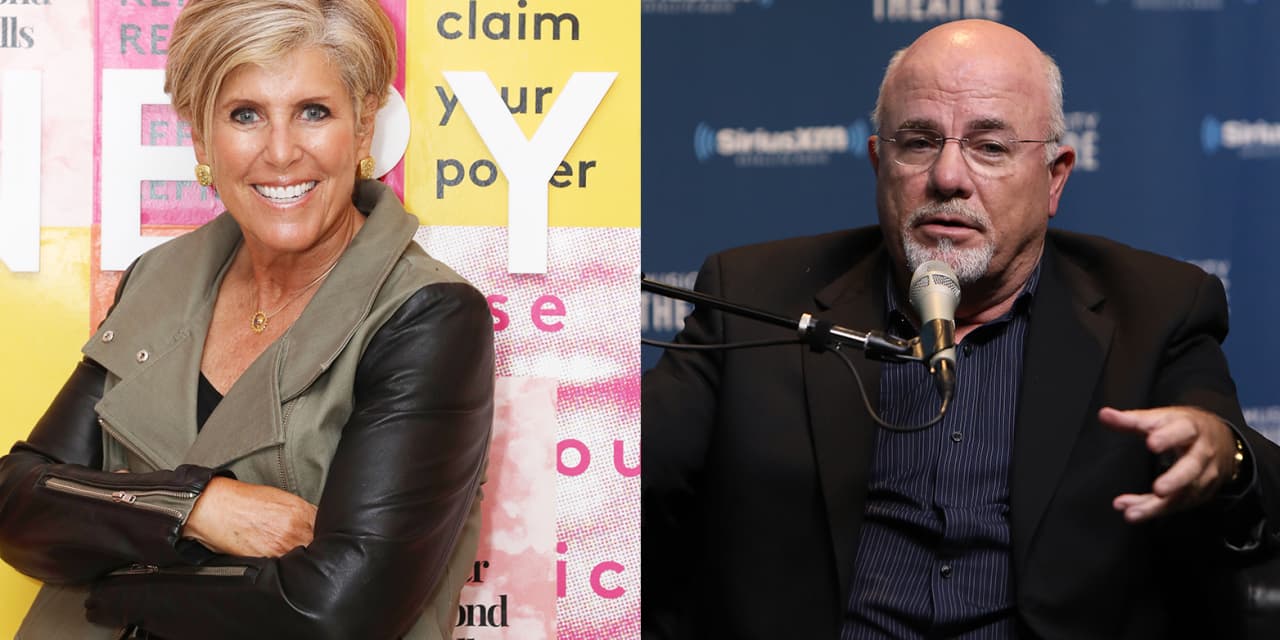

Professionals like Suze Orman and Dave Ramsey stress the value of an emergency fund — and it can assist avoid you from likely into credit card personal debt.

Getty Photos

Americans’ credit score-card personal debt rose to $887 billion in the second quarter of 2022, according to the Federal Reserve Lender of New York. And the No. 1 reason they cite for this debt? Unexpected emergency or surprising fees, with 46% of debtors citing an emergency or unexpected expenditure — including a medical bill, residence maintenance, motor vehicle repair service, or some other unexpected emergency/unpredicted price — as the purpose they carried a stability thirty day period to thirty day period, according to a new CreditCards.com report.

The remedy to this is a attempted-and-true rule espoused by virtually all the particular finance bigwigs: establish up an unexpected emergency fund. And there is great news on that entrance — savings accounts like these are now spending considerably far more than they did previous 12 months.

