Pushed by moral outrage above Russia’s invasion of Ukraine previously this yr, U.S. governors and other prime condition officials made it crystal clear: They wished to slice their monetary ties with Russia.

A handful of states quickly adopted through. Idaho offered $300,000 of bonds in a Russian oil enterprise in early March. A working day just before the invasion, the Kentucky Instructors Retirement Program sold its shares in the Russian financial institution Sberbank.

But these illustrations are outliers. 6 months into a war that has killed hundreds of Ukrainians and displaced about 12 million extra, most of the pledges to drop Russian investments — some made with terrific fanfare all through news conferences — have absent unfulfilled, according to an Affiliated Push assessment, state retirement administrators and companies that spend state resources.

Swift international reaction has reduce off significantly of Russia’s economic system from the relaxation of the entire world. That has manufactured it just about unachievable for divestment by point out pension cash, college endowments and other public-sector holdings — as properly as private investments these types of as these in 401(k) accounts.

“These pension funds want to get out, but it’s just not reasonable to sell all the things in the current surroundings,” said Keith Brainard, research director at the Nationwide Affiliation of Point out Retirement Administrators.

Benjamin Smith, a spokesperson for the Rhode Island treasury, claimed the components that make it tough to divest also clearly show that a globally effort and hard work to isolate Russian President Vladimir Putin is operating.

“This is excellent news simply because it indicates that tension from buyers across the entire world, including Rhode Island, is succeeding in exacting a toll on the Russian financial state, building it a lot more complicated for Putin to fund his navy operation, state-owned businesses, and corrupt network of oligarchs,” he mentioned in an electronic mail, noting that Rhode Island’s pension system exposure in Russia hardly ever exceeded .3% of its assets.

Any pre-war investments in Russia are now worthless, or almost so. Which is raising queries from some officials and fund professionals about whether or not divesting is even required.

In Hawaii, 1 of a handful of states the place prime administration officials did not pledge to divest, Gov. David Ige mentioned at a Could 5 news conference that the state’s employee pension method experienced “very little to practically nothing” invested in Russia.

“The couple of remaining investments are pretty compact, and so I did not feel compelled to just make a assertion for political motives that we would be divesting,” he explained.

In advance of Russia’s invasion in late February, many authorities-controlled investments had only modest holdings — a portion of 1% in each and every noted situation — in Russian investments. But even that could sum to millions of pounds.

The largest U.S. community-sector retirement fund, California’s CalPERS, reported just 17 cents of each and every $100 of its portfolio was in Russian investments as the war broke out. Even so, that translated into $765 million value of stocks, genuine estate and personal equity.

By the stop of June, the price experienced shrunk to $194 million. The entire loss was simply because the holdings dropped in price none had been marketed.

There is no way to know how a lot point out federal government entities in the U.S. have invested in Russia or firms based mostly there, but collectively they were value billions of bucks ahead of the war. Much of the revenue was invested in Russian federal government bonds, oil and coal organizations as section of rising-markets index money.

Fast to condemn the invasion, condition officers stated they could put tension on Putin by dumping their Russian investments.

“Our moral vital just before these atrocities need that you act to tackle Russia’s aggressions and instantly limit Russian entry to California’s money and investments,” California Gov. Gavin Newsom wrote in a letter Feb. 28 to the boards overseeing the huge pension resources that serve academics, point out and neighborhood authorities staff and university staff members.

Across the nation, governors and other top officers built related statements.

