(Bloomberg) — International finance chiefs acquire in Washington in the coming days with the warning of a probable $4 trillion decline in the world’s financial output ringing in their ears.

Most Read through from Bloomberg

That’s the Germany-sized hole in the advancement outlook by means of 2026 that Intercontinental Monetary Fund main Kristalina Georgieva determined previous week as a looming hazard.

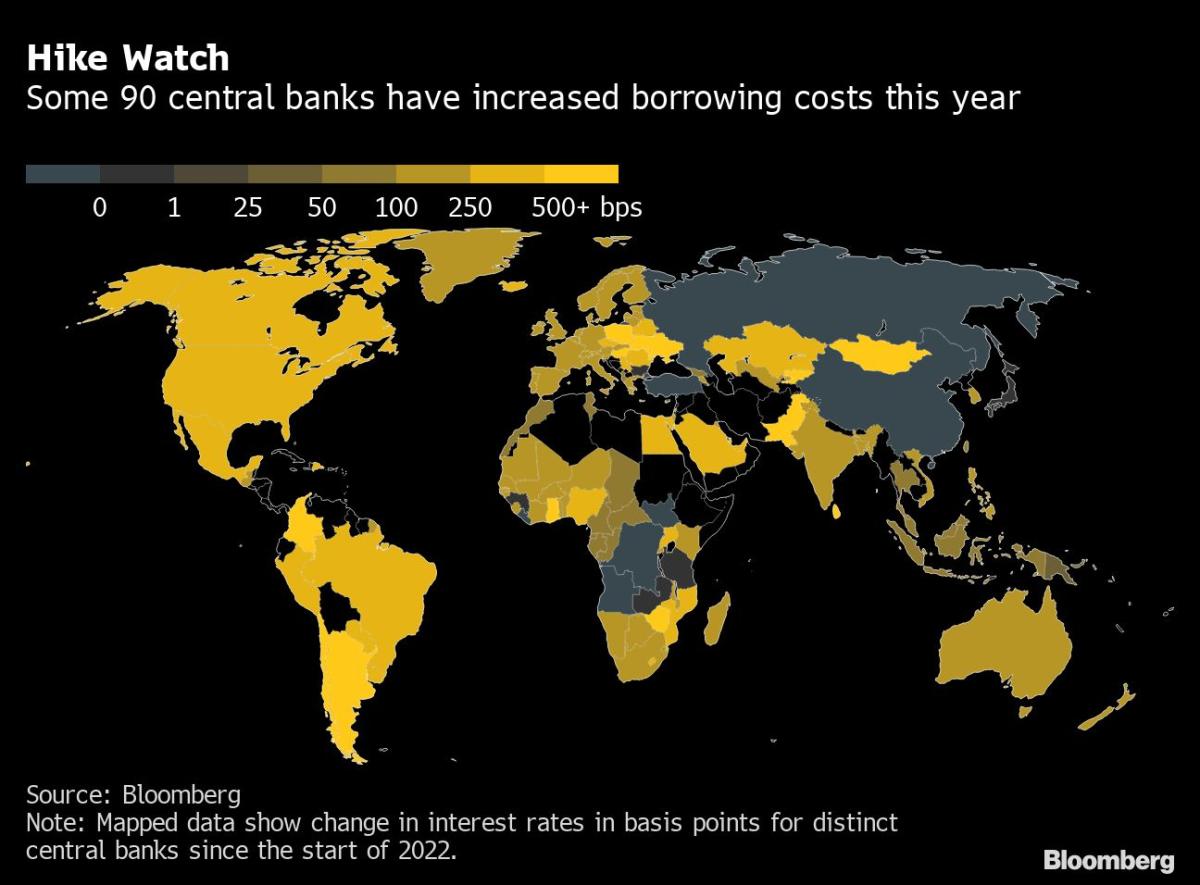

She’ll play host as central bankers, finance ministers and others confront the fallout on the worldwide financial state of rampant inflation, intense monetary-plan tightening, growing financial debt and the biggest ground war in Europe since Planet War II.