While professionals vary on precisely how considerably to help you save, the typical rule is 3 to 12 months of bills. For her aspect, Suze Orman is in the 12-months camp, indicating, “You know my hope is that you operate your way towards obtaining enough set aside to cover 12 months of crucial living expenditures. And you also know that I know that can consider time.” Dave Ramsey’s basic rule of thumb is that people today will need 3 to 6 months’ well worth of crisis savings. “The more steady your profits and home are, the much less you will need in your unexpected emergency fund,” states Ramsey. The objective is to soften the blow or deal with an unexpected expenditure fully. (See the finest personal savings accounts premiums you may get here.)

| Motives for credit card debt | % of people |

| Covering emergencies and sudden charges | 46% |

| Day-to-day expenditures like groceries, childcare and utilities | 24% |

| Retail buys like garments and electronics | 11% |

| Holiday vacation and enjoyment bills | 11% |

Melissa Lambarena, credit rating-playing cards specialist at NerdWallet, recommends getting ready for the sudden by performing up to an unexpected emergency fund of at least $500 to commence. “Even if it is by saving $5 for each 7 days. Following getting your monetary footing, pick out a shovel-like balance transfer credit score card or a credit card debt management system at a nonprofit credit rating counseling agency to dig your way out,” suggests Lambarena.

How to get out of credit history card personal debt

-

Signal up for a % curiosity balance transfer card

Rossman recommends signing up for a % balance transfer card. “These promotions very last as lengthy as 21 months. This is my favored debt payoff tactic for the reason that the typical credit history card charges 16.73% and a % equilibrium transfer card could help you save you hundreds or 1000’s of pounds in curiosity,” claims Ted Rossman, senior industry analyst at CreditCards.com. (You can come across some of the finest % transfer playing cards right here.) When applied successfully, a balance transfer credit history card can drastically decrease the amount you pay back over the lifetime of the harmony and shorten the time it can take to get out of debt. “You’ll have to have to have first rate credit score to get 1, but if you do, you are going to come across they are greatly readily available,” says Matt Schulz, chief credit rating analyst at LendingTree. That mentioned, it is vital to be disciplined about shelling out it off for the duration of the % period of time, and not applying the card to make any new purchases simply because the fascination rate will skyrocket as soon as the promo finishes.

-

Do the snowball strategy

A single way to deal with credit score card financial debt is to adhere to the snowball method, a little something Rossman suggests if you are overwhelmed by the entirety of your credit card debt. “Paying off the account with the most affordable balance, akin to getting momentum like a snowball rolling downhill, has psychological positive aspects,” suggests Rossman. (Of class, generally fork out the minimums on all debts.) By knocking out the smallest personal debt to start with, you experience like you are creating development and constructing motivation to continue on the endeavor. Though it might not make the most feeling mathematically, it can enable kickstart the system of shelling out off financial debt. - Credit rating card consolidation “You do it by using out a new mortgage, this sort of as a particular bank loan or a equilibrium transfer credit history card, and then you use that one personal loan to fork out off quite a few other loans,” says Schulz. Executing this can preserve you a sizeable sum in curiosity and can also simplify your finances since you will only have to regulate payments on one particular financial loan. (See some of the ideal private loans you may possibly get listed here.)

How to get your investing less than control

To nip your spending in the bud, Nick Ewen, director of information at the Details Male, recommends examining the overall income you anticipate to earn each individual thirty day period. “Then map out all of the important goods that ought to be paid just about every thirty day period — housing, groceries and utilities. Eventually, take a extremely essential eye to your discretionary paying out. Lower out anything at all that is really not needed like each day Starbucks and consuming lunch out with co-staff multiple situations for every 7 days,” claims Ewen.

The advice, recommendations or rankings expressed in this short article are those people of MarketWatch Picks, and have not been reviewed or endorsed by our industrial associates.

Professionals like Suze Orman and Dave Ramsey stress the value of an emergency fund — and it can assist avoid you from likely into credit card personal debt.

Getty Photos

Americans’ credit score-card personal debt rose to $887 billion in the second quarter of 2022, according to the Federal Reserve Lender of New York. And the No. 1 reason they cite for this debt? Unexpected emergency or surprising fees, with 46% of debtors citing an emergency or unexpected expenditure — including a medical bill, residence maintenance, motor vehicle repair service, or some other unexpected emergency/unpredicted price — as the purpose they carried a stability thirty day period to thirty day period, according to a new CreditCards.com report.

