Even as the federal government experiences the fastest financial development in virtually 40 a long time, the historic gains in earnings and wealth that inflated the economy in 2020 and 2021 are fading fast.

The air is coming out of the financial system. The air that cushioned the performing course from the COVID pandemic is leaking away. The air that boosted the earnings and portfolios of the investing course is deflating. The air that intoxicated the stock sector, the bond marketplace, the housing marketplace, the crypto industry, the SPACs, the NFTs and the memes is fizzling away. The air that inflated customer selling prices is going, heading, long gone.

The enormous unprecedented stimulus of the recent past has been changed by huge unprecedented dampening of incomes and prosperity. Wages are not keeping up with inflation, and the investing class is receiving nervous and defensive.

The wailing noise you listen to is the sound of belts tightening.

Destructive fiscal and financial coverage

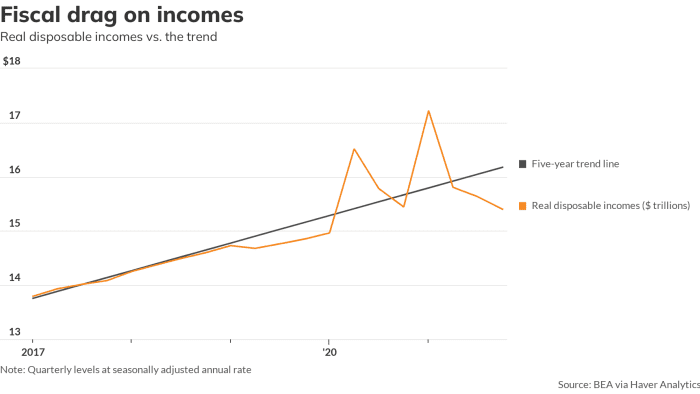

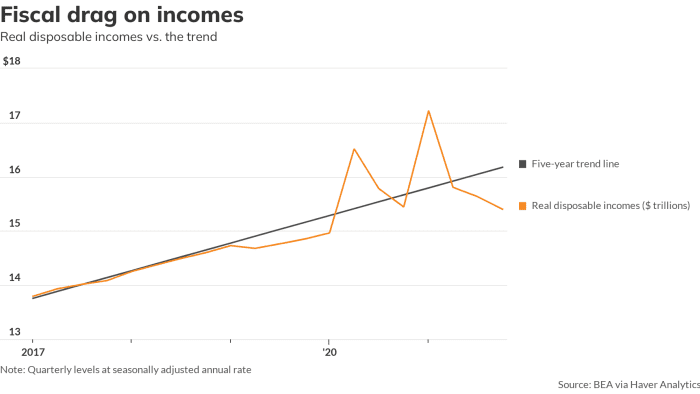

Fiscal coverage has currently turned sharply adverse, tugging down on an economy that it at the time pushed up. The money guidance presented to staff, companies, and community governments has been withdrawn. It is time to stand on your very own. Following incorporating far more than 5% in initial calendar year of the pandemic, fiscal coverage will subtract about 2.5% a calendar year from growth about the upcoming two yrs, suggests the Hutchins Center’s fiscal effects measure.

And now the Federal Reserve is telling us evidently that the Era of Totally free Cash is in excess of. Fed Chair Jerome Powell just introduced past call. The punch bowl is not likely to be refilled this time. It is closing time at the Central Lender Saloon.

Breaking news: Powell suggests Fed is ‘of a mind’ to raise interest rates in March to battle superior inflation

The risk of a occupation-killing tough landing can’t be disregarded.

It’s been so long because the Fed did this. The Fed that most investors know is the a person that generally props up inventory costs when it receives a whiff of a bear market. But with inflation managing at 7.1% for the earlier yr, the Fed is back in whole Paul Volcker manner. At minimum, that’s what Powell desires us to believe that.

Observe the complete inflation story at MarketWatch.

Inflation’s results in

To be crystal clear, much of our inflation trouble seriously just stems from the enormous shock to both of those source and need that had tiny to do with monetary plan, fascination fees

FF00,

or cash supply. Heaps of things price tag a lot more now because COVID disrupted all of the fragile world wide provide chains that present day multinational monetary capitalism has strung alongside one another to link inexpensive labor and raw materials to the marketplaces in the superior and rising economies where the individuals with revenue are living.

Here’s exactly where the inflation arrived from in 2021

You want a car but you cannot get 1 due to the fact Taiwan just cannot make or deliver plenty of personal computer chips to fulfill the need. It’s heading to choose time to develop the potential and reknit the source chains, but delayed gratification is a misplaced artwork. We’ve turn into accustomed to obtaining anything we want at that correct immediate we desire it. So we pay out no matter what it fees to get it now.

