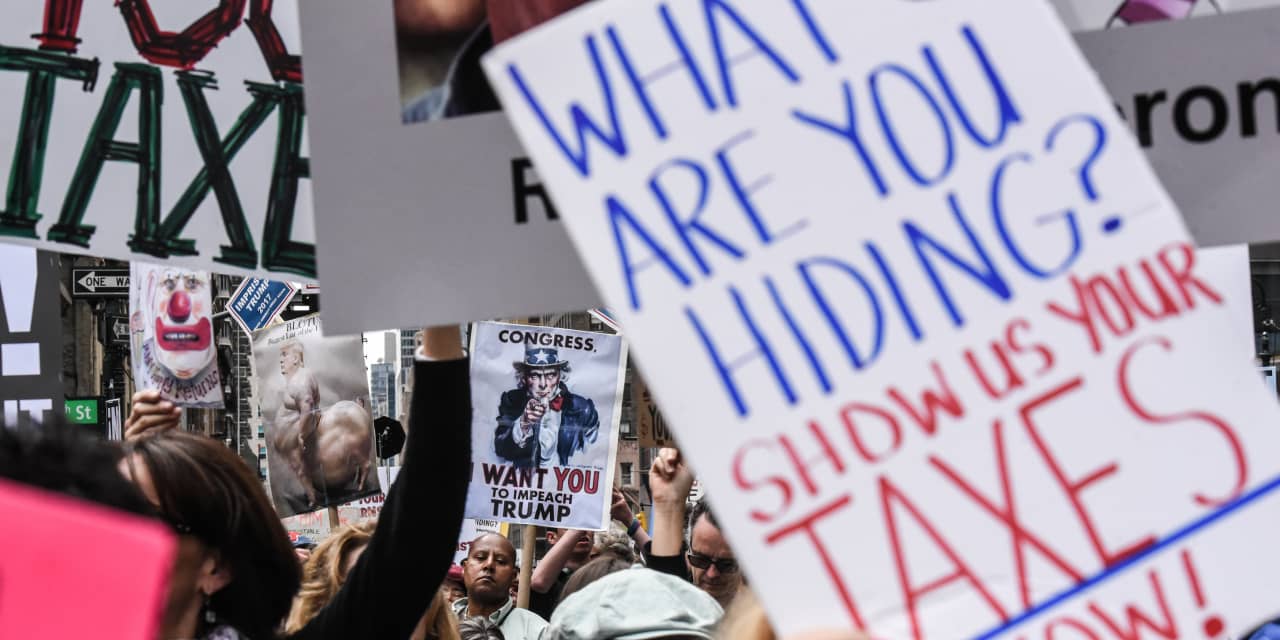

Individuals tend to have just one of two reactions to the revelation that former President Donald Trump paid out little to no taxes in modern decades: He’s possibly an amoral tax cheat or he’s wise.

To me, it reveals just how significantly is erroneous with the U.S. tax code, which Congress treats as a form of policy Swiss Military knife to offer with innumerable wanted social and financial plan ambitions, from homeownership to guarding the Maine blueberry business.

I teach a class on “the politics of taxes,” in which we take a look at how politics styles tax plan in the United States and other countries—as perfectly as how taxation affects politics. My college students are constantly struck by the extent to which Congress utilizes taxes as its default go-to coverage lever.

It wasn’t supposed to be this way.

The tax code normally takes about

In theory, the major perform of taxation is to fund the governing administration. But in observe, Congress also employs it to deal with difficulties in almost each and every policy space, from promoting conservation and charitable providing to encouraging entrepreneurship and guaranteeing continuous company revenue.

All of these insurance policies, nonetheless sound they produced be separately, make the cash flow tax system more complex for everyday taxpayers and results in a wide array of suggests by which some wealthy people can reduce their tax payments to levels that come to feel unfair to numerous voters. They also, in the long run, are not a extremely good way to attain accomplish the policy’s explicit ambitions.

This convoluted system was consequently not made in a huge bang of malfeasance or ineptitude but generally as a result of piecemeal variations that significantly complex the tax code. Legislative reforms intended to simplify the tax code, this sort of as people handed in 1986 and 2017, have attained minor.

“The end result of this approach is a set of quite complex provisions that show up to have no overall logic if the tax legislation have been staying created from scratch,” as the nonpartisan Tax Policy Centre place it.

How Trump will take advantage

This complexity has a variety of adverse impacts.

For illustration, estimates range but most suggest taxpayers most likely shell out effectively over $100 billion a calendar year in time and funds submitting their taxes each year—known as tax compliance. The 2017 Tax Cuts and Employment Act does not look to have lowered compliance prices regardless of its emphasis on simplifying the 1040 tax sort.

And it is a lot worse than in other prosperous nations.

The regular American spends about 13 hours filing their taxes each and every year, according to the Joint Committee on Taxation, compared with below an hour in the Netherlands, Japan and Estonia. In Sweden, the governing administration fills in the tax sorts routinely, and citizens can simply watch and approve them—or make changes—on their cellphone.

A further consequence is that social welfare plans in the U.S. can be needlessly intricate.

For instance, Canada provides its citizens with low cost youngster care simply just by subsidizing it so that it expenses $6 a working day. As a substitute of providing subsidies, the U.S. supports reduce- and middle-profits mom and dad mainly by way of the tax code with credits like the attained-income tax credit score and the kid tax credit history. But each are quite complicated, improperly understood and often do not arrive at all those who will need it.

Complexity also means that the tax code is littered with chances for wealthier taxpayers like Trump to decrease their tax bill really significantly. The perception that there are loopholes that only the rich can use leads numerous taxpayers to see the process as unfair.

Three of the strategies that Trump has made use of (in accordance to before reporting by the New York Moments) to keep away from taxes show this really very well.

In 2006, lawmakers needed to promote conservation though aiding farmers and ranchers, so they expanded conservation easements, in which home holders agree to not produce land in trade for a tax deduction. Trump made use of this frequently abused provision to declare a $21.1 million deduction in 2015 for not creating land around his Seven Springs estate that his family wished to use as a private retreat in any case.

One more illustration is how U.S. tax coverage lets individuals to wander away from an investment and, if they acquire nothing, declare any losses that haven’t however been taken on their present tax return, reducing profits by that quantity. The policy aim here is to encourage entrepreneurship by not producing small business failure way too onerous.

Trump used this abandonment rule in 2009 to declare a lot more than $700 million in losses when he walked absent from his Atlantic City casinos. Yet it seems he got a little something in trade for walking way—stock in a new company—which implies he could have violated the regulations of that tax break.

And in 2009, Congress wanted to enable enterprises recover from the fiscal crisis so it made it a lot easier to use the massive losses that lots of firms were being enduring to offset profits attained in prior many years, which resulted in refunds for taxes now paid out. This permitted Trump to claim a refund of $56.9 million he had paid in taxes in 2005 and 2006.

The federal government has means other than the tax code to put into practice a coverage with a social or economic aim, this sort of as via regulations or investing on a new or present govt program. Lawmakers have frequently chosen to use the tax code since it can appear less difficult and avoids the political expenditures involved with higher taxes.

Finally, nevertheless, research shows using tax code is not the finest way to achieve a policy’s finishes.

Gary Winslett is an assistant professor of political science at Middlebury College or university.

This commentary was initially posted on Oct. 28, 2020, by The Dialogue –Trump’s ultralow tax bills are what transpires when governing administration attempts to make policy by means of the tax code