(Trends Wide) — The case brought by New York prosecutors against former President Donald Trump for allegedly falsifying business records to cover up hush payments related to the 2016 election raises novel legal issues that make prosecution risky, but not impossible, experts say legal.

The way Manhattan District Attorney Alvin Bragg has laid out his allegations against Trump has raised skepticism among election law scholars and white-collar crime defense attorneys. But other experts stress that Bragg has a case that could plausibly end in a guilty verdict and that his legal theories are on solid, if never tested, ground.

“There are some risks and complications, but I also think there is a path to conviction,” said Cheryl Bader, a former federal prosecutor who now teaches Criminal Law and Procedure at Fordham University School of Law.

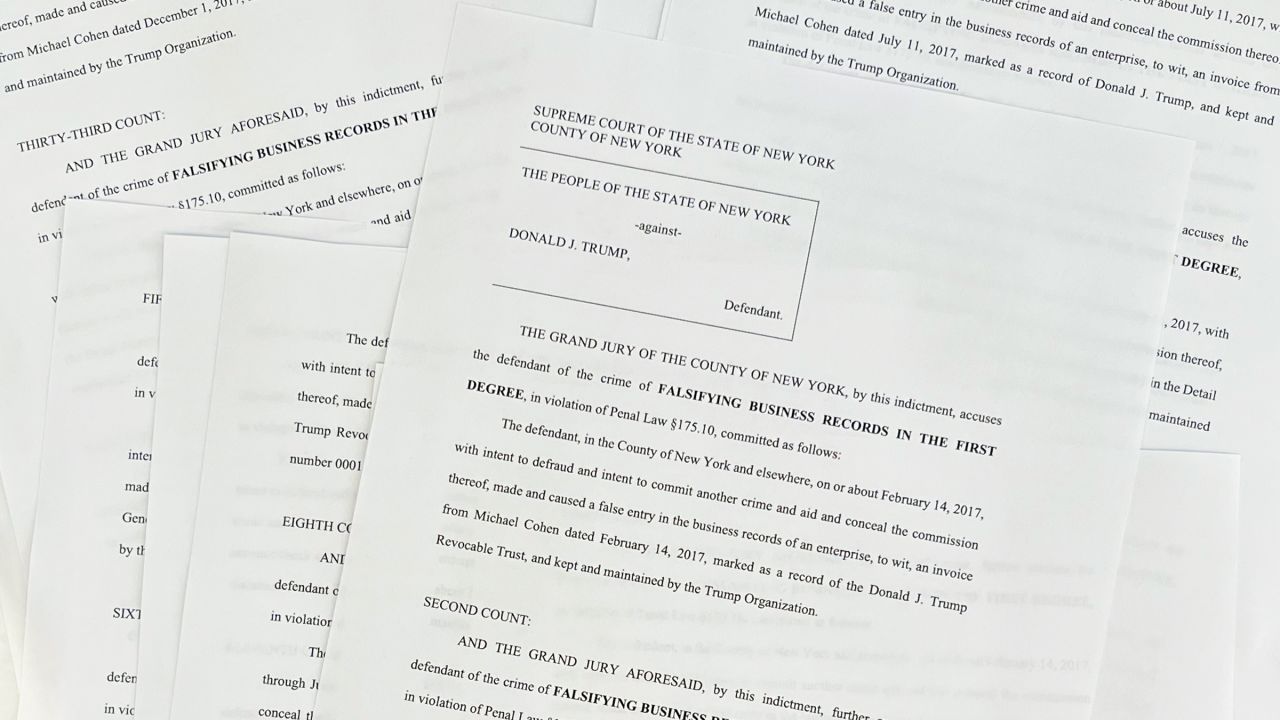

Trump was charged with 34 counts of falsifying business records, which at first glance seems like a pretty straightforward charge. But Bragg filed the charges, which by themselves are misdemeanors, as felonies. That will require his team to prove that the records were falsified with the intent to conceal or promote another crime, but the court documents Tuesday provided only some clarity on how Bragg intends to establish an underlying crime.

Prosecutors are not required to show their cards at this stage of the proceedings and there are minimum requirements for what an indictment must say. But given all that is at stake in this case, and that it appears to be based on a novel theory to bring felony charges, critics say more details would have been better for the public.

“I’m not saying there isn’t a clue to what the other crime is,” said Robert Kelner, a defense attorney specializing in political and election law. “But when you have this weird local statute, where to prove one crime you have to show that there was an intent to commit another, you would think about being very specific,” he added.

