(Bloomberg) — Traders be expecting this earnings period to pummel shares further and will enjoy Apple Inc. in unique as a bellwether of global financial circumstances.

Most Browse from Bloomberg

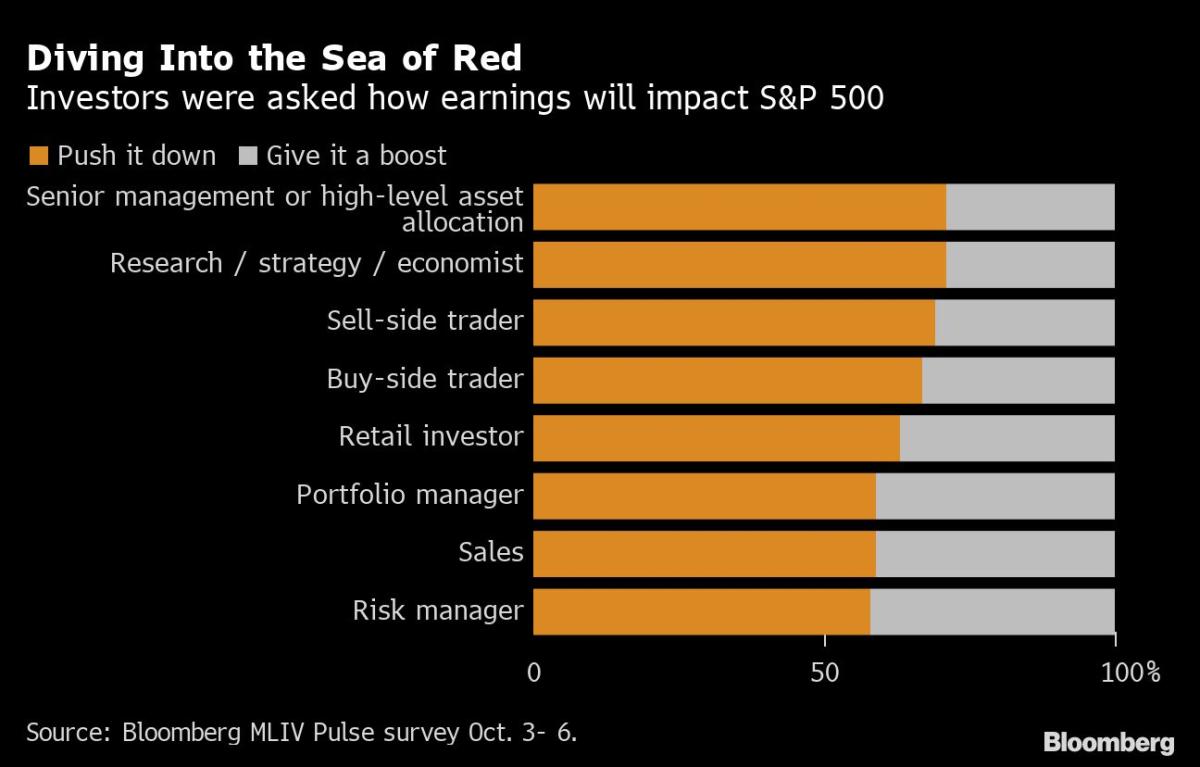

Additional than 60% of the 724 respondents to the most up-to-date MLIV Pulse study say this earnings period will thrust the S&P 500 Index lower. That signifies no conclusion in sight to the dismal run for stocks, right after a tumble Friday decisively dashed hopes that the eye-popping two-working day rally early past week would be the start off of a little something larger. About 50 percent of poll contributors also assume fairness valuations to pull back even even further from their common of the previous 10 years.

The benefits underscore Wall Street’s panic that even following this year’s brutal selloff, shares have however to cost in all the threats stemming from central banks’ aggressive tightening as inflation remains stubbornly high. The outlook isn’t probably to increase any time soon with the Federal Reserve steadfast on mountaineering rates, probably weighing on advancement and income in the method. Details on Friday showed that the US labor marketplace continues to be robust, growing the probabilities of another jumbo Fed level hike following thirty day period.

“Third-quarter earnings will disappoint with apparent downside threats to fourth-quarter analyst estimates,” said Peter Garnry, head of fairness strategy at Saxo Financial institution A/S. “The essential hazards to 3rd-quarter earnings are the charge-of-dwelling crisis impacting demand from customers for buyer products” and bigger wages ingesting into companies’ gains.

