Rising Treasury yields appeared Tuesday to last but not least capture up with a beforehand resilient stock market, leaving the Dow Jones Industrial Common and other key indexes with their worst working day so considerably of 2023.

“Yields are popping across the curve…This time it would seem, current market rates are actively playing capture up with fed money,” said veteran technological analyst Mark Arbeter, president of Arbeter Investments, in a note. Usually, market place costs tend to direct the way, he noticed.

Due to the fact the starting of the month, traders in fed-resources futures have priced in a much more intense Federal Reserve right after originally doubting the central lender would hit its forecast for a peak fed-funds rate higher than 5%. A handful of traders are now even pricing in the exterior risk of a peak amount in close proximity to 6%.

The generate on the 2-year Treasury take note

TMUBMUSD02Y,

jumped 10.8 foundation points to 4.729%, its optimum complete to a U.S. session due to the fact July 24, 2007. The 10-yr Treasury generate

TMUBMUSD10Y,

climbed 12.6 basis details to 3.953%, its greatest considering the fact that Nov. 9.

“At this level, the bond marketplace has all but deserted optimistic anticipations for restricted more hikes and a sequence of charge cuts in the back again 50 percent of 2023,” reported Daniel Berkowitz, expenditure director for Prudent Administration Associates, in emailed feedback.

Meanwhile, the U.S. dollar has also rallied, with the ICE U.S. Greenback Index including .2% to a February bounce. Arbeter also mentioned that breadth indicators, a evaluate of how numerous shares are collaborating in a rally, experienced previously deteriorated, with some measures reaching oversold amounts.

“Just yet another best storm in opposition to the fairness marketplaces in the limited time period,” Arbeter wrote.

Increasing yields can be a detrimental for shares, increasing borrowing charges. Much more important, increased Treasury yields necessarily mean that the present price of foreseeable future income and cash stream are discounted a lot more heavily. That can weigh intensely on tech and other so-referred to as advancement shares whose valuations are based on earnings considerably into the future. People shares were being pummeled closely past yr but have led gains in an early 2023 rally, remaining resilient by means of last 7 days even as yields extended a bounce.

Yields have been on the rise soon after a run of hotter-than-predicted economic info, which have boosted anticipations for Fed amount hikes. Weak steering Tuesday from Residence Depot Inc.

High definition,

and Walmart Inc.

WMT,

also contributed to the tone.

Residence Depot sank additional than 7%, creating it the most significant loser on the Dow Jones Industrial Typical

DJIA,

The drop arrived right after the dwelling-improvement retailer reported a surprise decline in fiscal fourth-quarter same-store sales, guided for a shock drop in fiscal 2023 earnings and earmarked an extra $1 billion to shell out its associates far more.

“While Wall Avenue expects resilient customers pursuing very last week’s sturdy retail income report, House Depot and Walmart are a great deal more cautious,” mentioned Jose Torres, senior economist at Interactive Brokers, in a observe.

“This morning’s facts offers much more mixed indicators relating to purchaser desire, but all through a customarily weak seasonal buying and selling time period, investors are shifting towards a glass fifty percent-vacant look at against the backdrop of a yr that is showcased the exact reverse so significantly, a glass 50 %-complete viewpoint,” he wrote.

The Dow slumped 697.10 details, or 2.1%, to close at 33,129.59, though the S&P 500

SPX,

dropped 2% to close at 3,997.34, finishing below the 4,000 degree for the 1st time given that Jan. 20. The fall slice the S&P 500’s year-to-date obtain to 4.1%, in accordance to FactSet, which is fewer than half of the 9% year-to-date obtain it experienced appreciated at its Feb. 2 peak.

The Nasdaq Composite

COMP,

fell 2.5%, trimming its year-to-day acquire to 9.8%. The losses left the Dow marginally unfavorable for the yr, down .5%. It was the worst working day for all three big indexes considering the fact that Dec. 15, according to Dow Jones Sector Facts.

