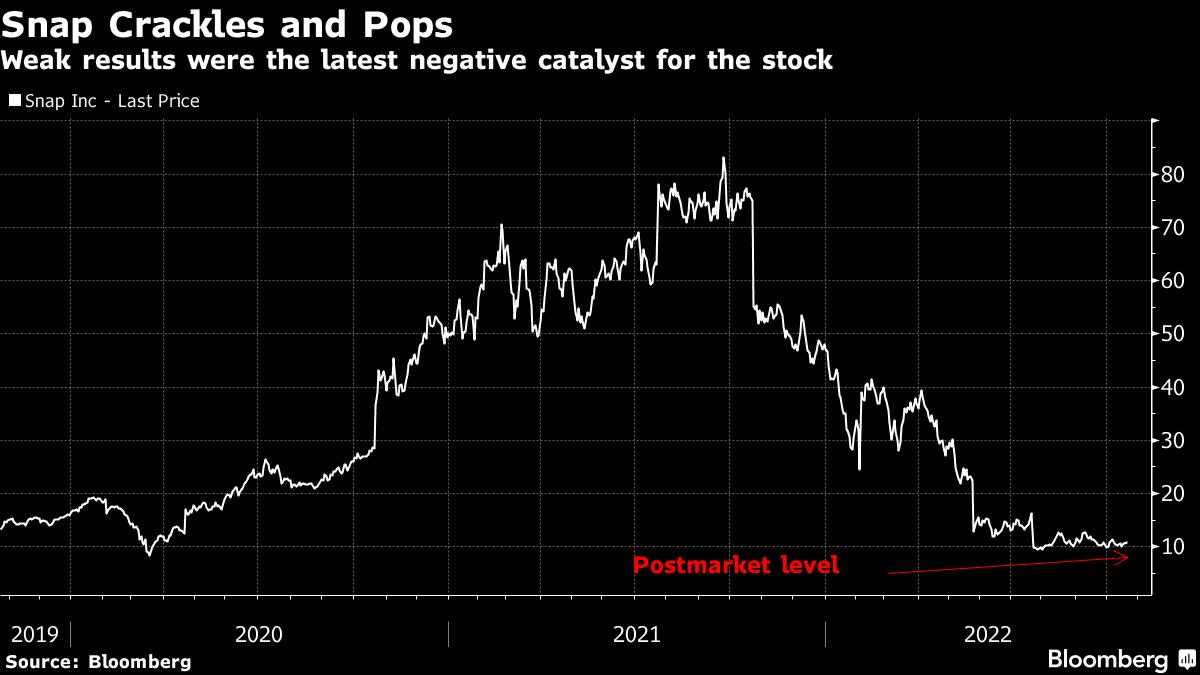

(Bloomberg) — For the 3rd time in as a lot of quarters, disappointing effects from Snap Inc. are roiling social media shares and including to signals that the economic slowdown is deepening.

Most Go through from Bloomberg

The maker of the Snapchat app described its slowest quarterly sales development ever on Thursday, indicating a decline in promotion expending continues to drag on effects.

Shares of Snap plunged 27% in late investing, with the selloff spreading to friends which includes Meta Platforms Inc., Alphabet Inc. and Pinterest Inc. The businesses had been set to drop a combined industry value of about $29 billion. Futures on the Nasdaq 100 Index fell .9%, signaling more suffering for a tech-large benchmark that has plunged 32% this yr.

Snap used the quarter shrinking and refocusing its company, asserting in August that it was slicing 20% of its workforce and slashing assignments that really do not add to user or profits expansion, or to the company’s augmented truth endeavours. The improvements were being in response to plunging sales, which Snap attributed to a slowdown in marketer spending.

Snap and platforms like Meta’s Fb and Alphabet’s Google are competing for a shrinking pool of advertising dollars this yr. Spiraling inflation is placing strain on providers and consumer spending. In the meantime, new policies from Apple Inc. that have to have all applications to get smartphone users’ authorization to be tracked on line have produced it far more difficult for advertisers to measure and regulate their ad strategies.

Earnings advancement “continues to be impacted by a amount of things we have noted in the course of the previous yr, together with platform coverage modifications, macroeconomic headwinds, and greater competition,” Snap explained in its geared up remarks for traders. “We are acquiring that our advertising companions throughout quite a few industries are reducing their advertising budgets, primarily in the confront of operating ecosystem headwinds, inflation-driven cost pressures, and growing charges of capital.”

Snap’s quarterly results had been the initial from huge net organizations that rely on promotion, environment the phase for what traders can count on when bigger gamers like Alphabet and Meta Platforms report following week.

–With aid from Alex Barinka, Subrat Patnaik and Phil Serafino.

(Adds a lot more element on Snap outcomes from fourth paragraph.)

Most Go through from Bloomberg Businessweek

©2022 Bloomberg L.P.