The arrival of Spin de Oxxo, the fintech of Fomento Economico Mexicano (Femsa), has complicated the scenario for fintechs that require intermediaries to carry out cash operations.

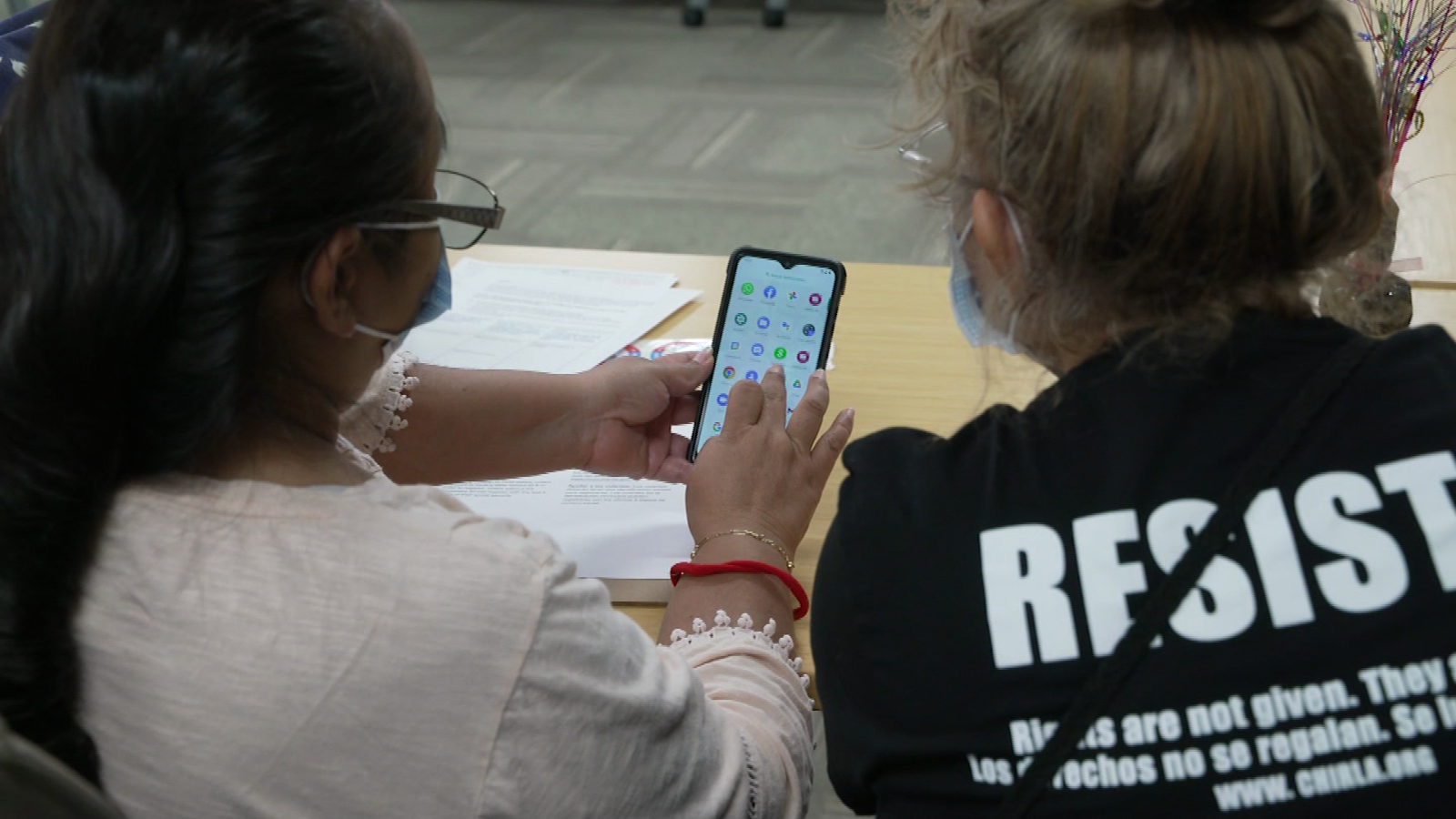

Barbara Gonzalez, CEO of Name in Mexico, he commented that when Spin exited as a fintech, it closed the cash channels for the fintech companies that required the chain’s services. The situation complicates the path for financial technology companies in their goals towards financial inclusion, as he commented during a panel at the “Web3paraEllas” event.

“We have the case of Oxxo, many of the startups in Mexico they were receiving cash deposits through their entire network and from Conekta (…) last year, Oxxo withdrew all that, to launch their own business and cut off access to all startups”, he commented.

The directive of the fintech specialized in the exchange of cryptocurrencies, added that the measure of the chain directly impacts the financial inclusion that startups can generate, due to the fact that many of their users go to the chain’s branches to fund your accounts

“Many people could go to Oxxo to carry out operations without the need for a bank account, such as funding many of the startups, Bitso was a beneficiary, but there was more,” González added.

In his report, FEMSA need that Spin de Oxxo reached 4.3 million users, with more than 69% actively interacting.

Oxxo currently has 20,382 stores (branches) throughout the country, from which you can purchase the services of its fintech, in addition to digital form. Its bet is to maintain a physical and virtual presence, to complement its offer of financial services.

They will seek alliance

In an interview, Gonzalez indicated that despite the situation that has arisen, they do not rule out the possibility of collaborating through the fintech Spin, to open cash transaction channels, however, he indicated that if this is not the case, they will seek the opportunity to work with some other company.

“We are going to find a solution, I hope we can continue collaborating with them to see how to work on their new project and continue to be allies in promoting financial inclusion and access to all Mexicans,” he explained.

On the other hand, the directive highlighted that the fintech sector requires institutional power, support from the authorities to promote financial inclusion and innovation from a favorable regulation for users.

“That they see us as allies for the population, because a reality is that all the projects are doing things differently, our mission and the reason for existing is that we want to generate a change,” he said.

In the discussion, the panel also commented on the role of cryptocurrencies and fintech in the country’s financial inclusion, agreeing that it was necessary to reduce gender gaps in the financial system, for what González pointed out that it was necessary to create “useful crypto”, in the lives of users.

rrg

hartford car insurance shop car insurance best car insurance quotes best online car insurance get auto insurance quotes auto insurance quotes most affordable car insurance car insurance providers car insurance best deals best insurance quotes get car insurance online best comprehensive car insurance best cheap auto insurance auto policy switching car insurance car insurance quotes auto insurance best affordable car insurance online auto insurance quotes az auto insurance commercial auto insurance instant car insurance buy car insurance online best auto insurance companies best car insurance policy best auto insurance vehicle insurance quotes aaa insurance quote auto and home insurance quotes car insurance search best and cheapest car insurance best price car insurance best vehicle insurance aaa car insurance quote find cheap car insurance new car insurance quote auto insurance companies get car insurance quotes best cheap car insurance car insurance policy online new car insurance policy get car insurance car insurance company best cheap insurance car insurance online quote car insurance finder comprehensive insurance quote car insurance quotes near me get insurance