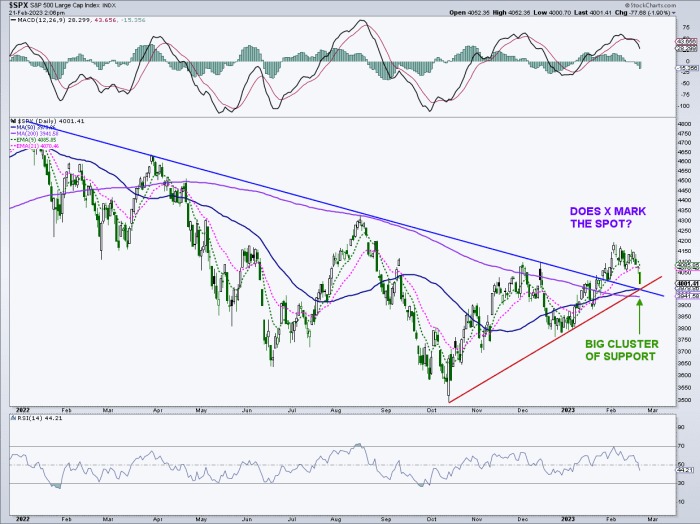

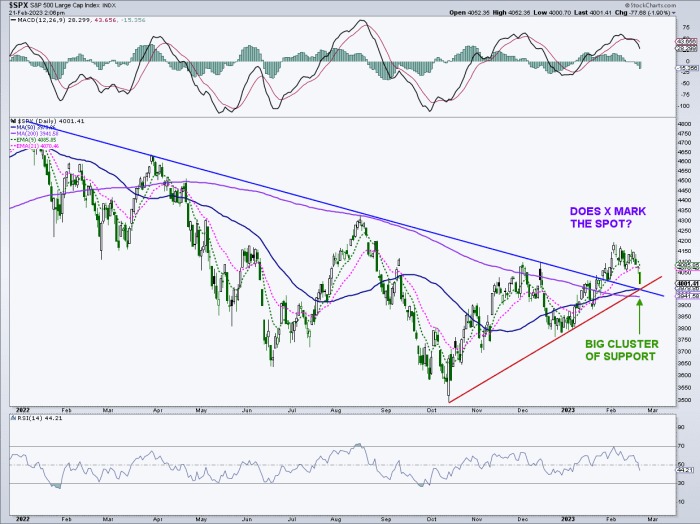

Arbeter recognized a “very interesting cluster” of aid just under the Tuesday low for the S&P 500, with the convergence of a pair of development strains alongside with the index’s 50- and 200-day relocating averages all close to 3,970 (see chart down below).

Arbeter Investments LLC

“If that zone does not represent the pullback lows, we have extra trouble in advance,” he wrote.

Rising Treasury yields appeared Tuesday to last but not least capture up with a beforehand resilient stock market, leaving the Dow Jones Industrial Common and other key indexes with their worst working day so considerably of 2023.

“Yields are popping across the curve…This time it would seem, current market rates are actively playing capture up with fed money,” said veteran technological analyst Mark Arbeter, president of Arbeter Investments, in a note. Usually, market place costs tend to direct the way, he noticed.

Due to the fact the starting of the month, traders in fed-resources futures have priced in a much more intense Federal Reserve right after originally doubting the central lender would hit its forecast for a peak fed-funds rate higher than 5%. A handful of traders are now even pricing in the exterior risk of a peak amount in close proximity to 6%.

The generate on the 2-year Treasury take note

TMUBMUSD02Y,

jumped 10.8 foundation points to 4.729%, its optimum complete to a U.S. session due to the fact July 24, 2007. The 10-yr Treasury generate

TMUBMUSD10Y,

climbed 12.6 basis details to 3.953%, its greatest considering the fact that Nov. 9.

“At this level, the bond marketplace has all but deserted optimistic anticipations for restricted more hikes and a sequence of charge cuts in the back again 50 percent of 2023,” reported Daniel Berkowitz, expenditure director for Prudent Administration Associates, in emailed feedback.

Meanwhile, the U.S. dollar has also rallied, with the ICE U.S. Greenback Index including .2% to a February bounce. Arbeter also mentioned that breadth indicators, a evaluate of how numerous shares are collaborating in a rally, experienced previously deteriorated, with some measures reaching oversold amounts.

“Just yet another best storm in opposition to the fairness marketplaces in the limited time period,” Arbeter wrote.

Increasing yields can be a detrimental for shares, increasing borrowing charges. Much more important, increased Treasury yields necessarily mean that the present price of foreseeable future income and cash stream are discounted a lot more heavily. That can weigh intensely on tech and other so-referred to as advancement shares whose valuations are based on earnings considerably into the future. People shares were being pummeled closely past yr but have led gains in an early 2023 rally, remaining resilient by means of last 7 days even as yields extended a bounce.

Yields have been on the rise soon after a run of hotter-than-predicted economic info, which have boosted anticipations for Fed amount hikes. Weak steering Tuesday from Residence Depot Inc.

High definition,

and Walmart Inc.

WMT,

also contributed to the tone.

Residence Depot sank additional than 7%, creating it the most significant loser on the Dow Jones Industrial Typical

DJIA,

The drop arrived right after the dwelling-improvement retailer reported a surprise decline in fiscal fourth-quarter same-store sales, guided for a shock drop in fiscal 2023 earnings and earmarked an extra $1 billion to shell out its associates far more.

“While Wall Avenue expects resilient customers pursuing very last week’s sturdy retail income report, House Depot and Walmart are a great deal more cautious,” mentioned Jose Torres, senior economist at Interactive Brokers, in a observe.

“This morning’s facts offers much more mixed indicators relating to purchaser desire, but all through a customarily weak seasonal buying and selling time period, investors are shifting towards a glass fifty percent-vacant look at against the backdrop of a yr that is showcased the exact reverse so significantly, a glass 50 %-complete viewpoint,” he wrote.

The Dow slumped 697.10 details, or 2.1%, to close at 33,129.59, though the S&P 500

SPX,

dropped 2% to close at 3,997.34, finishing below the 4,000 degree for the 1st time given that Jan. 20. The fall slice the S&P 500’s year-to-date obtain to 4.1%, in accordance to FactSet, which is fewer than half of the 9% year-to-date obtain it experienced appreciated at its Feb. 2 peak.

The Nasdaq Composite

COMP,

fell 2.5%, trimming its year-to-day acquire to 9.8%. The losses left the Dow marginally unfavorable for the yr, down .5%. It was the worst working day for all three big indexes considering the fact that Dec. 15, according to Dow Jones Sector Facts.

Arbeter recognized a “very interesting cluster” of aid just under the Tuesday low for the S&P 500, with the convergence of a pair of development strains alongside with the index’s 50- and 200-day relocating averages all close to 3,970 (see chart down below).

Arbeter Investments LLC

“If that zone does not represent the pullback lows, we have extra trouble in advance,” he wrote.