(Bloomberg) — A shock turnaround in equities despatched Wall Avenue looking for anything — everything — to explain how however another purple-very hot inflation range translated into the finest working day for bulls in a 7 days.

Among the the responses: more and more durable positioning which includes effectively-provisioned hedges, a watershed instant for chart watchers, and numerous much less-than-horrible earnings experiences. Throw in some short masking, and the result was a trough-to-peak run-up in S&P 500 futures that approached 5% at its widest.

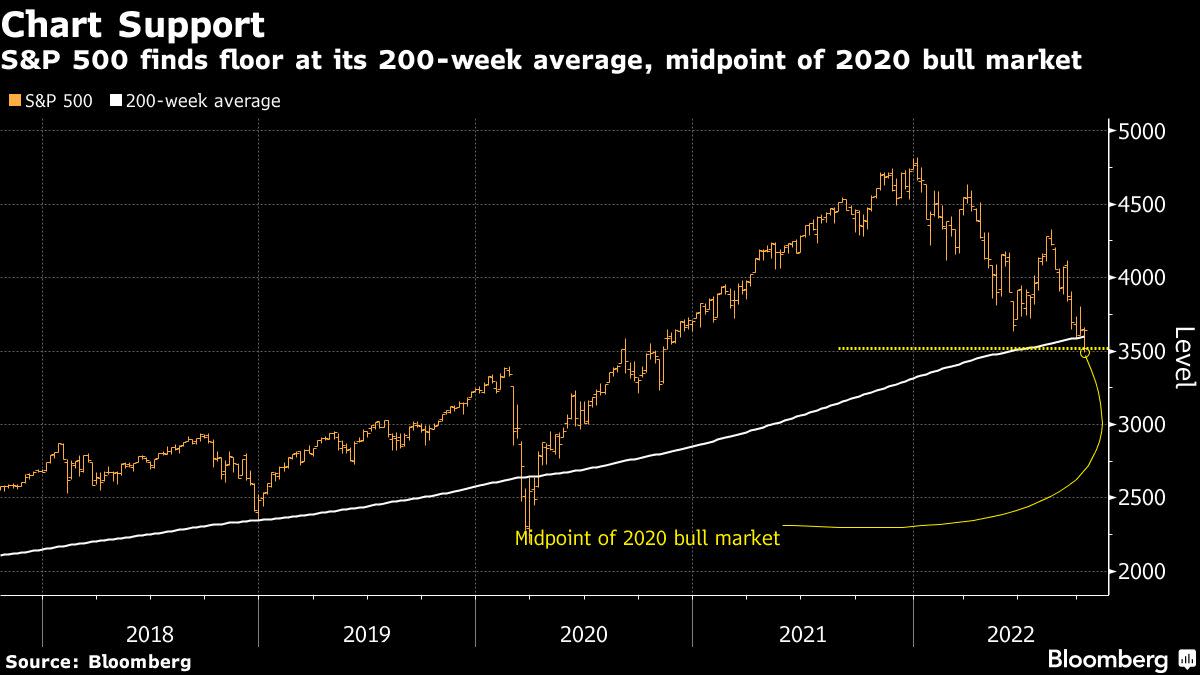

Anticipate the unexpected has develop into the only mantra in a current market when cross-currents are flowing from each individual direction, such as a Federal Reserve bent on subduing inflation though maintaining 50 % an eye on economic balance. Thursday’s turnaround came following the S&P 500 erased fifty percent its climb from 2020’s pandemic very low, a hit to prosperity that though demonstrating no signal nonetheless of curbing inflation, may well one particular day perform a portion in accomplishing that aim.

“It’s the mother nature of the beast these times the place in some cases you get these intraday big swings. We can all speculate on what may well be behind it,” said Liz Ann Sonders, chief expenditure strategist for Charles Schwab & Co. “A great deal of it has to do, for deficiency of a greater phrase, the mechanics of the market, the simple fact that there is extra shorter-phrase revenue in the marketplace, there is a lot more funds that moves all-around based on algorithms, quantitative procedures. And at any issue in time you can have triggers that can cause a 180 in the center of the day.”

With contacting the course of stocks a around impossibility, skilled traders have been active restricting their publicity to surprise moves. Institutions acquired more than $10 billion in places on specific stocks very last 7 days, a history for that group and shut to the most at any time by any cohort of traders, in accordance to Sundial Capital Analysis.

There was circumstantial evidence these wagers paid out off in the rapid aftermath of the government’s report on consumer price ranges, which showed hotter-than-anticipated inflation. Though equity futures marketed off, the Cboe Volatility Index, a gauge of current market nervousness tied to possibilities on the S&P 500, really fell, most likely a indication of earnings-having by hedged traders. And as all those positions were monetized, that prompted industry makers to unwind short positions they had put on to maintain their neutral industry stance.

“It’s a combination of quick masking/set providing,” mentioned Danny Kirsch, head of choices at Piper Sandler & Co. “It’s a extremely-properly hedged event. It’s trading like party handed, offer your hedges, contributing to current market rally.”

Somewhere else, a clutch of specialized signals was on the bulls’ facet, among them the 50% retracement in the 22-thirty day period rally that broke out in the S&P 500 in March 2020. When the index undercut the 3,517 stage, some market watchers took that as a indication the 9-thirty day period selloff experienced gone too much.

One more buffer came in at the index’s 200-7 days regular, a threshold that hovers about 3,600 and has come to be a battle line for bulls and bears in latest weeks. In 2016 and 2018, the extended-expression trendline halted large S&P 500 declines.

“We bounced off of this guidance level and that gets self-satisfying,” explained Ellen Hazen, main market strategist and portfolio supervisor at F.L.Putnam Financial commitment Administration. “There’s so a lot uncertainty in the market and so a lot of knowledge factors are conflicting that the market responds to no matter what is the most the latest.”

It is the first time considering that July that the S&P 500 wiped out an intraday decline of a lot more than 2%, still another of the wild swings is a signature of 2022’s stock current market as traders wrestle to guess the Fed’s coverage path and its effects on the economy. The index has posted 2% reversal days, up or down, six periods given that January, poised for the wildest yr given that the 2008 economical disaster.

When offering guidance for tactical traders, the erasure of half the bull market’s bounty is a further grim reminder of how brutal the market has been in 2022. With the S&P 500 is at hazard of only its 3rd 20%-moreover calendar-year reduction of the century. The aspiration state the ruled marketplaces next the outbreak of Covid-19 is bit by bit lifting, leaving buyers exposed to the affect of a hyper-aggressive Fed and bubble-like valuations.

A person bull argument that has persisted through the selloff is the resilience of company earnings. With the 3rd-quarter reporting period about to go into total swing, bulls may possibly be taking cues from Thursday’s greater-than-expected final results from organizations like Delta Air Lines Inc. and Walgreens Boots Alliance Inc.

Regardless of this year’s $15 trillion wipeout, stocks are much from screaming purchases. At 17.3 periods profits, the index’s numerous is earlier mentioned trough valuations found in all former 11 bear cycles, data compiled by Bloomberg present. In other words and phrases, really should equities recuperate from below, this bear market place base will have been the most high priced because the 1950s.

“People just realized the extended beating of hazard property has to conclusion some time. FOMO prospects men and women to chase this rally,” mentioned Larry Weiss, head of equity investing at Instinet. “Unfortunately, we nonetheless have lots of time to damage this rally.”

Additional stories like this are offered on bloomberg.com

©2022 Bloomberg L.P.