(Bloomberg) — Inflation displays couple signs of cooling in the financial system. The exact are unable to be explained of marketplaces, which are commencing to appear like the only issue the Federal Reserve has heading for it these days.

Most Browse from Bloomberg

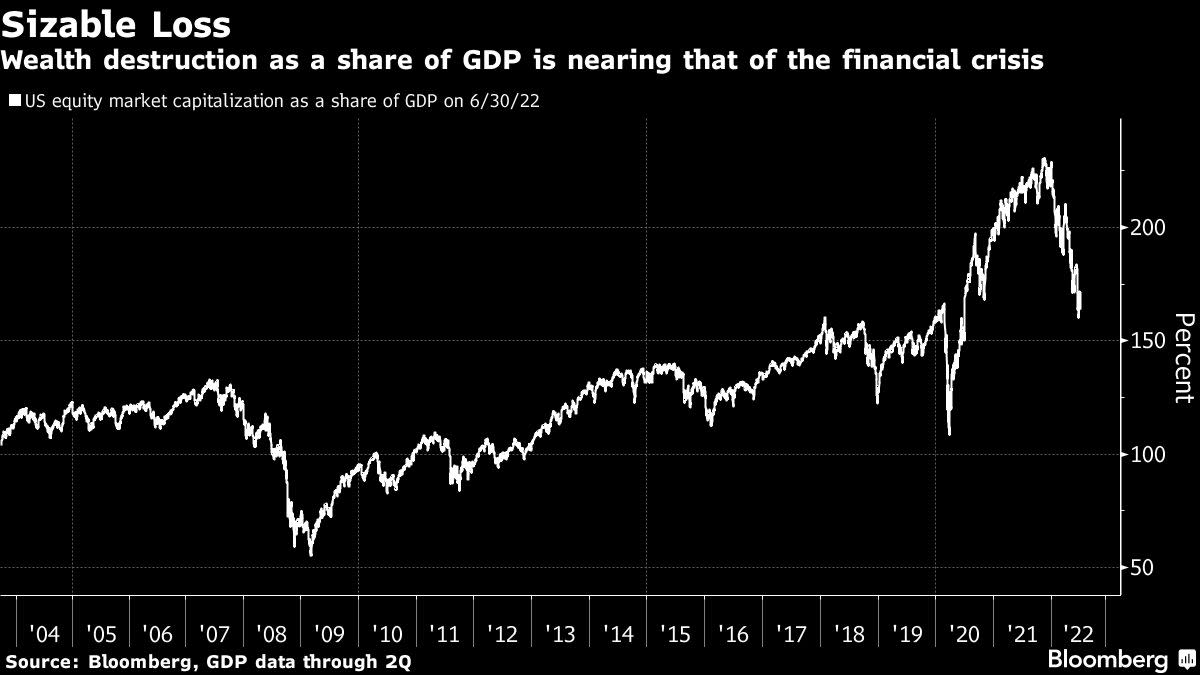

Even with Thursday’s significant bounce, the S&P 500 has dropped a quarter of its value this 12 months. Shocking as that is been for buyers, it is a person of the couple items going on any place that in fact accords with the Fed’s aim of draining the financial system of bloat. Not too long ago, the toll in terms of wealth destroyed — about $15 trillion to day — has begun to tactic that of the 2008 economical crisis, when calculated in opposition to US gross domestic item.

And even though the inventory market place is not the financial system, it’s a sign and an enter into it, impacting all the things from purchaser sentiment to the selling price of non-public enterprises. Declines on a par with what is already occurred in equities have been a good proxy for reversals in inflation a lot more than a dozen situations due to the fact the late 1950s, according to analysis from Doug Ramsey, chief financial commitment officer at the Leuthold Team.

“The prosperity impact performed a increased function than it ever experienced in inciting the inflationary spiral, and it is also going to play a fantastic part in cutting down it,” Ramsey explained in an interview at Bloomberg’s headquarters in New York. “When you imagine about the stock marketplace declining in standard share conditions on the index, that understates the amount of prosperity that it wipes out.”

Buttressed by effortless-funds guidelines and significant fiscal stimulus, the S&P 500 additional than doubled among its pandemic very low and this year’s significant, earning People who owned stocks really feel richer, if only on paper. All that has changed in 2022, with the Fed elevating prices at the swiftest rate in many years.

Plunging fairness selling prices wiped 4.1% off Americans’ mixture web really worth to $144 trillion in the quarter ending June 30. That was the next-major decrease considering that 2008.

It hasn’t taken a noteworthy toll on customer psyches still, with Thursday’s looking at on shopper prices for September exhibiting stubbornly significant inflation. By Ramsey’s logic, it will someday, serving to the central financial institution achieve its aims. A far more frugal client won’t be the only force driving moderating inflation — which also depends on interest premiums and moves in the dollar — but it may perhaps help.

The scope of the strike to wealth in this rout is having more difficult to disregard. Among its November history and late previous thirty day period, the Wilshire 5000 Index experienced plunged about 27%. Expressed as a percentage of GDP, the decline equals to 54%, close to the 61% that evaporated throughout the economic disaster, info compiled by Leuthold display.

Tumbling asset costs have historically revealed a track report of possibly assuaging inflationary pressures or signaling their reduction.

Concerning 1957 and very last year, the S&P 500 had posted 15 corrections of 19% or much more. In 10 of the circumstances, inflation was reduced 12 months afterwards, declining an normal 2.3%, according to details collated by Leuthold.

And it is not just the stock industry. Climbing borrowing charges have roiled aspiring household customers, making house ownership — a major supply of wealth for Individuals — out of attain for some. The affordability of housing is deteriorating at a more quickly rate than at any level in the past three decades, estimates compiled by Morgan Stanley demonstrate.

“Much of Americans’ prosperity resides in residence fairness and financial-market portfolios, equally of which have taken big hits this 12 months,” Ed Yardeni, founder of his namesake investigate company, claimed in a notice to customers. “We see crimson flags in the weak point of the housing market place, the adverse wealth effect, and the strength of the dollar.”

Bridgewater Associates LP’s Bob Prince painted a to some degree serious situation around the summer, declaring the Fed’s try to go after two goals — deliver down inflation although preventing an unacceptably deep economic downturn — could lead to policymakers to pause their price-climbing cycle, sooner or later undertaking two rounds of tightening alternatively of one particular.

This situation, now off-charts for the marketplace, “presents the greatest possibility of massive prosperity destruction,” the firm’s co-main financial commitment officer explained in observe.

When agonizing in the small run, the decrease of the equity market’s dimensions relative to that of the economic system can be noticed as a balanced improvement for market bulls.

Plunging asset selling prices have finally pushed the inventory-sector capitalization relative to national gross domestic profits out of the top rated quintile of historic readings, which has preceded fairness declines in the next yr, a few and five yrs, data compiled by Ned Davis Investigate show.

“The wealth result is becoming felt not only in equities and fiscal marketplaces, but also housing prices heading down,” Mona Mahajan, senior expenditure strategist at Edward Jones, mentioned in an job interview. “That diminished wealth result is what can be a self-fulfilling cycle: people may well rein in their purses, and that has a ripple outcome on the financial state. We could be receiving there.”

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.