The indictment over hush payments in Manhattan is not the only front of legal danger for the former president and top Republican contender for the White House in 2024. In the coming weeks or months, Trump could face criminal charges in Georgia stemming from the special grand jury inquiry into his attempts to undermine the 2020 election. Two federal grand jury investigations led by special counsel Jack Smith, one focusing on allegations of subversion of the 2020 election and another involving the documents of the White House that took Mar-a-Lago, also pose a significant legal risk to Trump.

“I think the Bragg case is the squirt gun needlessly preceding the attack by the F-35 missile launcher piloted by Jack Smith with Merrick Garland as co-pilot,” said Ty Cobb, a defense attorney who represented the Trump White House in the investigation into Russia by special counsel Robert Mueller.

A simple case of records that is complicated by being charged as a felony

The first part of the prosecutors’ case is to prove that a series of Trump business records — including invoices, checks and ledger entries — were false, and the case here is straightforward, experts told Trends Wide.

Prosecutors will have physical evidence to show that the checks made out to Michael Cohen were wrongly recorded as payments for legal fees, when in fact they were supposedly a refund for money given to adult film star Stormy Daniels.

If Bragg were bringing the charge solely as a misdemeanor, he would only have to prove that the records were falsified with the intent to fraud, another fairly easy hurdle to clear.

But Bragg has filed all 34 counts as felonies, and convincing the courts, and ultimately a jury, that this is justified will be the “toughest part” of the case, according to Paul S. Ryan, an election law expert. and Deputy Executive Director of the Funders’ Committee for Civic Participation.

To make it a felony, prosecutors will have to target another possible crime that Trump was trying to promote or hide when he allegedly falsified the way Cohen’s payments were recorded.

The indictment does not specify exactly what this underlying crime is, but only a slight reference was made to it during the accompanying statement of facts and in comments by prosecutors on Tuesday: they describe an “illegal” plan to influence the presidential election of 2016 by preventing damaging information about Trump from getting out.

The DA’s theory, as well as the lack of transparency around how Bragg intends to present it, raises concerns about whether the case will hold up in court.

Rick Hasen, an expert on election law, told Trends Wide that it was “far from being an easy case.”

“It raises some political questions about whether this is the case to make,” said Hasen, a professor at the UCLA School of Law.

The complexity of the case can take years of litigation before it is fully resolved.

“I see it as likely that this case will ultimately reach the Supreme Court [de EE.UU.]”said John Coffee Jr, a professor of white-collar crime at Columbia Law School. “You don’t convict a former president for a novel legal theory without a Supreme Court review.”

Three paths to felony, each with their own obstacles

Manhattan prosecutors have hinted at three possible underlying crimes that would support felony charges, but each presents its own set of novel legal issues.

The first apparent argument is that business records were falsified to hide federal campaign finance crimes committed with 2016 hush payments to women who claimed they had extramarital affairs with Trump, crimes to which Cohen pleaded guilty in 2018.

Hasen said he was “skeptical” that a federal campaign finance indictment could be used to support charges in state court. Braggs’ defenders have pointed out that New York’s false records statute appears to cover the commission or concealment of any crime, and therefore, they argue, covers violations of federal law. In either case, the issue could be the subject of litigation in the pre-trial phase.

The second possible underlying offense is a state election law that Bragg referenced in his press briefing: a New York misdemeanor that prohibits two or more people from conspiring to advance a candidacy through unlawful means.

Election law experts are divided on whether that state crime argument could work as a felony ground. The debate centers on a legal concept known as preemption, which comes into play when federal law appears to supersede state law, and whether state prosecutors can prosecute conduct tied to a federal election, i.e., the 2016 presidential campaign. .

“Federal election law, generally speaking, takes precedence over state election law when it comes to governing federal elections, except that there are exceptions where certain state election laws may come into play,” said Jerry H. Goldfeder, a veteran election and campaign finance attorney at Stroock & Stroock & Lavan. “Apparently [los fiscales] have looked at this seriously enough to conclude that they were within their limits.”

Finally, the charging documents appear to imply that there was intent to violate New York tax law, suggesting that reasoning could be used to support the felony. Under that theory, the way Cohen’s refunds were structured in Trump’s business records would give them different tax treatment than they would have if they had been accurately documented.

“This is about state tax crimes,” Ryan Goodman, a New York University law professor, told Trends Wide’s Erin Burnett Tuesday night. “That’s a stronger case because it’s insulated from a lot of legal challenges, of which there are strong legal challenges that will be made to election law crimes.”

— Katelyn Polantz, Devan Cole and Fredreka Schouten contributed reporting.