That the IMF and Planet Bank once-a-year meetings will be thoroughly in-human being for the very first time because the outbreak of Covid-19 in early 2020, displaying progress in bringing the pandemic to heel, will be of limited ease and comfort specified other headaches.

The recent confluence of economic, weather and security crises tends to make it as opposed to something world coverage makers have viewed given that 1945. Nevertheless specified components, this sort of as the emerging-marketplace havoc wreaked by Federal Reserve desire-level hikes in the early 1980s, chime with the existing predicament.

“The huge problem for the meetings is, ‘What are we likely to do in conditions of the institutional reaction to this, over and above small business as regular,’” Masood Ahmed, president of the Washington-centered Centre for World wide Growth, said very last 7 days.

Here’s a fast look at some issues officers will grapple with:

-

Earth Economic Outlook: the IMF releases this on Tuesday. Georgieva stated very last 7 days that the 2023 international expansion forecast of 2.9% will be lowered.

-

Ukraine: the nation Vladimir Putin’s forces invaded in February will keep in concentration, from the affect of a depleted grain harvest to Russia’s fuel squeeze on Europe. The IMF board on Friday authorized a $1.3 billion mortgage for Ukraine, its initial lending to the country considering the fact that early March.

-

Food stuff Selling prices: the IMF board very last month permitted a new emergency finance “food shock window” to support nations hurt by soaring agricultural charges.

-

The Uk: the state continues to be susceptible following marketplace turmoil compelled a partial U-turn on a tax-lower package deal from new Key Minister Liz Truss’s authorities that was panned by the IMF.

-

The Fed: US tightening is hurting other economies. IMF calculations show 60% of very low-cash flow nations and a quarter of rising marketplaces at or in close proximity to debt distress.

-

Local weather: the crisis is only acquiring worse, as proven not too long ago by disasters from flooding in Pakistan to a hurricane that slammed Puerto Rico and Florida.

In other places this 7 days, a a lot quicker core inflation looking at in the US, British isles economic stability information, a South Korean fee hike and the Nobel Prize for economics will be amid highlights.

What Bloomberg Economics States:

“When overseas finance ministers and central bankers get in Washington for the Environment Financial institution-IMF conferences in the coming 7 days, several may possibly claim the rest of the globe simply cannot afford any even further Fed hikes.”

–Anna Wong, Andrew Husby and Eliza Winger. For total evaluation, click in this article

Click on here for what transpired previous week and down below is our wrap of what’s coming up elsewhere in the international economic system.

US Financial system

In the US, the consumer price tag index is the spotlight in the coming 7 days. The Labor Department’s report on Thursday will give Fed officers a snapshot of how inflationary pressures are evolving following a sequence of large interest-rate increases.

Economists estimate the CPI rose 8.1% in September from a year back, marking a deceleration from the prior month’s 8.3% once-a-year maximize as vitality price ranges settled back again. Having said that, excluding fuel and food, the so-known as core CPI is nonetheless accelerating — it’s envisioned to present a 6.5% annual achieve, versus 6.3% in August.

An improve of that magnitude in the main measure would match the greatest progress given that 1982, illustrating stubborn inflation and retaining the pump primed for a fourth-straight 75 foundation-issue price enhance at the Fed’s November meeting.

Buyers will hear from a amount of US central bankers in the coming week, which include Vice Chair Lael Brainard and regional Fed presidents Loretta Mester, Charles Evans and James Bullard. Minutes of the Fed’s September conference will be launched on Wednesday.

Other data include figures on prices compensated to US producers. So-called wholesale inflation has shown signs of moderating as commodity price ranges weaken amid issues about a international economic slowdown.

The week will be capped by retail gross sales knowledge. Economists forecast a modest monthly advance in September, aided by a pickup in purchases of motor vehicles. Excluding vehicles, the price of retail income is seen declining for a 2nd thirty day period. Because the figures aren’t adjusted for inflation, the info suggest desire for items slowed in the third quarter.

