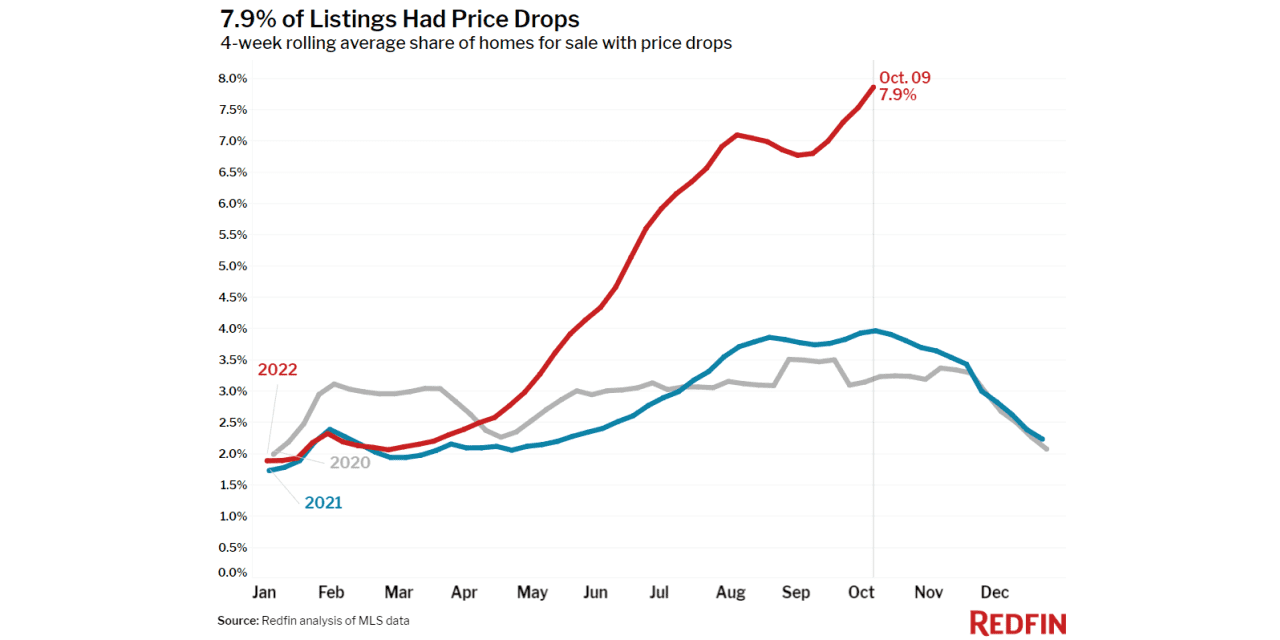

Here’s a chart that speaks a thousand text about the condition of the true-estate market place suitable now.

The chart over, element of a new report by serious-estate brokerage Redfin

RDFN,

on the house market place, reveals how property sellers are adjusting to the new standard of 7% home finance loan rates.

The chart states that 7.9% of properties for sale on the industry each individual 7 days experienced their prices slashed — and that’s a record high.

That is in comparison to just 4% of households possessing their price ranges lowered just about every 7 days over the same interval a yr back.

Redfin’s data goes again to 2015. The corporation averaged out the share of listings which noticed a price tag reduce around 4 weeks, to smoothen out any outliers.

Taylor Marr, deputy main economist at Redfin, additional that looking about a greater time period, i.e. a thirty day period, the company’s data reveals that a quarter of residences proper now are dropping costs.

“We have hardly ever been this high,” Marr informed MarketWatch in an job interview.

As opposed to prospective buyers, who are substantially additional sensitive to growing house loan prices, “sellers are just sluggish to respond to the modifications in demand… they set costs based mostly on where they believe the market is [and] are often unwilling to established their prices too low,” Marr mentioned.

So for sellers, selling prices are a little stickier, he additional, and slower to appear down.

But even if it took a even though, it’s finally taking place.

Soon after all, mortgage prices are at multi-ten years highs, with the 30-12 months trending steadily over 7% as of Friday afternoon, according to Home loan News Day-to-day. And that is likely to go up even more, as the 10-yr Treasury be aware

TMUBMUSD10Y,

is trending earlier mentioned 4%.

In the meantime, Redfin explained that the median home on the current market was mentioned at more than $367,000, up 7% about final 12 months.

The month-to-month home loan for that home at the present-day fascination charge of 6.92%, in accordance to Freddie Mac, is $2,559.

A calendar year back, when prices ended up at 3.05%, that month to month payment would’ve been just $1,698.

Two strategies for house prospective buyers struggling with significant mortgage loan prices

Sellers are dropping their selling prices by 4 to 5% on typical, Marr explained.

“You would just about count on it to be a whole lot worse,” he added, provided how rapidly fees rose and eroded obtaining energy.

But customers and sellers are also employing two unique methods to get some aid on home loan fees, Marr said.

One, sellers are achieving out to prospective buyers and presenting concessions to purchase home finance loan charges down.

In other phrases, sellers are inquiring purchasers to fork out the total inquiring price tag, but proposing to use portion of that as a concession to get buyers a lessen desire level on their house loan.

“Which is effectively a price tag drop,” Marr stated, “it’s the identical issue … but it does not necessarily clearly show up in the details.” And it’s difficult to get a perception of the magnitude of how this is taking part in out, he added.

How it operates is as this kind of, Marr explained: If a buyer is putting down $100,000 for a 20% downpayment on their house at a 6.5% desire level, they can as an alternative allocate 10% for the downpayment, and commit the relaxation of the $50,000 purchasing down the mortgage loan level to 5%.

“5% is not pretty poor, and it may well seem to be like a ton of dollars, but … probabilities are you’re heading to be incentivized to refinance [in the future] and you are going to have to shell out the closing expense on that bank loan to refinance, which could be upwards of 15 grand,” Marr added.

Customers are also switching to adjustable-fee home loans, which provide decrease desire rates at the get started of the time period. ARMs are virtually 12% of general home finance loan apps, the Mortgage loan Bankers Association observed on Wednesday, which is substantial.

The place prices are slipping

As to exactly where price ranges are falling, a couple of sites stood out to Redfin.

They claimed that house costs fell 3% year-in excess of-yr in Oakland, Calif., and 2% in San Francisco. New Orleans also saw a 2% drop.

“Even in Atlanta, or Orlando, we’re seeing potential buyers backing out,” Marr observed.

So with the backdrop of sellers ultimately dropping listing costs, if you’re a consumer appropriate now, never be spooked by mounting premiums and stop on the lookout, he advised.

“There have been opportunities when fees really came down and gave prospective buyers the moment to soar again in and get some great offers on houses that did fall their costs,” he claimed.

Plus, “it does not hurt to make a small ball provide,” Marr extra. “Some sellers are desperate, and that can be a excellent tactic … we have heard from some of our own agents that some customers are acquiring outstanding deals right now.”

But if you will need to rent for a yr and wait around for items to tranquil down, then do that, Marr stated, and bulk up those people savings for that desire property.

Bought ideas on the housing marketplace? Write to MarketWatch reporter Aarthi Swaminathan at aarthi@marketwatch.com