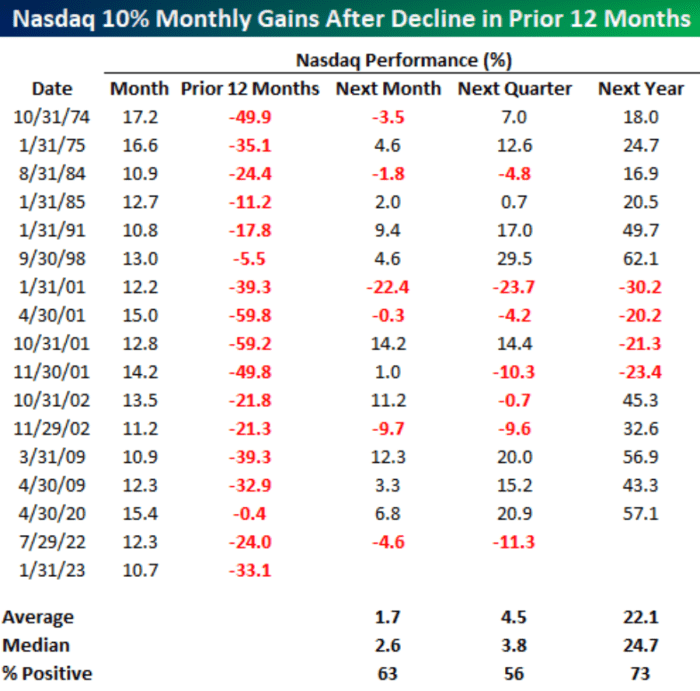

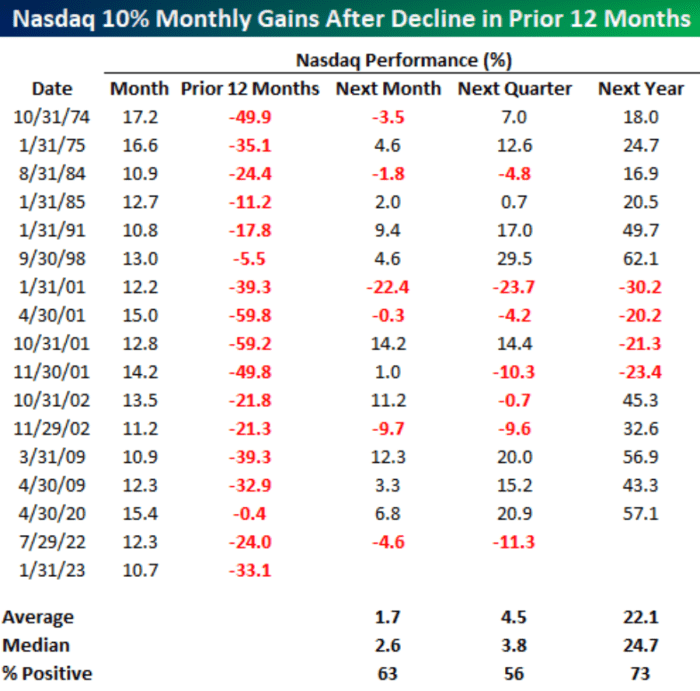

The technologies-laden Nasdaq Composite surged additional than 10% previous thirty day period after a down yr in 2022, with heritage showing the stock-current market index tends to complete properly in the next 12 months following this kind of a scenario — other than in 2001, Bespoke Expense Team warned.

The Nasdaq just wrapped up its very best January effectiveness given that 2001 with a achieve of 10.7%, in accordance to Dow Jones Marketplace Details. That’s immediately after plunging 33.1% in 2022, which include an 8.7% fall in December, FactSet data clearly show.

“After closing out an by now poor calendar year on a down note, the Nasdaq stormed into 2023 [by] rallying 10.7% in January,” Bespoke stated in a report emailed Wednesday. “Since the Nasdaq’s inception in 1971, there have been 33 prior months wherever it rallied at least 10%.”

But the quantity of occurrences drops to just 16 when narrowed to rallies of that magnitude pursuing a 12-month stretch in which the index was down, in accordance to Bespoke. In this kind of instances, the organization located, the Nasdaq’s efficiency then tends to be constructive about the future 12 months, except in 2001, “when there were four distinctive [monthly gains of 10% or more] and the Nasdaq was lessen a person calendar year afterwards just after all four of them.”

For instance, the chart below shows the Nasdaq jumped 12.2% in January 2001, just after plummeting 39.3% in excess of the prior 12 months. The index tumbled 30.2% around the subsequent 12 months.

BESPOKE Financial commitment Group REPORT EMAILED FEB. 1, 2023

“With the current interval routinely drawing comparisons to the bursting of the dot-com bubble from 2000 to 2002, it’s not notably comforting to see that there have been various [10%-plus] month to month gains in 2001, and they have been all followed by eventual declines,” Bespoke stated.