The US earnings time begins in earnest this 7 days with outcomes from key banking institutions, which includes JPMorgan Chase & Co. and Citigroup Inc., established to give buyers a likelihood to listen to from some of Corporate America’s most influential leaders.

Enjoy Apple

As for stocks to watch in the up coming couple of months, 60% of study takers see Apple as vital. The Iphone maker, which has the heaviest weighting on the S&P 500, will give perception into an array of crucial themes, this sort of as purchaser demand, offer chains, the result of the soaring dollar and larger rates. The firm reports on Oct. 27. JPMorgan garnered the 2nd-greatest point out, at 25%, but Microsoft Corp. and Walmart Inc. also drew a noteworthy range of votes.

The reporting extend kicks off with the S&P 500 down 24% this year, on pace for its worst performance considering that the Fantastic Financial Disaster. From that grim backdrop, just about 40% of survey members are inclined to commit a lot more in benefit shares, when compared with 23% for expansion, the earnings outlook for which is susceptible when fascination rates rise. Nonetheless, 37% selected neither of individuals groups, potentially reflecting Citigroup quantitative strategists’ perspective that equity marketplaces have “turned decidedly defensive” and are only just starting to reflect the threats of a recession.

US shares have had an terrible year, but so have other economical belongings, from Treasuries to corporate bonds to crypto. The well balanced 60/40 portfolio mixing shares and bonds in an endeavor to shield against robust moves in the marketplaces either way has missing a lot more than 20% so considerably this 12 months.

Inflation Fears

Study respondents assume that references to inflation and economic downturn will dominate earnings calls this year. Only 11% of members stated they expect chief executive officers to utter the word “confidence,” underscoring the gloomy backdrop.

“I’m anticipating additional cautious and damaging assistance on the foundation of broad financial weak point and uncertainty and tighter monetary plan,” explained James Athey, expense director at abrdn.

About fifty percent of poll respondents see equities valuations deteriorating further in the up coming couple months. Of people, some 70% assume the S&P 500’s value-to-earnings ratio to slide to the 2020 lower of 14, when a quarter see it tumbling to the 2008 small of 10. The index at the moment trades at about 16 occasions ahead earnings, beneath the common for the last ten years.

Rough Outlook

Wall Avenue has a equally dim look at. Citigroup strategists count on a 5% contraction in global earnings for 2023, reliable with under-development worldwide economic growth and elevated inflation. The bank’s earnings-revisions index demonstrates downgrades outweighing updates for the US, Europe and the world, with the US observing the deepest downgrades. Strategists at Financial institution of The united states Corp. anticipate 20% draw back for European earnings for every share by mid-2023, while Goldman Sachs Group Inc. counterparts say Asia ex-Japan equities can see far more earnings downgrades amid weak macro and industrial details.

With all the pessimism, there is scope for positive surprises in advance. A conquer to decreased earnings expectations is likely in third-quarter reporting, according to Bloomberg Intelligence strategists. Meanwhile, at Barclays Plc, strategists led by Emmanuel Cau mentioned that the benefits aren’t likely to be a “disaster” due in section to continue to-higher nominal expansion, but they doubt the outlook will be constructive.

“Earnings estimates for 2023 have began to shift reduce but have even further to tumble. Estimate revisions are a essential element of producing a long lasting base in equity marketplaces,” explained Madison Faller, global strategist at JPMorgan Non-public Lender. “As estimates drop, investors will be anxious to get a lot more engaged in anticipation of a prospective pause in the Fed’s climbing cycle.”

Join us on Oct. 11 at 10 a.m. New York time for a discussion on the survey benefits with Amy Kong, main expense officer at Barrett Asset Administration, and Kim Forrest, founder and main financial investment officer of Bokeh Money Companions.

To subscribe to MLIV Pulse stories, click on in this article. For more marketplaces evaluation, see the MLIV blog.

Most Study from Bloomberg Businessweek

©2022 Bloomberg L.P.

:max_bytes(150000):strip_icc():focal(605x417:607x419)/Alabama-Woman-Forced-to-Attend-Jury-Duty-011725-tout-b-2583e44b563f4d4fbeec46beb0a5ee35.jpg)