(Bloomberg) — For traders wanting for a dip-obtaining possibility in the global chip industry, Berkshire Hathaway Inc. could have a suggestion: Taiwan Semiconductor Manufacturing Co.

Most Study from Bloomberg

Warren Buffett’s conglomerate picked up a $5 billion stake in the business in the the latest quarter amid a rout that wiped out above $250 billion from the stock. It has not commented publicly on the offer but market place watchers attribute the obtain to TSMC’s affordable valuations, know-how management and solid fundamentals.

Berkshire’s invest in, alongside with a similar transfer by Tiger Global Administration LLC, may propose that value is emerging in the chip sector right after a turbulent period of time marked by slowing demand from customers and US-China tensions. A expanding variety of Wall Road banking companies have reaffirmed bullish calls on TSMC, with analysts at Morgan Stanley indicating the stock has reached “a good entry place.”

“With its remarkable technological know-how leadership, TSMC is a terrific price participate in in the lengthy-term if you glance past the present-day semiconductor downcycle,” claimed Andy Wong, fund supervisor at LW Asset Administration. “Buffett could be investing in the up coming-ten years progress with burgeoning demand from customers from IoT, renewable and automobiles.”

TSMC’s shares have jumped about 10% in Taiwan because Berkshire’s acquisition was disclosed previous 7 days. Morgan Stanley says they are trading under their downcycle valuation with a 30% to 40% discounted due to geopolitical threats, according to a Nov. 8 observe.

The inventory has a valuation many of all-around 12.6 instances based on its estimated earnings for the next year, according to info compiled by Bloomberg. Goldman Sachs Team Inc. estimates that to be the reduce finish of the 10-calendar year common. The organization is less costly than most of the users of the Philadelphia Inventory Exchange Semiconductor Index, which tracks the most significant US-listed chip firms.

“We assume TSMC to go on to demonstrate its resilience vs . other friends all through the business downcycle supplied its remarkable execution,” Goldman analysts wrote in a Nov. 16 take note. Valuations are appealing and the firm is best positioned to capture the industry’s extended-term structural expansion in 5G, artificial intelligence, higher-functionality computing and electrical vehicles, they extra.

Funds Movement

TSMC also has a different benefit: it has managed to produce double-digit income advancement and a gross margin properly previously mentioned 50% this year even with a slowdown in the sector. This has capped the stock’s yr-to-date loss at 21%, assisting it outperform friends these as Micron Know-how Inc. and SK Hynix Inc.

The Taiwanese company’s background of healthier income circulation and steady dividends may have also served draw Buffett, according to analysts.

“TSMC (and other foundries) all have to incur significant cash expenditure in the race for tech/ability management, but heritage displays TSMC has managed to make respectable dollars flows regardless of capex,” stated Phelix Lee, fairness analyst at Morningstar Asia Ltd. The firm has a monitor record of paying dividends since the 2000s, he included.

The stock’s latest dividend produce is 2.6%, increased than Micron’s .8% and virtually on par with SK Hynix’s, in accordance to data compiled by Bloomberg.

Even now, even though Buffett’s wager has boosted retail sentiment towards the stock, the shares may well keep on to encounter swings in the quick expression due to geopolitical dangers and inventory adjustments in the chip field.

The semiconductor sector is at the middle of a developing rift amongst the US and China as the two nations vie for management in the world wide know-how field. Washington has imposed elevated sanctions on large-close chips produced for Chinese prospects exclusively to forestall them generating their way into the fingers of the Chinese armed forces.

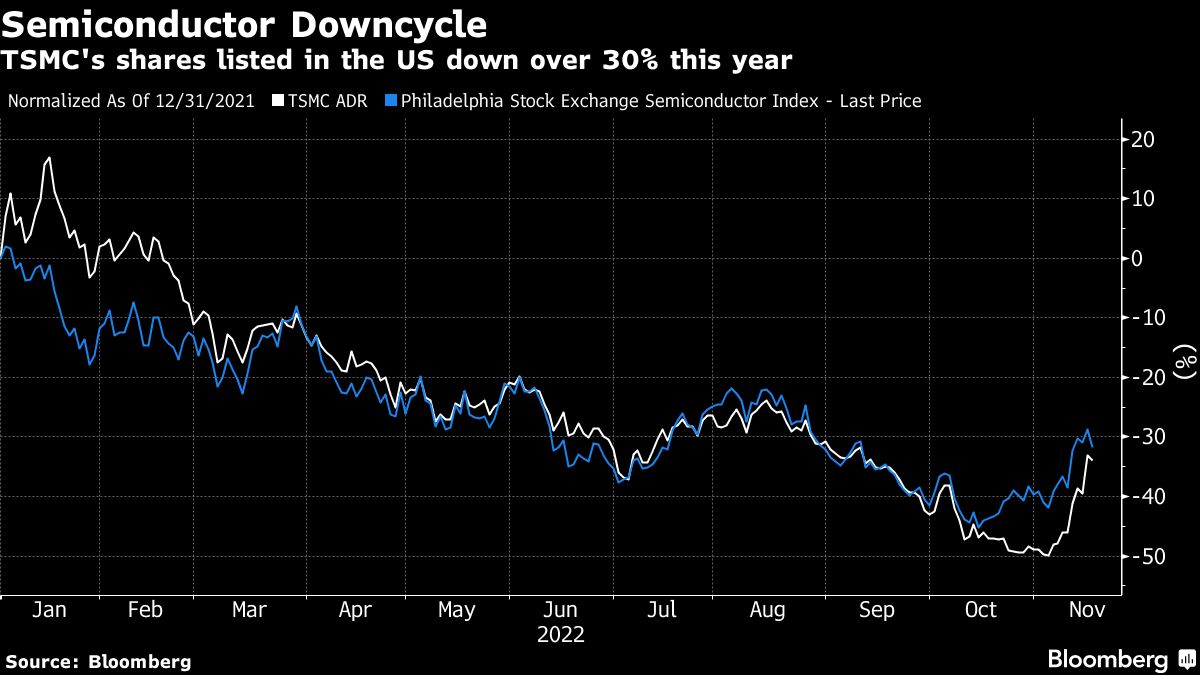

To reflect the challenges, analysts have slash the ordinary concentrate on selling price for TSMC’s stock by about 30% considering the fact that February. Its shares mentioned in the US are down over 30% this year, in line with the fall posted by the world semiconductor benchmark.

“Investors are nervous about increased-than-common stock, which reveals no indications of easing yet,” explained Jason Su, fund supervisor at Cathay Taiwan 5G Additionally Communications ETF. “Companies such as TSMC said before they anticipate inventory correction to proceed via to start with 50 % upcoming year,” he mentioned, introducing that chip shares are possible to rebound soon after inventory changes are completed.

Most Read through from Bloomberg Businessweek

©2022 Bloomberg L.P.