The U.S. stock market place sank last year as the Federal Reserve quickly lifted its benchmark fascination rate in an work to control inflation. Technologies and advancement stocks ended up specially really hard-hit.

Read: ‘Joy of missing out’: Here’s the silver lining after 2022’s inventory-market ‘nightmare,’ says GMO’s Ben Inker

Fed main Jerome Powell was scheduled to host a push convention Wednesday afternoon at 2:30 p.m. Japanese time, soon after the U.S. central lender concludes its two-day policy meeting. The sector is expecting the Fed will announce that it is increasing its benchmark rate by a quarter of a share stage to a range of 4.5% to 4.75%, possibly slowing its pace of charge hikes amid indications of easing inflation. The Fed’s assertion on its selection is owing out at 2 p.m. Japanese time.

The Nasdaq is “still only 1% larger than where it was at the conclude of November, but the powerful start to the year has a good deal of bulls recently emboldened,” Bespoke wrote in the report, emailed forward of the market’s open up Wednesday. “There’s also much more than a little minority of traders indicating they won’t get fooled yet again.”

The U.S. inventory market place opened decrease Wednesday. The Dow Jones Industrial Typical

DJIA,

was down .9% around midday, whilst the S&P 500

SPX,

fell .5% and the Nasdaq

COMP,

drop .3%, in accordance to FactSet information, at previous examine.

Read: QQQ is bleeding property, but are ETF buyers ‘finally bailing’ on advancement shares just as tech shares soar in 2023?

The technologies-laden Nasdaq Composite surged additional than 10% previous thirty day period after a down yr in 2022, with heritage showing the stock-current market index tends to complete properly in the next 12 months following this kind of a scenario — other than in 2001, Bespoke Expense Team warned.

The Nasdaq just wrapped up its very best January effectiveness given that 2001 with a achieve of 10.7%, in accordance to Dow Jones Marketplace Details. That’s immediately after plunging 33.1% in 2022, which include an 8.7% fall in December, FactSet data clearly show.

“After closing out an by now poor calendar year on a down note, the Nasdaq stormed into 2023 [by] rallying 10.7% in January,” Bespoke stated in a report emailed Wednesday. “Since the Nasdaq’s inception in 1971, there have been 33 prior months wherever it rallied at least 10%.”

But the quantity of occurrences drops to just 16 when narrowed to rallies of that magnitude pursuing a 12-month stretch in which the index was down, in accordance to Bespoke. In this kind of instances, the organization located, the Nasdaq’s efficiency then tends to be constructive about the future 12 months, except in 2001, “when there were four distinctive [monthly gains of 10% or more] and the Nasdaq was lessen a person calendar year afterwards just after all four of them.”

For instance, the chart below shows the Nasdaq jumped 12.2% in January 2001, just after plummeting 39.3% in excess of the prior 12 months. The index tumbled 30.2% around the subsequent 12 months.

BESPOKE Financial commitment Group REPORT EMAILED FEB. 1, 2023

“With the current interval routinely drawing comparisons to the bursting of the dot-com bubble from 2000 to 2002, it’s not notably comforting to see that there have been various [10%-plus] month to month gains in 2001, and they have been all followed by eventual declines,” Bespoke stated.

The U.S. stock market place sank last year as the Federal Reserve quickly lifted its benchmark fascination rate in an work to control inflation. Technologies and advancement stocks ended up specially really hard-hit.

Read: ‘Joy of missing out’: Here’s the silver lining after 2022’s inventory-market ‘nightmare,’ says GMO’s Ben Inker

Fed main Jerome Powell was scheduled to host a push convention Wednesday afternoon at 2:30 p.m. Japanese time, soon after the U.S. central lender concludes its two-day policy meeting. The sector is expecting the Fed will announce that it is increasing its benchmark rate by a quarter of a share stage to a range of 4.5% to 4.75%, possibly slowing its pace of charge hikes amid indications of easing inflation. The Fed’s assertion on its selection is owing out at 2 p.m. Japanese time.

The Nasdaq is “still only 1% larger than where it was at the conclude of November, but the powerful start to the year has a good deal of bulls recently emboldened,” Bespoke wrote in the report, emailed forward of the market’s open up Wednesday. “There’s also much more than a little minority of traders indicating they won’t get fooled yet again.”

The U.S. inventory market place opened decrease Wednesday. The Dow Jones Industrial Typical

DJIA,

was down .9% around midday, whilst the S&P 500

SPX,

fell .5% and the Nasdaq

COMP,

drop .3%, in accordance to FactSet information, at previous examine.

Read: QQQ is bleeding property, but are ETF buyers ‘finally bailing’ on advancement shares just as tech shares soar in 2023?