“The COVID economic downturn was the 1st downturn in historical past that remaining most people today richer than they experienced been in advance of.”

COVID also twisted the normal expending styles. With much less access to confront-to-confront providers this sort of as vacation, enjoyment and recreation, people normally purchased extra stuff—durable goods—to replace the solutions they craved but could no for a longer time get pleasure from.

But a part of our inflation dilemma is the classic imbalance of too much cash chasing also handful of products and providers. The COVID recession was the 1st downturn in background that remaining most folks richer than they experienced been in advance of. Congress pumped trillions into home and organization bank accounts. The Fed pumped trillions into reserve balances, and some of that sloshed into monetary markets. And the entire world of crypto produced trillions additional out of slim air, the top fiat currency.

Fiscal coverage supported the incomes of the doing work course while the full religion and credit score of the Federal Reserve stood behind the portfolios of the investing class. Anyone felt richer and they expended like it.

The “problem” of too considerably income is becoming solved, even ahead of the initial enhance in desire fees.

Authentic disposable incomes fell at a 5.8% annual speed in the fourth quarter.

MarketWatch

Serious incomes slipping

Incomes are now dropping like a stone. Most of the aid Congress delivered past 12 months and the yr in advance of has been withdrawn. Genuine disposable incomes (modified for acquiring ability) fell at a 5.8% yearly tempo in the fourth quarter and are on concentrate on to slide more in the initial quarter as the refundable child tax credit goes away and inflation eats up any wage gains workers control to get.

Workers managed to preserve some of the windfall that Congress furnished previously, but they’ll soon run by way of that. Then hunger and the need to have to place a roof about their heads will bring hundreds of thousands again into the labor power, resigned to get any work, no subject how unsafe, inhumane or improperly paid out. It will give new meaning to the phrase “The Excellent Resignation.”

And what of the wealth of the investing class? As of early January, it was up about 30% (or a interesting $30 trillion) given that the depths of the March 2020 selloff. The S&P 500 is down about 10% from its highs. Step by step, monetary markets are repricing the value of the Fed put—the now-out of date assumption that the central bank would maintain filling up the punch bowl anytime it looked like the occasion may stop.

If the Fed isn’t likely to assist asset charges any more, then most property search a small (or a whole lot) overvalued. They’ll find a new equilibrium shortly plenty of. But odds are that wealth of the investing course won’t go up one more $30 trillion above the next two several years.

The place does that depart the financial state? Powell says that the overall economy is sturdy and that all people can tolerate the Fed’s anti-inflation drugs. But I consider that is bluster. Underneath the surface, the foundation appears to be weak.

The concern for Powell is this: Who’ll crack 1st?

Be a part of the debate

Nouriel Roubini: Inflation will harm equally stocks and bonds, so you have to have to rethink how you will hedge risks

Rex Nutting: Why curiosity fees aren’t truly the appropriate instrument to management inflation

Stephen Roach: Luckily, the Fed has decided to halt digging, but it has a great deal of get the job done to do right before it gets us out of gap we’re in

Lance Roberts: Below are the many factors why the Federal Reserve won’t raise desire prices as a great deal as predicted

Even as the federal government experiences the fastest financial development in virtually 40 a long time, the historic gains in earnings and wealth that inflated the economy in 2020 and 2021 are fading fast.

The air is coming out of the financial system. The air that cushioned the performing course from the COVID pandemic is leaking away. The air that boosted the earnings and portfolios of the investing course is deflating. The air that intoxicated the stock sector, the bond marketplace, the housing marketplace, the crypto industry, the SPACs, the NFTs and the memes is fizzling away. The air that inflated customer selling prices is going, heading, long gone.

The enormous unprecedented stimulus of the recent past has been changed by huge unprecedented dampening of incomes and prosperity. Wages are not keeping up with inflation, and the investing class is receiving nervous and defensive.

The wailing noise you listen to is the sound of belts tightening.

Destructive fiscal and financial coverage

Fiscal coverage has currently turned sharply adverse, tugging down on an economy that it at the time pushed up. The money guidance presented to staff, companies, and community governments has been withdrawn. It is time to stand on your very own. Following incorporating far more than 5% in initial calendar year of the pandemic, fiscal coverage will subtract about 2.5% a calendar year from growth about the upcoming two yrs, suggests the Hutchins Center’s fiscal effects measure.

And now the Federal Reserve is telling us evidently that the Era of Totally free Cash is in excess of. Fed Chair Jerome Powell just introduced past call. The punch bowl is not likely to be refilled this time. It is closing time at the Central Lender Saloon.

