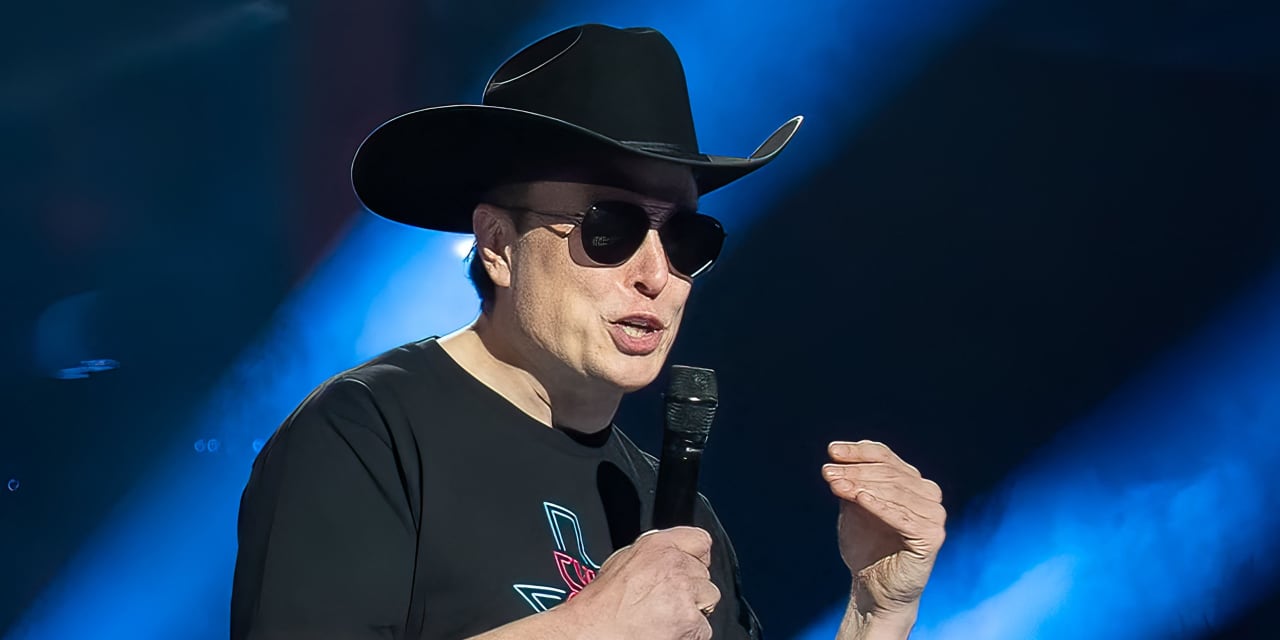

Tesla Inc. shares closed reduced than $150 for the initially time in much more than two decades Monday, immediately after analysts claimed they are concerned that Chief Executive Elon Musk is being distracted from functioning the $484 billion electric-vehicle maker as he also operates the social-media support Twitter.

Tesla

TSLA,

shares shut down .2% at $149.87. Factoring in the stock’s 3-for-1 break up in August, shares closed lessen than they have since Oct. 15, 2020, when they finished at a split-modified $149.63. The S&P 500 index

SPX,

slipped .9% Monday and the tech-hefty Nasdaq Composite Index

COMP,

declined 1.5%.

Tesla shares are down 57.5% 12 months to day, as opposed with a 19.9% drop on the S&P 500 and a 32.6% fall on the Nasdaq. Tesla shares suffered their worst week because 2020 last week, as a high-profile trader named on Musk to title a new Tesla CEO and Musk marketed $3.6 billion in Tesla stock, his second substantial sale of shares in a minimal much more than a month.

For extra: Tesla inventory suffers worst week given that 2020 as Elon Musk sells, substantial shareholder asks for new CEO

Tesla shares have struggled considering the fact that Musk agreed to purchase Twitter for $44 billion before this year, then sued to try out to get out of the deal. Considering that formally closing the deal in Oct, Musk has appeared to expend much of his time centered on the social-media assistance, and has reportedly pulled in personnel of Tesla as perfectly as SpaceX in an try to convert Twitter close to.

FactSet/MarketWatch

Oppenheimer analyst Colin Rusch downgraded Tesla to perform in a Monday observe, citing the maelstrom at Twitter and noting he experienced experimented with to overlook it formerly.

“While we go on to see Tesla evolving EV and autonomous technological innovation in progress of friends and driving costs to ranges these friends will wrestle to match—and have tried out to individual Elon Musk’s non-Tesla endeavors (personal and specialist) from our assessment on TSLA—we believe that Mr. Musk’s acquisition and subsequent management of Twitter now make that separation untenable,” Rusch mentioned.

“The mixture of Twitter’s unclear money needs and diminishing alternatives for Mr. Musk to serve people desires amid the broad community backlash pushed by inconsistent benchmarks application for Twitter users, notably banning decide on journalists, is pushing us to the sidelines,” Rusch continued.

“Time to close this nightmare as CEO of Twitter,” Wedbush analyst Dan Ives wrote in a independent Monday observe, citing a poll that Musk posted on Twitter late Sunday, asking buyers no matter whether he need to phase down as CEO.

Read through: Poll shows Twitter users favor removal of Elon Musk

“From the botched verification subscription strategy to banning journalists to political firestorms brought on on a every day foundation its been the fantastic storm as advertisers have operate for the hills and remaining Twitter squarely in the red ink most likely on observe to drop around $4 billion for each year we estimate,” wrote Ives, who has an outperform ranking on Tesla and a $250 price target.

In the meantime, Sen. Elizabeth Warren termed on Tesla’s Chair Robyn Denholm to address issues that the board has unsuccessful to meet its lawful obligations in not addressing its CEO’s conduct.

Browse: ‘Tesla is not Musk’s personal plaything’ — Sen. Elizabeth Warren asks Tesla chair to address CEO’s conflict with Twitter

Of the 43 analysts who deal with Tesla, 27 have buy-quality rankings,13 have keep scores, and 3 have promote ratings, alongside with an normal concentrate on selling price of $281.19.