The remedy to this is a attempted-and-true rule espoused by virtually all the particular finance bigwigs: establish up an unexpected emergency fund. And there is great news on that entrance — savings accounts like these are now spending considerably far more than they did previous 12 months.

While professionals vary on precisely how considerably to help you save, the typical rule is 3 to 12 months of bills. For her aspect, Suze Orman is in the 12-months camp, indicating, “You know my hope is that you operate your way towards obtaining enough set aside to cover 12 months of crucial living expenditures. And you also know that I know that can consider time.” Dave Ramsey’s basic rule of thumb is that people today will need 3 to 6 months’ well worth of crisis savings. “The more steady your profits and home are, the much less you will need in your unexpected emergency fund,” states Ramsey. The objective is to soften the blow or deal with an unexpected expenditure fully. (See the finest personal savings accounts premiums you may get here.)

| Motives for credit card debt | % of people |

| Covering emergencies and sudden charges | 46% |

| Day-to-day expenditures like groceries, childcare and utilities | 24% |

| Retail buys like garments and electronics | 11% |

| Holiday vacation and enjoyment bills | 11% |

Melissa Lambarena, credit rating-playing cards specialist at NerdWallet, recommends getting ready for the sudden by performing up to an unexpected emergency fund of at least $500 to commence. “Even if it is by saving $5 for each 7 days. Following getting your monetary footing, pick out a shovel-like balance transfer credit score card or a credit card debt management system at a nonprofit credit rating counseling agency to dig your way out,” suggests Lambarena.

How to get out of credit history card personal debt

-

Signal up for a % curiosity balance transfer card

Rossman recommends signing up for a % balance transfer card. “These promotions very last as lengthy as 21 months. This is my favored debt payoff tactic for the reason that the typical credit history card charges 16.73% and a % equilibrium transfer card could help you save you hundreds or 1000’s of pounds in curiosity,” claims Ted Rossman, senior industry analyst at CreditCards.com. (You can come across some of the finest % transfer playing cards right here.) When applied successfully, a balance transfer credit history card can drastically decrease the amount you pay back over the lifetime of the harmony and shorten the time it can take to get out of debt. “You’ll have to have to have first rate credit score to get 1, but if you do, you are going to come across they are greatly readily available,” says Matt Schulz, chief credit rating analyst at LendingTree. That mentioned, it is vital to be disciplined about shelling out it off for the duration of the % period of time, and not applying the card to make any new purchases simply because the fascination rate will skyrocket as soon as the promo finishes.

-

Do the snowball strategy

A single way to deal with credit score card financial debt is to adhere to the snowball method, a little something Rossman suggests if you are overwhelmed by the entirety of your credit card debt. “Paying off the account with the most affordable balance, akin to getting momentum like a snowball rolling downhill, has psychological positive aspects,” suggests Rossman. (Of class, generally fork out the minimums on all debts.) By knocking out the smallest personal debt to start with, you experience like you are creating development and constructing motivation to continue on the endeavor. Though it might not make the most feeling mathematically, it can enable kickstart the system of shelling out off financial debt. - Credit rating card consolidation “You do it by using out a new mortgage, this sort of as a particular bank loan or a equilibrium transfer credit history card, and then you use that one personal loan to fork out off quite a few other loans,” says Schulz. Executing this can preserve you a sizeable sum in curiosity and can also simplify your finances since you will only have to regulate payments on one particular financial loan. (See some of the ideal private loans you may possibly get listed here.)

How to get your investing less than control

To nip your spending in the bud, Nick Ewen, director of information at the Details Male, recommends examining the overall income you anticipate to earn each individual thirty day period. “Then map out all of the important goods that ought to be paid just about every thirty day period — housing, groceries and utilities. Eventually, take a extremely essential eye to your discretionary paying out. Lower out anything at all that is really not needed like each day Starbucks and consuming lunch out with co-staff multiple situations for every 7 days,” claims Ewen.

The advice, recommendations or rankings expressed in this short article are those people of MarketWatch Picks, and have not been reviewed or endorsed by our industrial associates.