Asia

Lender of Korea Governor Rhee Chang-yong may vacation resort to a mini U-turn on the scale of price hikes. Even though he returned to the usual quarter-level increment in August, many economists see him opting for a transfer 2 times that dimension on Wednesday as the Fed’s immediate tightening piles force on the won.

The Financial Authority of Singapore is found set to tighten for a fifth straight meeting, while the Condition Bank of Pakistan is predicted to continue to keep the benchmark charge continuous for a third.

Assistant Governor Luci Ellis might lose mild on the Reserve Financial institution of Australia’s most up-to-date pondering on plan next its pivot to smaller hikes.

Financial institution of Japan Governor Haruhiko Kuroda and Finance Minister Shunichi Suzuki will be in Washington for the IMF meetings, with the yen’s actions still underneath close scrutiny.

Europe, Middle East, Africa

The 7 days kicks off with announcement of the Nobel Prize for economics on Monday. The award was established by Sweden’s Riksbank in 1968, adding a sixth category to current prizes for physics, chemistry, drugs, peace and literature. 3 U.S.-based lecturers received in 2021 for do the job employing experiments that attract on true-existence predicaments to revolutionize empirical research.

The Financial institution of England’s Economic Plan Committee will get heart stage on Wednesday, a certain-fireplace signal the Uk is dealing with considerable problems.

The panel, accountable for crisis intervention to prevent a bond-market place spiral past month, will launch a history of its newest conference. That could offer you insights into no matter whether officials see a danger of renewed turmoil that currently plagued pension money following Britain’s mini-price range. It could also deal with the implications of a sharp improve in mortgage prices.

BOE Governor Andrew Bailey is among the a number of officers because of to speak in the coming 7 days, quite a few of whom will show up at or all over the IMF conferences.

In the same way, several other officials from all-around Europe will communicate in Washington or close by. European Central Financial institution President Christine Lagarde, and Thomas Jordan, her Swiss Countrywide Bank counterpart, are both equally scheduled to supply remarks.

In phrases of European data, the United kingdom will offer the most considerable news. Work opportunities and development reviews may paint a richer photograph of how the British overall economy is faring amid soaring costs and superior inflation.

Euro-zone industrial manufacturing on Wednesday is probable to have partially rebounded in August following a much even larger decline the past month.

Inflation knowledge will consider prominence through the rest of the location. In Hungary on Tuesday, the pace of price progress might attain shut to 20%, though on Thursday, Sweden’s crucial measure is expected to exceed 9%. Israel and Egypt will release inflation studies as very well.

More south, Ghana’s evaluate of rate progress is anticipated to be additional than triple the ceiling of the central bank’s 10% focus on for a 3rd straight thirty day period.

Latin The us

The 7 days will get below way with the Brazilian central bank’s closely viewed weekly Emphasis survey of industry anticipations. Analysts have minimize their 2022 inflation forecasts for 14 straight weeks to 5.74%, whilst the 2022 GDP forecast has been marked up throughout that time to 2.7%.

That progressively optimistic acquire on Brazil’s customer selling prices will probable be borne out by info posted Tuesday: analysts count on value gains moderated for a 3rd straight month in September, leaving the yr-on-yr speed just higher than 7% — completely 5 percentage details below April’s 12.13% peak.

With inflation in Chile in close proximity to a three-decade superior, the central bank is all but sure to lengthen a document tightening cycle, most likely pushing the crucial fee up 50 basis factors to an all-time superior of 11.25%. The bank subsequent fulfills in December.

On Thursday, Mexico’s Banxico posts the minutes of its Sept. 29 meeting, where coverage makers hiked the important charge to a history 9.25%. Quite a few analysts see a further 125 to 175 basis details of tightening just before officials ascertain that their occupation is finished.

Ending off the week, Argentina on Friday is anticipated to report September yr-on-calendar year inflation not significantly off the 83.45% posted by Turkey, the greatest in the Team of 20. Analysts surveyed by Argentina’s central financial institution see a yr-conclude fee of 100.3%.

Most Study from Bloomberg Businessweek

©2022 Bloomberg L.P.