[ad_1]

(Bloomberg) — Months of gut-wrenching turmoil are holding investors on the lookout for further more volatility explosions, in spite of the uneasy tranquil that’s not long ago descended on earth markets.

Most Go through from Bloomberg

Revenue managers’ worst fears of 2008-type ructions finally proved unfounded, nonetheless the failure of three US banking companies and the crisis rescue of Credit rating Suisse Team AG in Europe disclosed indicators of financial worry, sparking some of the worst turbulence in current yrs. Wild swings in interest-level expectations and rallies in haven bonds ricocheted via other asset classes as traders experimented with to guess exactly where a new crisis could possibly erupt.

The stampede into greater-quality belongings has now began to reverse, Citigroup Inc. strategists stated. Still it is probably way too shortly to declare the all-very clear. A gauge of bond volatility stays at a single of the greatest amounts considering the fact that the 2008 economic disaster, even right after slipping from a the latest peak.

“We anticipate to see noteworthy current market swings also heading ahead, as traders ponder in which central bank premiums will finish up, what will it choose to provide inflation again to goal, what will the expenses be to the financial system — and indeed, also who will be the future casualties of greater premiums,” said Jan von Gerich, main analyst at Nordea Financial institution Abp.

Eye of the Storm

Ironically, it was exposure to the world’s most secure asset, US Treasuries, that precipitated the downfall of Silicon Valley Bank. Still, Treasuries rallied massively as worry spread, and traders speculated that the banking turmoil would pressure central banks to pause policy tightening and even slash desire rates. The ICE BofA Move index, which tracks fixed-revenue volatility, nevertheless implies large uncertainty above the path of premiums.

“Volatility has appear off the extraordinary highs that have been unsustainable but intellect the aftershocks,” explained Tanvir Sandhu, main world wide derivatives strategist at Bloomberg Intelligence. “If we are in a larger inflation routine, really don’t assume at any time quickly that we will go back again to the bond volatility lows when rates had been close to zero.”

Very little to Anxiety?

In contrast to bonds, equity swings have been subdued — the VIX Index, a gauge of selection fees tied to the S&P 500, rose earlier 30 but stayed very well beneath pandemic-time stages of previously mentioned 80.

The VIX is now back underneath 20. For strategists at Tier1 Alpha Investigation, that signals “there’s absolutely nothing on the horizon truly worth fearing.” They reckon it’s time to go brief equity volatility.

But other folks such as Ilga Haubelt, head of equities for Europe at Fidelity Intercontinental, say the fallout from an financial slowdown and credit history tightening is however to be felt.

“We anticipate a lot more volatility in equities,” Haubelt instructed clients. “We are going to commence viewing intensifying best line pressures, labour charges rising, funding charges mounting and cyclical indicators demonstrating extra weakness.”

Forex Crunch Ahead?

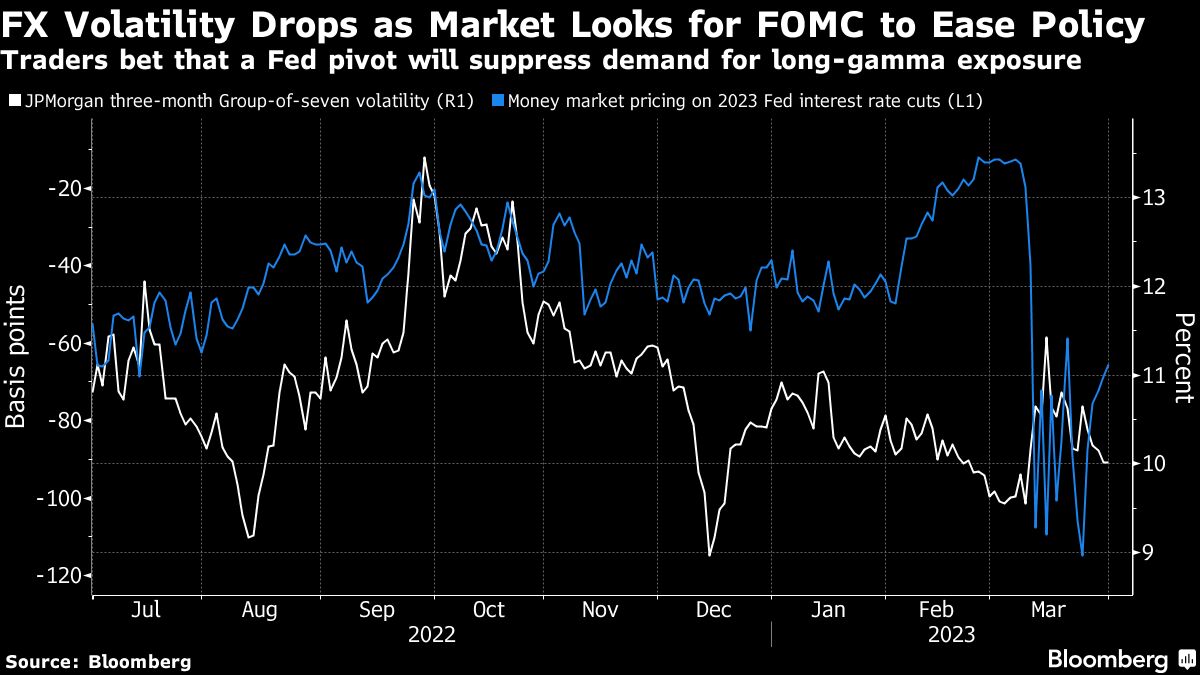

A measure of potential volatility in key currencies jumped as the disaster unfolded but stayed reduce than concentrations strike late previous calendar year. It has given that ebbed amid anticipations the Federal Reserve will stop up reducing costs afterwards this 12 months.

Still, strategists at Financial institution of The usa Corp. alert that currency markets stay susceptible to a liquidity crunch in 2023 as economic disorders tighten and financial expansion slows. That could see volatility ramp up all over again as “the lagged outcome of bank-credit score tightening” performs out, they extra.

Credit history Stalls

The string of US lender failures brought new bond income to a standstill, although the rescue of Credit score Suisse wiped out its junior bondholders. Volatility on indexes measuring credit rating default swaps — effectively credit card debt coverage derivatives — rose to pandemic-time highs even though yield premia on a Bloomberg index of US junk-rated company credit card debt blew out to about 540 basis details, the highest considering the fact that October.

With spreads lingering about 487 foundation details, lowly-rated businesses may perhaps have to wait around a when ahead of they undertaking all over again to bond marketplaces.

Bond Sales Confront Challenging Reset in Costs Following Banking companies Jolted Markets

–With support from Jan-Patrick Barnert, Abhinav Ramnarayan and Vassilis Karamanis.

Most Go through from Bloomberg Businessweek

©2023 Bloomberg L.P.

[ad_2]