&P World, reported all through an inteview.

“Oil price ranges will be identified by, metaphorically talking, Jerome Powell and Xi Jinping,” Yergin claimed, referring to the Federal Reserve’s fee-hike route and China’s write-up-pandemic restoration. S&P World expects international oil demand to get to an all-time significant of 102 million barrels per day.

With the circumstance for higher oil prices developing, US President Joe Biden has less equipment at his disposal with which to counteract the blow to consumers. The president already has tapped the Strategic Petroleum Reserve to the tune of 180 million barrels in a bid to relieve gasoline prices as they ended up spiking in 2022. Electricity Secretary Jennifer Granholm is probable to get a frosty reception at the CERAWeek by S&P World-wide event in Houston staring March 6 if she follows Biden’s lead and assaults the sector for supplying far too substantially back again to investors. That small business model is “here to remain,” said Dan Pickering, chief investment decision officer of Pickering Electrical power Companions.

“There’s going to be a level at which the US needs to create much more due to the fact the market is heading to desire it,” Pickering reported. “That’s likely when investor sentiment shifts to expansion. Until finally then, returning money looks like the greatest notion.”

–With guidance from Lu Wang and Tom Contiliano.

Most Read through from Bloomberg Businessweek

©2023 Bloomberg L.P.