Breaking news: Powell suggests Fed is ‘of a mind’ to raise interest rates in March to battle superior inflation

The risk of a occupation-killing tough landing can’t be disregarded.

It’s been so long because the Fed did this. The Fed that most investors know is the a person that generally props up inventory costs when it receives a whiff of a bear market. But with inflation managing at 7.1% for the earlier yr, the Fed is back in whole Paul Volcker manner. At minimum, that’s what Powell desires us to believe that.

Observe the complete inflation story at MarketWatch.

Inflation’s results in

To be crystal clear, much of our inflation trouble seriously just stems from the enormous shock to both of those source and need that had tiny to do with monetary plan, fascination fees

FF00,

or cash supply. Heaps of things price tag a lot more now because COVID disrupted all of the fragile world wide provide chains that present day multinational monetary capitalism has strung alongside one another to link inexpensive labor and raw materials to the marketplaces in the superior and rising economies where the individuals with revenue are living.

Here’s exactly where the inflation arrived from in 2021

You want a car but you cannot get 1 due to the fact Taiwan just cannot make or deliver plenty of personal computer chips to fulfill the need. It’s heading to choose time to develop the potential and reknit the source chains, but delayed gratification is a misplaced artwork. We’ve turn into accustomed to obtaining anything we want at that correct immediate we desire it. So we pay out no matter what it fees to get it now.

“The COVID economic downturn was the 1st downturn in historical past that remaining most people today richer than they experienced been in advance of.”

COVID also twisted the normal expending styles. With much less access to confront-to-confront providers this sort of as vacation, enjoyment and recreation, people normally purchased extra stuff—durable goods—to replace the solutions they craved but could no for a longer time get pleasure from.

But a part of our inflation dilemma is the classic imbalance of too much cash chasing also handful of products and providers. The COVID recession was the 1st downturn in background that remaining most folks richer than they experienced been in advance of. Congress pumped trillions into home and organization bank accounts. The Fed pumped trillions into reserve balances, and some of that sloshed into monetary markets. And the entire world of crypto produced trillions additional out of slim air, the top fiat currency.

Fiscal coverage supported the incomes of the doing work course while the full religion and credit score of the Federal Reserve stood behind the portfolios of the investing class. Anyone felt richer and they expended like it.

The “problem” of too considerably income is becoming solved, even ahead of the initial enhance in desire fees.

Authentic disposable incomes fell at a 5.8% annual speed in the fourth quarter.

MarketWatch

Serious incomes slipping

Incomes are now dropping like a stone. Most of the aid Congress delivered past 12 months and the yr in advance of has been withdrawn. Genuine disposable incomes (modified for acquiring ability) fell at a 5.8% yearly tempo in the fourth quarter and are on concentrate on to slide more in the initial quarter as the refundable child tax credit goes away and inflation eats up any wage gains workers control to get.

Workers managed to preserve some of the windfall that Congress furnished previously, but they’ll soon run by way of that. Then hunger and the need to have to place a roof about their heads will bring hundreds of thousands again into the labor power, resigned to get any work, no subject how unsafe, inhumane or improperly paid out. It will give new meaning to the phrase “The Excellent Resignation.”

And what of the wealth of the investing class? As of early January, it was up about 30% (or a interesting $30 trillion) given that the depths of the March 2020 selloff. The S&P 500 is down about 10% from its highs. Step by step, monetary markets are repricing the value of the Fed put—the now-out of date assumption that the central bank would maintain filling up the punch bowl anytime it looked like the occasion may stop.

If the Fed isn’t likely to assist asset charges any more, then most property search a small (or a whole lot) overvalued. They’ll find a new equilibrium shortly plenty of. But odds are that wealth of the investing course won’t go up one more $30 trillion above the next two several years.

The place does that depart the financial state? Powell says that the overall economy is sturdy and that all people can tolerate the Fed’s anti-inflation drugs. But I consider that is bluster. Underneath the surface, the foundation appears to be weak.

The concern for Powell is this: Who’ll crack 1st?

Be a part of the debate

Nouriel Roubini: Inflation will harm equally stocks and bonds, so you have to have to rethink how you will hedge risks

Rex Nutting: Why curiosity fees aren’t truly the appropriate instrument to management inflation

Stephen Roach: Luckily, the Fed has decided to halt digging, but it has a great deal of get the job done to do right before it gets us out of gap we’re in

Lance Roberts: Below are the many factors why the Federal Reserve won’t raise desire prices as a great deal as predicted