(Bloomberg) — The speedy selloff in Tesla Inc. shares has still left most value targets from at any time-bullish Wall Street analysts seemingly out of date.

Most Study from Bloomberg

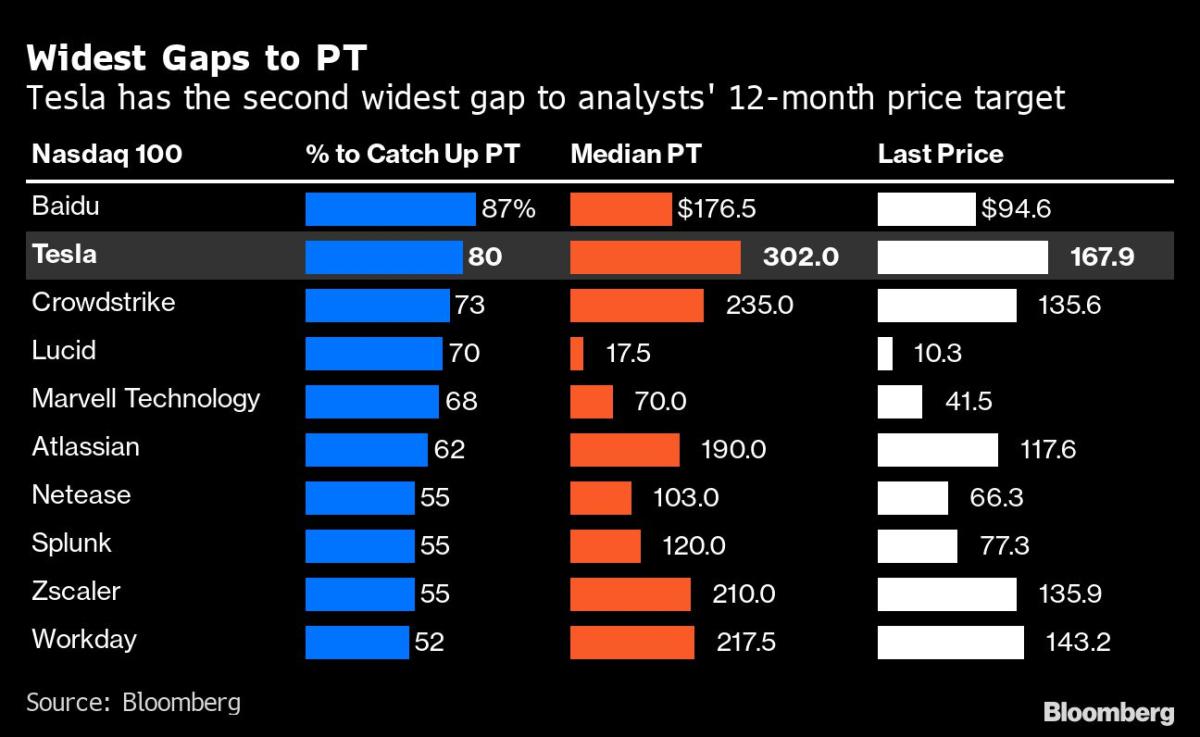

The yawning hole means Tesla shares need to have to rally a whopping 80% to hit the median analyst target price — the 2nd widest on the Nasdaq 100 Index, just at the rear of Baidu Inc. The Elon Musk-led firm’s stock has slumped 52% this yr to $167.87, while analysts have a median 12-thirty day period goal price tag of $302.

Tesla has been going through a host of challenges together with Musk’s shift-in-emphasis on turning close to Twitter Inc. to China’s return to Covid Zero curbs. Incorporating to that are source-chain snarls, rising uncooked-content expenses and prospective buyers experience the squeeze of stubborn inflation and soaring interest costs.

Nevertheless, a lot of analysts are sticking to their bullish calls, with 27 of them ranking the inventory a invest in, although 11 have a maintain and seven have sell. The most bullish simply call has a price focus on of $530, according to knowledge compiled by Bloomberg.

“It could be extremely tricky for the stock to recuperate in the coming a long time,” stated Valerie Gastaldy, a complex analyst at DaybyDay. “We recommend not on the lookout back and waving bye-bye to this previous darling.”

The slump this calendar year has taken Tesla’s current market capitalization to a touch higher than $530 billion, a far cry from a trillion bucks in April.

Most Read through from Bloomberg Businessweek

©2022 Bloomberg L.P.