Britain’s property market boomed in the pandemic thanks to the stamp duty holiday, pent-up demand and a race for space.

Buyers outstripped homes for sale by 20-to-one and average asking prices climbed every month between January and July to reach an all-time high of £338,447, according to property website Rightmove.

And the red-hot housing market has delivered for a legion of ‘property flippers’ who buy a home in need of improvement, refurbish it quickly and sell it on within 12 months.

Quids in: Natalie Duke hopes to make £200,000 profit on her Essex home

Exclusive analysis of official data for Money Mail by estate agent Hamptons International reveals that close to 19,000 homes were ‘flipped’ during the pandemic — and three-quarters sold for more than they were bought for, earning investors an average profit of £48,190.

Many flippers were driven by the chance to save up to £15,000 after Chancellor Rishi Sunak scrapped stamp duty on the first £500,000 of property purchases until June 30.

The tax-free threshold was pared back to £250,000 in July, but buyers in England and Northern Ireland can still save up to £2,500 before the holiday ends at the end of this month.

Those who are buying a second home or an investment property, though, have to pay an extra 3pc on top of normal stamp duty rates.

John Howard, a property developer and investor with 40 years’ experience, says: ‘Every property boom is slightly different. This boom is unique because it is self-made due to the stamp duty holiday and incredibly low interest rates.

‘And families have been stuck at home, saving more, which means they can bring forward plans for five or ten years in the future to now.’

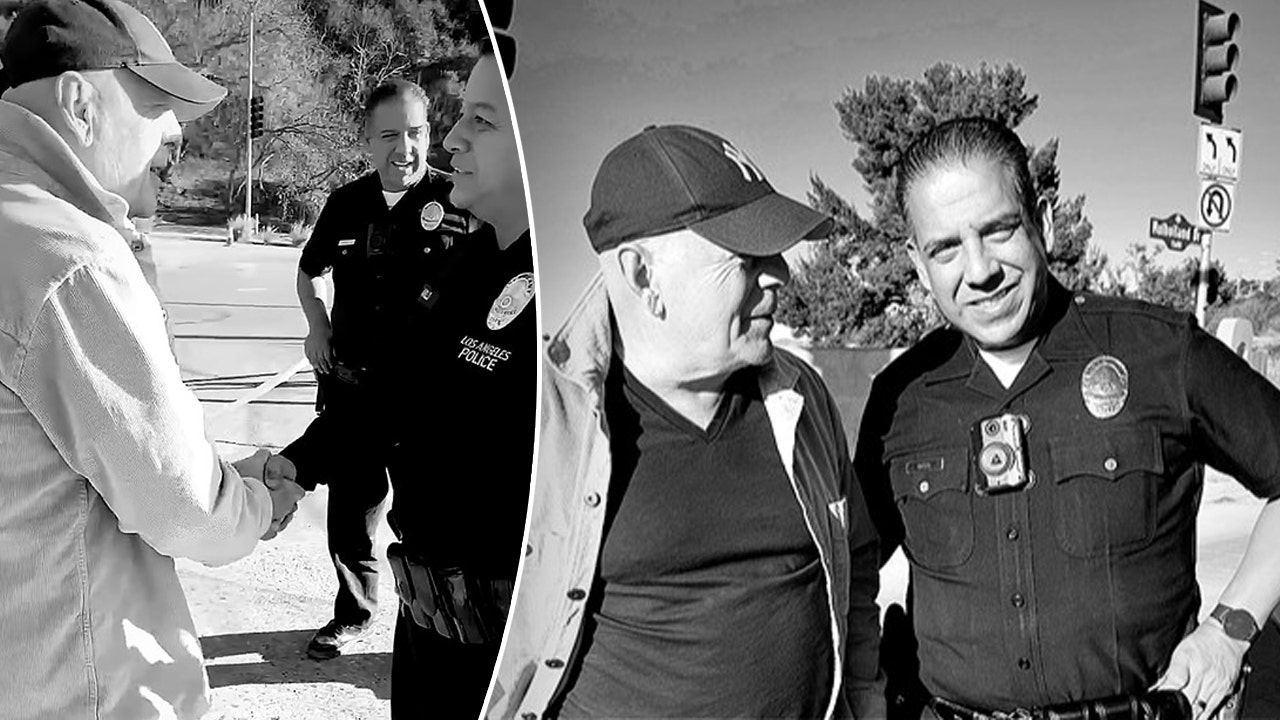

Bullish approach: Joe Robertson, pictured with partner Polly, made a £45,000 profit by buying and selling a house in the pandemic

So investors bold enough to buy a bargain property in early 2020, when most other buyers were too nervous to make an offer, are now selling to a hot housing market full of househunters armed with cash savings.

Natalie Duke may have become a property flipper by accident in the pandemic.

The mother of two sold her home near Hampstead in North-West London to move out of the city. Natalie, who has worked on property interiors for the past 20 years, wanted more space, so she moved to a five-bedroom, Grade II-listed Georgian farmhouse in Saffron Walden, Essex, which she bought for £1.07million.

She spent the past seven months renovating it, spending about £100,000 and turning it into ‘a completely different house’.

She has now decided to put it on the market and hopes to make at least £200,000 profit. Natalie, 59, bought the bigger house thinking her children, who were both furloughed during the pandemic, could live with her if they needed to.

She says: ‘But now things have settled and they are back on their feet again. So while I didn’t set out to flip the property, I may do now.’

Saif and Gina Derzi, both 29, bought a three-bed detached house in Lincoln at the start of 2020, just before lockdown measures were introduced. It cost £172,000 with an 80pc bridging loan from Together Finance, and they spent around £90,000 doing it up.

They sold the property in September to a cash buyer for £275,000 but Saif says if they had waited, they could have got perhaps £25,000 more.

Saif, who lives in Lincoln, says that the cost of building materials has risen significantly over the past few months, as has the price of properties.

He adds: ‘All of a sudden, everyone wants to be a developer. Over lockdown many people found they had more cash as they were spending less, and it created a market for people wanting to take on a project. Derelict properties are like gold dust.’

Higher taxes for buy-to-let landlords also mean property investors are turning to flipping.

Jo Breeden, managing director of mortgage broker Crystal Specialist Finance, says: ‘Since tougher taxation rules came in that reduced landlords’ profits, flipping has become more popular. ‘The number of flipping transactions we’ve arranged has increased by 40pc in each of the past four years.’

But experts warn that when the furlough scheme and stamp duty holiday end, the market will reset.

Early signs of a slowdown have already emerged, as annual growth fell from 8.7 pc to 7 pc between June and July, according to Halifax.

Yet while sellers may be less enthusiastic about a market slowdown, it could pose more opportunities for property flippers to haggle with homeowners over house prices.