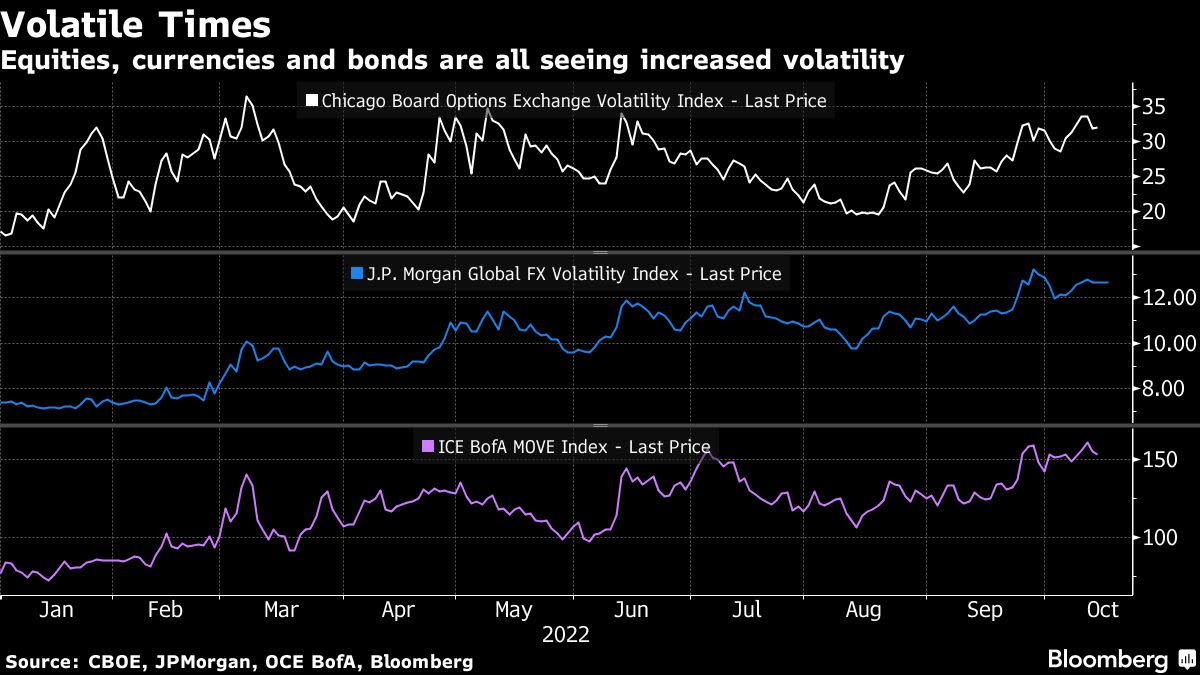

(Bloomberg) — Investors are girding for a further volatile 7 days in marketplaces, with Asian stocks poised to open decreased, big currencies susceptible to greenback strength and bond yields elevated amid persistent inflationary strain.

Equity index futures for Japan, Hong Kong and Australia all fell more than 1%. In international trade markets, traders are on guard for feasible intervention to help the yen, which is in close proximity to a 32-year lower and within get to of the important 150 level as opposed to the greenback. The pound rallied in early Asia investing on anticipations that the Uk may perhaps reverse more of its unfunded tax cuts.

The S&P 500 fell extra than 2% Friday though the development-sensitive Nasdaq 100 dropped far more than 3% and Treasury yields climbed as US 12 months-forward inflation anticipations rose. The outlook for purchaser costs fueled bets that the Federal Reserve may well make jumbo fee hikes at its future two conferences, more tough global expansion.

A modest uptick in US stock futures and marginal gains in major currencies versus the dollar early Monday offered a contact of relief.

Nonetheless versus this wider unfavorable backdrop, buyers also have to contend with information from China’s Communist Get together congress in Beijing, where by President Xi Jinping claimed China’s world-wide power experienced amplified although warning of “dangerous storms” ahead. There were couple of signs of any allow up in the Covid-Zero campaign or housing market place procedures that are weighing on the financial state. Xi also reported China would prevail in its fight to create strategically significant technological innovation amid growing tension with the US.

United kingdom markets may possibly be in for a significantly torrid 7 days, with Britain’s beleaguered prime minister Liz Truss battling to rescue her premiership right after the Lender of England ended its crisis bond-acquiring program on Friday.

Fed officers in their newest opinions advised they were completely ready to hike charges greater than formerly planned. Kansas Metropolis Fed President Esther George claimed the terminal level may perhaps need to have to be bigger to amazing prices. San Francisco Fed’s Mary Daly mentioned she’s “very supportive” of elevating to restrictive ranges and to involving 4.5% and 5% “is the most possible end result.”

Corporate The us made available some bright places Friday, with big banks which includes JPMorgan Chase & Co. and Wells Fargo & Co. increasing following reporting results, though Morgan Stanley fell as equity investing profits unhappy.

Vital situations this week:

-

Earnings this 7 days will supply clues on the power of a swathe of businesses, which includes Lender of America Corp., China Telecom Corp., Up to date Amperex Know-how Co., Hindustan Unilever Ltd, Hong Kong Exchanges & Clearing Ltd., Goldman Sachs Team Inc., Johnson & Johnson, Netflix Inc., Tesla Inc. and United Airways Holdings Inc.

-

China medium-term lending, Monday

-

US empire manufacturing, Monday

-

ECB Vice President Luis de Guindos speaks, Monday

-

China retail gross sales, industrial creation, GDP, surveyed jobless, Tuesday

-

US industrial generation, NAHB housing marketplace index, Tuesday

-

Fed’s Neel Kashkari speaks, Tuesday

-

Euro place CPI, Wednesday

-

United kingdom CPI, PPI, retail price tag index, Wednesday

-

US MBA home finance loan applications, developing permits, housing commences Fed Beige Guide, Wednesday

-

Fed’s Neel Kashkari, Charles Evans, James Bullard discuss Wednesday

-

US present dwelling sales, initial jobless claims, Convention Board top index, Thursday

Some of the primary moves in markets:

Stocks

-

S&P 500 futures rose .2% as of 7:23 a.m. Tokyo time. The S&P 500 fell 2.4% on Friday

-

Futures on the Nasdaq 100 rose .2%. The Nasdaq 100 fell 3.1%

-

Cling Seng futures fell 1.2%

-

S&P/ASX 200 futures fell 1.5%

-

Nikkei 225 futures fell 1.9%

Currencies

-

The euro was tiny adjusted at $.9730

-

The Japanese yen was minimal altered at 148.66 for each dollar

-

The offshore yuan was little altered at 7.2189 for each dollar

-

The British pound rose .5% to $1.1225

Cryptocurrencies

-

Bitcoin fell .2% to $19,285.26

-

Ether fell .5% to $1,304.31

Bonds

Commodities

Additional tales like this are accessible on bloomberg.com

©2022 Bloomberg L.P.