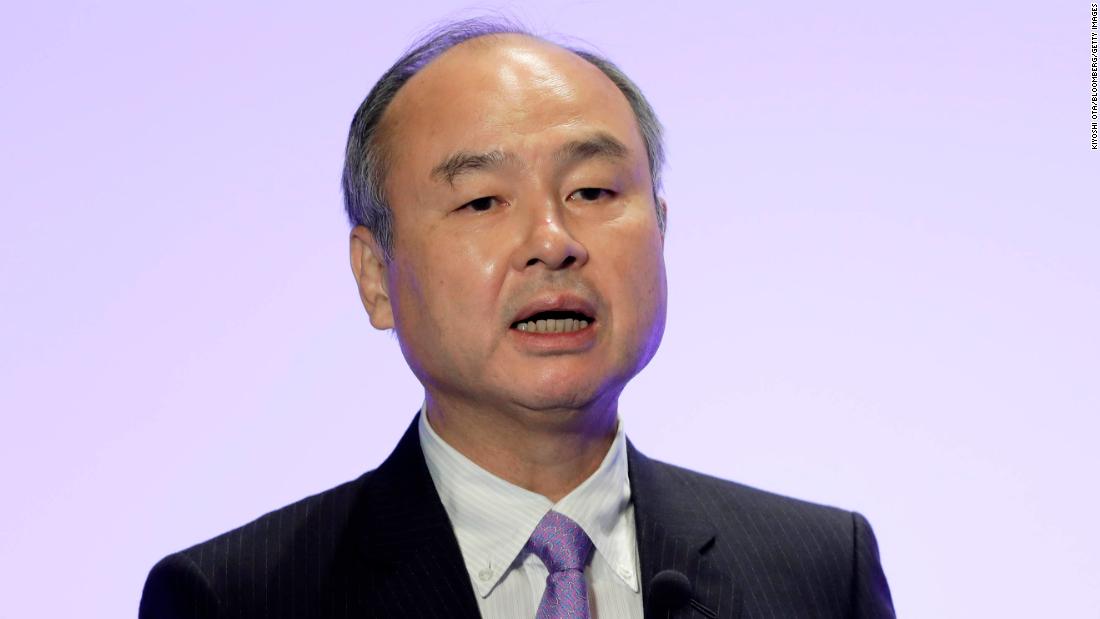

The Japanese billionaire mentioned at an earnings presentation Tuesday that he would take a cautious strategy till the influence of latest rules are clear.

Chinese language corporations accounted for 23% of SoftBank’s large Imaginative and prescient Fund funding portfolio on the finish of July. However solely 11% of Imaginative and prescient Fund funding has been directed to the nation since April, Son mentioned.

“It is as a result of we wish to wait and see some time,” he added.

Taking questions from reporters, Son acknowledged that the corporate was “going through robust challenges relating to investments in China.”

“That is true,” he mentioned. “That is one thing we would prefer to watch out about, and be cautious. As soon as we’ve got a greater view, then we would prefer to resume [further] investments.”

Son didn’t touch upon Didi particularly through the presentation, however mentioned that he nonetheless had “good expectations” from SoftBank’s portfolio corporations in China.

He reiterated that the agency wished to “wait and see how issues go” as rules continued to roll out, including that there was no particular timeline on how lengthy it deliberate to take that strategy.

“Is it six months, 12 months? I do not know but,” the manager mentioned.

“[But] in a single yr or two years, below the brand new guidelines, and below new orders, I feel issues will likely be a lot clearer … As soon as issues get clearer, then we’re open to resuming energetic funding.”

Regardless of the crackdown, Son mentioned he stays bullish on China in the long term.

“There are nonetheless dangers on the market, just like the dangers in China. However we need to take dangers,” he mentioned. “We aren’t towards or for the Chinese language authorities, and we haven’t any doubt about [the] future potential of China.”

— Laura He contributed to this report.