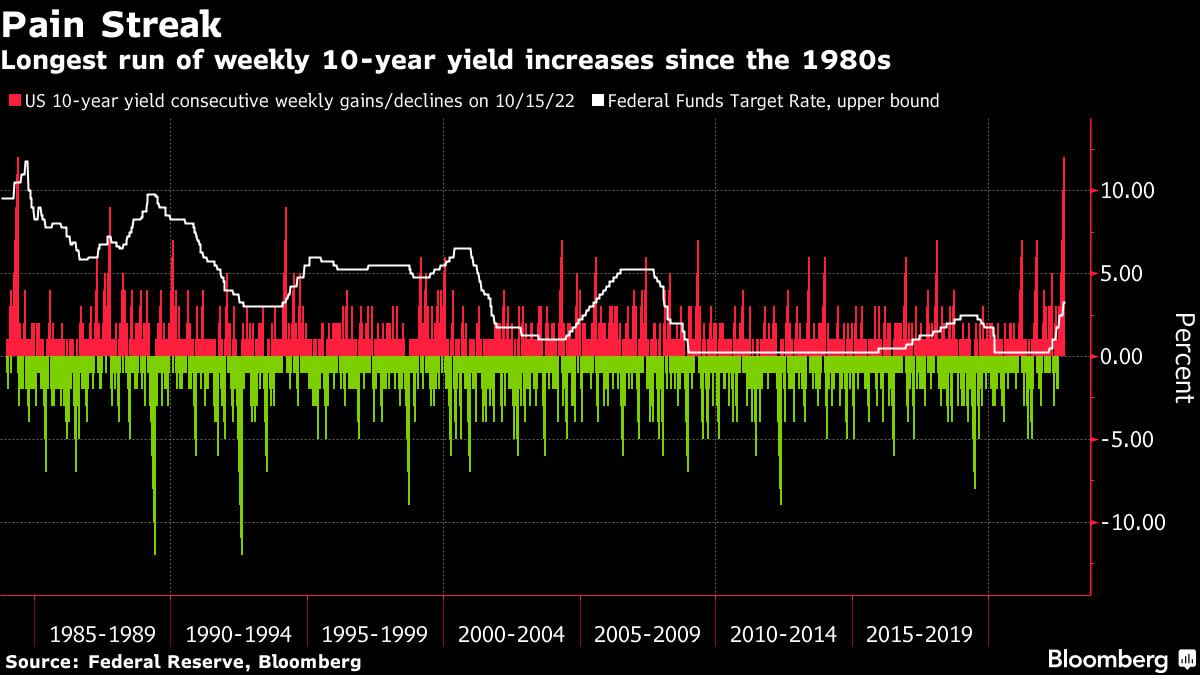

(Bloomberg) — US Treasuries have entered the longest sustained slump in 38 several years, as coverage makers signal their perseverance to preserve increasing fees right up until they are guaranteed inflation is under management.

Most Examine from Bloomberg

The yield on benchmark 10-12 months notes jumped 23 foundation factors this week to 4.25% on Friday, heading for a 12-week streak of raises that would match the duration of the 1984 episode when then-Federal Reserve Chairman Paul Volcker was carrying out a collection of quick interest level hikes.

Bonds and equities have fallen sharply this calendar year as central banking companies rushed to hike interest prices to tame surging inflation. That despatched yields and volatility soaring, prompting traders to pile into the greenback as the vital harmless haven. 20-two of 31 important currencies tracked by Bloomberg are down additional than 10% this calendar year.

The most recent spur for the around the world selloff arrived as swaps traders priced in the best peak yet for the Fed’s coverage price, projecting it topping-out at 5% in the initial fifty percent of 2023. March and Might 2023 right away index swap contracts each individual exceeded 5% on Thursday in the New York session. Each were under 4.70% as lately as Oct. 13 in advance of US consumer inflation exceeded estimates.

“This is a kind of milestone,” previous US Treasury Secretary Lawrence Summers claimed on Twitter. The industry-implied terminal amount is “more probably than not to increase far more.”

Tighter coverage anticipations drove the produce on 10-12 months inflation-shielded Treasuries up as a great deal as 3 foundation factors to 1.76%, the optimum given that 2009, feeding by to decrease equity valuations due to a drag on company earnings.

The swift collective central-banking pivot from stimulus to stinginess is putting strains on governments and economies all-around the planet. The Bloomberg combination bond index has now tumbled 25% from the peak reached in Jan. 2021 as the initial world wide bear market in at minimum a generation shows no indications of waning.

On Friday the generate on three-yr Australian financial debt surged 15 basis points to 3.78%, a 10-year significant, and the Financial institution of Japan was pressured to intervene for a second working day to try and hold the 10-12 months yield at its .25% ceiling.

Traders also received new warnings about intense tightening from Fed Lender of Philadelphia President Patrick Harker. Officials are probably to increase curiosity prices to “well above” 4% this 12 months and maintain them at restrictive stages to fight inflation, Harker stated in well prepared remarks on Thursday.

The Fed has hiked its plan charge five moments considering the fact that March and the industry is anticipating a fourth consecutive 3-quarter-issue raise at the future assembly in November.

–With aid from Elizabeth Stanton.

(Provides serious prices degree in the sixth paragraph)

Most Study from Bloomberg Businessweek

©2022 Bloomberg L.P.