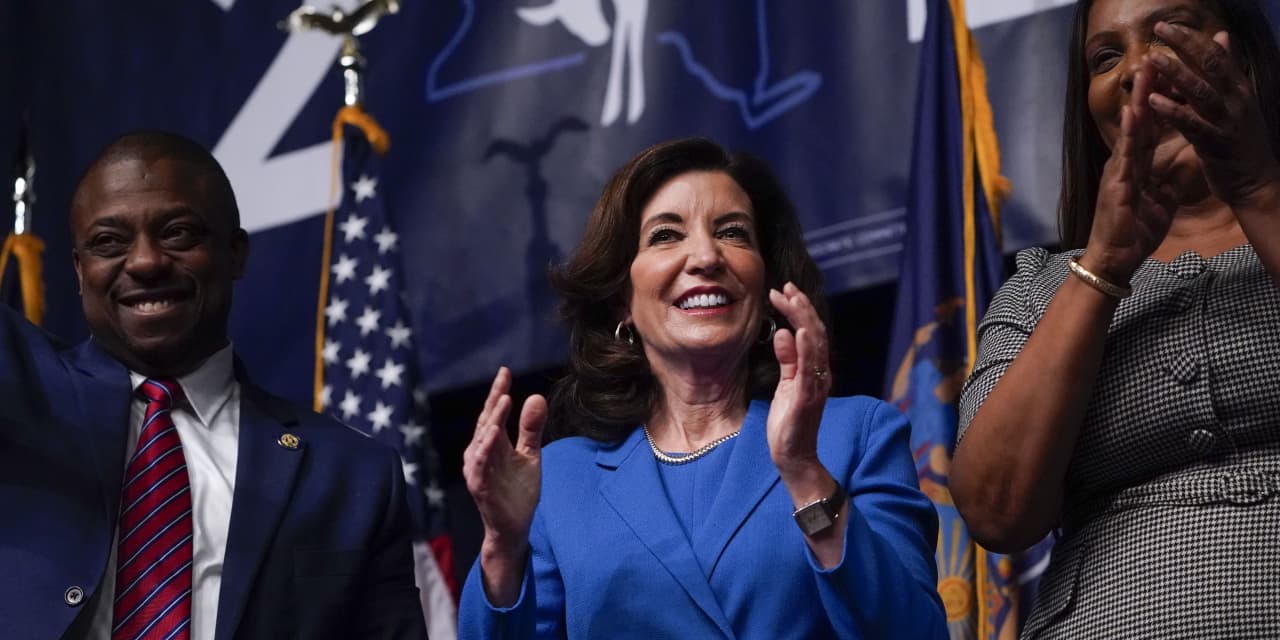

Just right after the invasion started, New York Gov. Kathy Hochul signed an government order calling for divestment “to the extent attainable,” while Arizona’s Board of Regents voted to exit any Russian investments.

The treasurers for 36 states in addition the District of Columbia and U.S. Virgin Islands signed a joint letter in March advocating divestment of publicly managed cash from Russia. They pointed out a monetary reason for accomplishing so: “The existing crisis also constitutes a sizeable chance for states’ investments and our financial safety.”

A key chunk of the govt holdings in Russia are in the sort of index money that investors use to mimic over-all inventory market place functionality. Russian shares ended up frequently element of resources specializing in emerging marketplaces. MCSI and other corporations that choose which shares really should be in the money promptly dropped Russian securities.

But the corporations that promote investment items based on all those indexes ended up left in the lurch, however leaving pieces of Russian shares in their investors’ portfolios.

As section of the sanctions, stock marketplaces in the U.S. and somewhere else stopped the trading of Russian stocks. And the Moscow Inventory Exchange was closed for approximately a thirty day period, reopening with restricted controls that preserve U.S. buyers from selling.

The assets sank in price amid the invasion, however the exact price is not normally distinct.

Maryland mentioned that as of the starting of February, $197 million of its condition retirement and pension system cash ended up invested in Russian belongings. A month afterwards, the condition believed the value had plunged and amounted to just $32 million. The point out has been not able to unload its investments.

For the handful of states in which top officials have not endorsed divestment, eroding values like that are a main reason.

Shortly following the invasion, South Carolina Gov. Henry McMaster reported the amount of point out investments in Russia was “miniscule” and observed that the value was about to “shrink to virtually almost nothing as the Russian overall economy is remaining practically shut off from the planet.”

In Florida, Lamar Taylor, the interim executive director of the company that oversees investments of pension cash, reported through a cabinet assembly that some expense professionals may possibly request to unload Russian property as quickly as they’re equipped, while some others could maintain on in situation they’re really worth additional afterwards.

At the assembly, Gov. Ron DeSantis claimed the Point out Board of Administration has a lawful accountability to test to make cash for the retirement procedure.

“That would violate your fiduciary responsibility, if you liquidated at large losses for political explanations somewhat than for the finest interests of the beneficiaries,” he claimed.

But DeSantis stated there was a way to make it much easier: Lawmakers passing a monthly bill banning financial investment in Russia.

“If the Legislature could communicate clearly, that would be anything we’d welcome right here, just to make guaranteed we’re not furthering investments in sections of the entire world that are not reflective of our passions or values,” he said.

Hank Kim, executive director of the Nationwide Meeting on Public Employee Retirement Systems, stated he has explained to member pension money that getting steps to divest is essential even if it cannot be accomplished right away.

“The community has a right to know that it was debated in a really serious fashion,” he reported.