(Bloomberg) — Tesla Inc. increased price ranges of its Product S and X automobiles in the US right after steep markdowns early this yr took a toll on profitability and the carmaker’s shares.

Most Study from Bloomberg

Tesla bumped up each variant of its superior-finish designs by $2,500, elevating the price tag of the sedan and activity utility vehicle by 2% to 3%, in accordance to the company’s internet site. The Design S and X now start out at $87,490 and $97,490, respectively.

The raises still depart the automobiles less expensive than they were being at the stop of the 1st quarter, when price cuts across Tesla’s lineup squeezed income margins. The changes come two times immediately after Tesla decreased price ranges of its significantly higher-quantity Design Y SUV and Design 3 sedan for the second time this month.

Tesla shares slid 9.7% on Thursday, their largest fall since Jan. 3, soon after Chief Executive Officer Elon Musk advised the business will continue to keep reducing rates to stoke demand from customers. The inventory traded up 1.8% prior to the begin of standard trading Friday.

“We’ve taken a check out that pushing for better volumes and a bigger fleet is the right preference right here as opposed to a lessen volume and greater margin,” Musk instructed analysts late Wednesday.

Examine A lot more: Tesla Sinks as Musk Eyes Much more Price tag Cuts Irrespective of Margin Squeeze

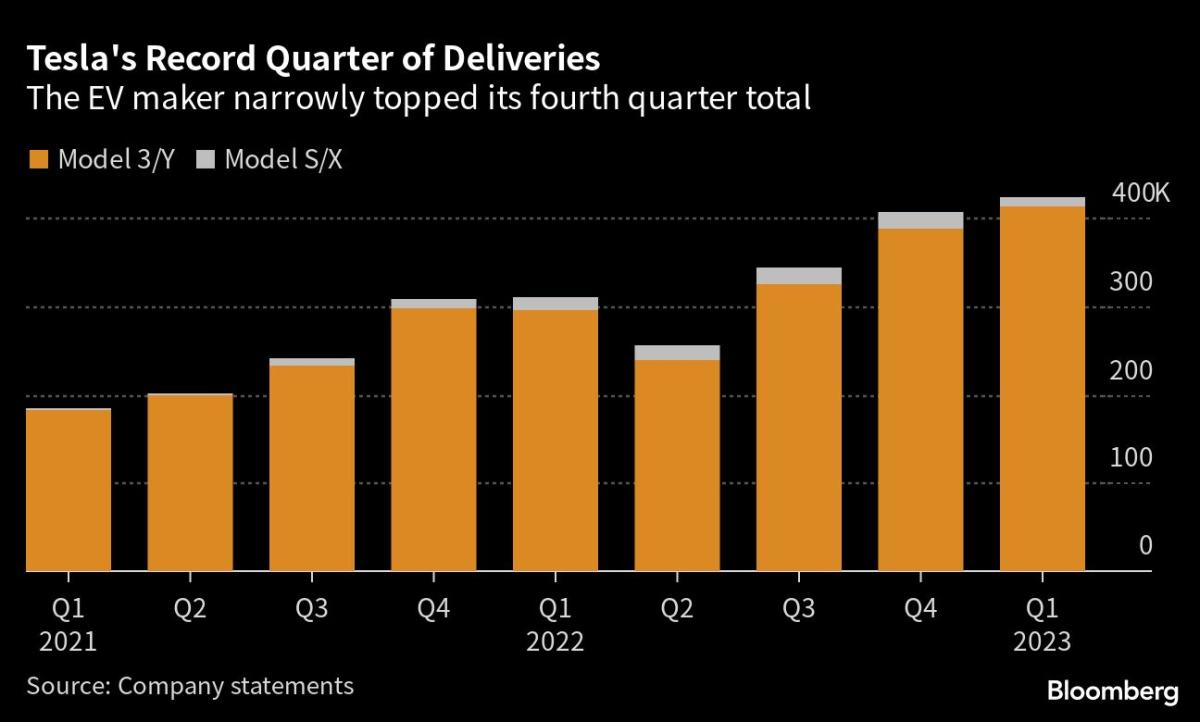

Tesla going close to costs of its greater-conclusion automobiles is substantially significantly less meaningful to its base line than altering what it prices for the Product 3 or Y. The corporation offered just 10,695 Model S and X vehicles in the very first quarter, about 2.5% of full deliveries. Whilst Musk has said the two automobiles are “of slight importance” to Tesla’s future, the company a short while ago started exporting them again from its California car or truck plant.

Tesla’s automotive gross margin excluding product sales of regulatory credits dipped to 19% for the quarter, below the 20% threshold that Main Fiscal Officer Zachary Kirkhorn reported 3 months back the corporation expected to stay earlier mentioned this yr. Its functioning margin shrank to 11.4%, a approximately two-year very low.

The company remains in advance of other automakers in return on product sales: In 2022, Typical Motors Co. described an operating margin of 6.6%, even though Ford Motor Co.’s was 4%.

Several hours before the selling price hikes have been posted, Ford CEO Jim Farley said Tesla could start off a selling price war and transform particular electric vehicles into commodities.

Tesla’s moves to bolster growth are “completely rational and ought to surprise no one,” Farley stated at a charity event in Detroit. “Price wars are breaking out in all places. Who’s likely to blink for growth?”

See: Ford’s Farley Says Tesla Pricing Could Commence an EV Price War

Tesla’s unique place among the EV makers has drawn comparisons to the early times of Ford. Its early 1900s innovation — the going assembly line — put other carmakers out of business by decreasing costs to ranges other businesses couldn’t match.

Musk reported Wednesday that Tesla isn’t searching to put opponents out of enterprise, but to make its vehicles additional obtainable amid soaring interest costs and stubborn inflation.

–With guidance from Dana Hull, Sean O’Kane and Danny Lee.

(Updates with early investing in the fourth paragraph.)

Most Browse from Bloomberg Businessweek

©2023 Bloomberg L.P.